Tech

Exploring Three High Growth Tech Stocks In The United States

Over the last 7 days, the market has risen 3.1%, and it is up 25% over the last 12 months, with earnings forecast to grow by 15% annually. In this thriving environment, identifying high growth tech stocks that can capitalize on these favorable conditions is crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| Super Micro Computer | 20.84% | 35.00% | ★★★★★★ |

| Iris Energy | 70.63% | 125.09% | ★★★★★★ |

| G1 Therapeutics | 24.26% | 51.62% | ★★★★★★ |

| Invivyd | 42.85% | 71.50% | ★★★★★★ |

| Clene | 73.06% | 62.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 254 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Take-Two Interactive Software, Inc. develops, publishes, and markets interactive entertainment solutions for consumers worldwide with a market cap of $26.38 billion.

Operations: Take-Two Interactive Software, Inc. generates its revenue primarily through its publishing segment, which contributed $5.40 billion. The company focuses on developing and marketing interactive entertainment solutions for a global audience.

Take-Two Interactive Software’s revenue growth of 14.6% annually outpaces the US market’s 8.8%, yet it remains unprofitable with a net loss of $262 million in Q1 2024. Despite this, earnings are projected to surge by 100.61% per year, driven by strong performance from segments like NBA 2K25, which leverages cutting-edge ProPLAY™ technology for enhanced realism and player engagement. The company invested significantly in R&D, aligning with its innovative product offerings to capture future market share effectively.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Coherent Corp. develops, manufactures, and markets engineered materials, optoelectronic components, and devices worldwide with a market cap of approximately $11.87 billion.

Operations: Coherent generates revenue primarily from three segments: Lasers ($1.40 billion), Materials ($1.47 billion), and Networking ($2.34 billion). The company’s focus spans engineered materials, optoelectronic components, and devices across global markets.

Coherent Corp. projects a robust revenue growth of 11.7% annually, outpacing the US market’s 8.8%. Despite a net loss of $48.4 million in Q4 2024, the company is on track for significant earnings improvement, with forecasts suggesting a 95.42% annual increase over the next three years. Notably, Coherent invested heavily in R&D, allocating $520 million last year to drive innovation across its laser and photonics segments, potentially transforming industry standards and client capabilities like those seen with TSMC’s high-profile customers.

Simply Wall St Growth Rating: ★★★★★☆

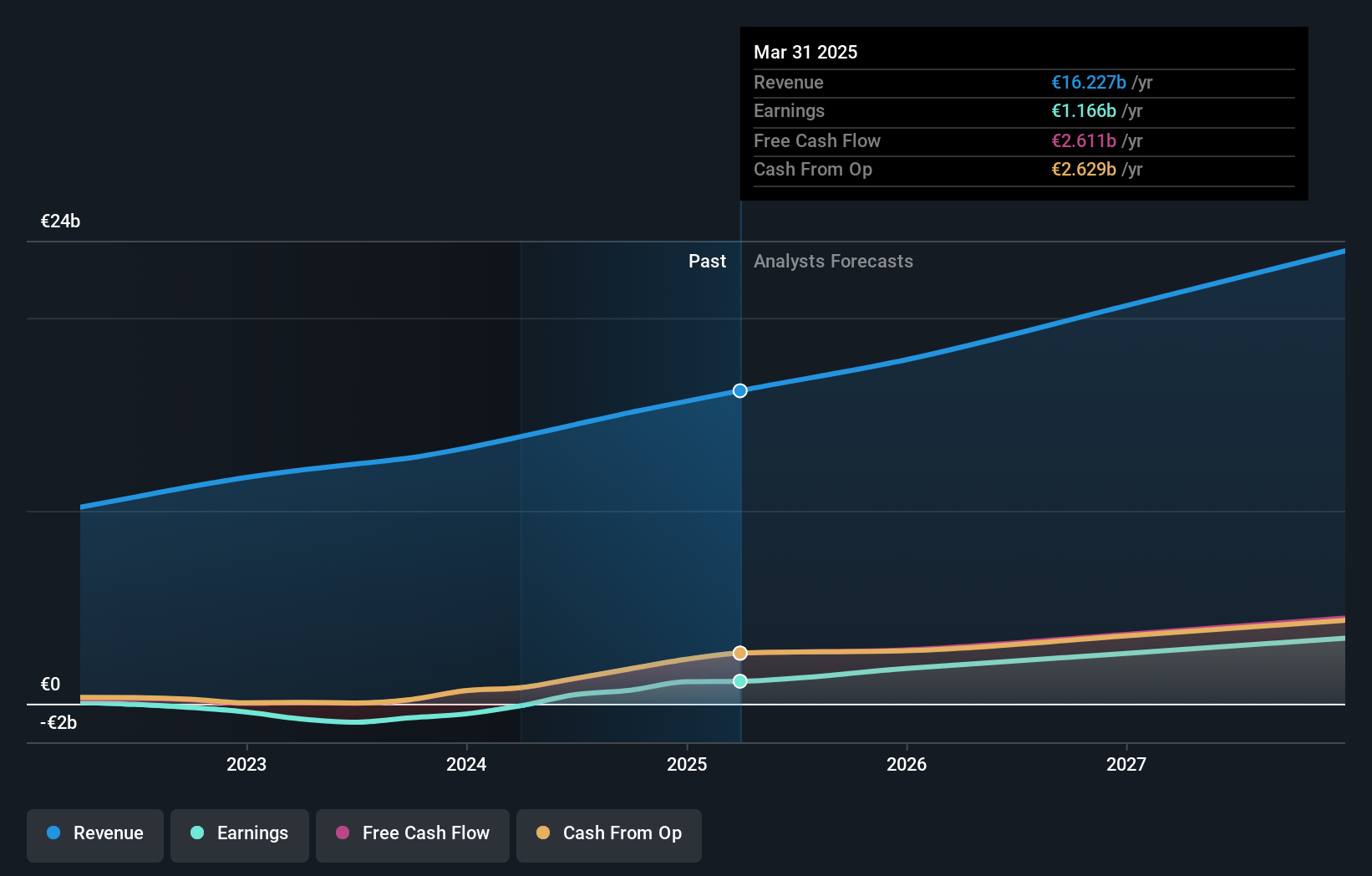

Overview: Spotify Technology S.A., together with its subsidiaries, provides audio streaming subscription services worldwide and has a market cap of $69.22 billion.

Operations: Spotify generates revenue primarily from its Premium subscription services (€12.68 billion) and Ad-Supported segment (€1.79 billion).

Spotify’s revenue is forecast to grow 12.4% annually, outpacing the US market’s 8.8%. The company reported a net income of €274 million for Q2 2024, reversing a net loss of €302 million from the previous year. With an expected annual earnings growth rate of 29.5%, Spotify has also become profitable within the last year. Significant investments in R&D, totaling $520 million in the past year, underscore its commitment to innovation and expanding its content offerings, including new video content from Cineverse Corp., enhancing user engagement across its platform.

Turning Ideas Into Actions

- Reveal the 254 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It’s free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com