Sports

Institutional Investments In Sports: Fueling Revenue And Valuation Growth – Sport – Media, Telecoms, IT, Entertainment

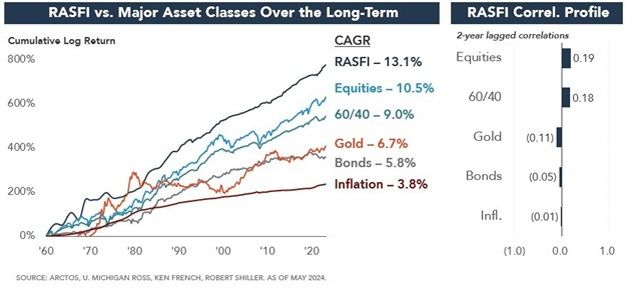

There was a time when ownership of a professional sports

franchise was not regarded as a serious business venture. Owning a

team, even in one of the major leagues in North America, was

regarded as more of a frolic and detour, a cool thing to do if you

had the money. No more—professional sports have become very

serious business and returns on team investments can rival or

exceed the returns from traditional asset classes. The recently

developed Ross-Arctos Sports Franchise Index (RAFSI) measures the

returns of team investments in the four major leagues in North

America (MLB, NFL, NBA and NHL):

North American professional sports franchises in the Big Five

leagues (NFL, NBA, MLB, NHL and MLS) were worth an average of

nearly $3.2 billion in 2023. One of the most recent transactions in

the NFL (the acquisition of the Washington Commanders) was valued

at more than $6 billion and NFL clubs are reported to have average

valuations that now approach or exceed $5 billion. The growth in

NFL valuations has outpaced the S&P 500 over the past 20

years.1

The exceptional growth in professional sports valuations has

been driven by dramatic increases in league media revenues. For

example, the NBA’s new $76 billion suite of national media

deals generates an average annual value (AAV) that represents a

2.6x increase over the previous national packages and could

generate an average of nearly $200 million per team, beginning in

the 2025-2026 season.

Against this backdrop of spiraling team valuations and

unprecedented demand for sports-connected assets, leagues have been

turning to institutional investors as important sources of capital

and liquidity. The NBA, NHL, MLS and MLB have developed and

implemented guidelines for private equity investments and the NFL

has just announced that it will now follow suit and allow

institutional investments. Key elements of the just-announced NFL

policy:

- Teams may sell up to 10% of their common equity to

league-approved institutional investors; the minimum deal size is

3%. - Such investments will not convey governance rights nor is

preferred equity allowed. - Investments are subject to a six-year minimum holding

period. - No fund can invest in more than six teams.

- Funds must have committed capital of $2 billion and no team

interest can account for more than 20% of a fund’s assets.

Private equity investments in sports have become increasingly

commonplace as private equity firms, sovereign wealth funds and

other asset managers have acquired interests in a number of NBA,

MLB, NHL, MLS and NWSL clubs. In addition, private credit is

beginning to play an increasingly important role in league and team

financing. The rules governing such investments vary from

league-to-league.

National Basketball Association

NBA franchise valuations have sky-rocketed over the last decade,

driven by the League’s very valuable media rights and

burgeoning international interest. Between 2010 and 2013, a number

of NBA teams changed hands and the prices ranged from $350 million

to $550 million. According to Sportico, in 2024, the average NBA

team is now valued at nearly $4 billion. That’s way beyond

Unicorn status.

The NBA’s ownership rules provide for institutional

investments in teams. Private equity funds are permitted to hold up

to a 20% stake in any franchise and each individual fund is limited

to holding interests in a maximum of five franchises. The NBA also

requires that any fund holding team interests have at least $750

million in assets and any team investment may not account for more

than 25% of the applicable fund’s assets (though the NBA has

flexibility to grant exceptions). The NBA also limits team owners

from selling more than 30% of team equity to institutional

investors.

Although the NBA once prohibited investments by governmental or

quasi-governmental authorities and sovereign wealth funds, the

League granted an exception to allow the Qatar Investment Authority

(QIA) to acquire a minority, passive stake in Monumental Sports

& Entertainment.

National Women’s Soccer League

The NWSL has seen rapidly increasing team valuations, driven by

the tidal wave of interest in women’s sports. For example,

Angel City FC recently sold a controlling stake that valued the

team at more than $250 million. The NWSL has always seen

institutional investment as a key part of their growth strategy and

private equity firms are not limited to minority investments in

teams—Bay FC is owned by Sixth Street. The NWSL allows

institutional investors to acquire minority stakes in up to three

franchises, with ownership limited to between 5-20% of each

club’s equity. Clubs may not sell more than 30% of their equity

to institutional investors, and investing funds must have capital

commitments of at least $100 million and must hold the investment

for a minimum of five years. As with other leagues, all

transactions (acquisitions and exits) are subject to league

approval and must provide the club’s controlling owner with a

right of first purchase. This requirement is like one that governs

club transactions in MLS.2 At present, the NWSL does not

allow investments from governmental or quasi-governmental

entities.3

Major League Baseball

MLB became the first North American professional sports league

to allow for institutional investment in 2019. MLB ownership rules

cap limits private equity investors to 30% of any club’s

equity, and a single fund may hold up to 15% of a team. Funds are

not limited in the number of teams they may invest in, but

investments in multiple teams are subject to a minimum five-year

holding period.

National Hockey League

The NHL’s rules on institutional ownership permit clubs to

sell up to 30% of their equity to institutional investors.

Institutional investors may hold up to 20% of a maximum of five

franchises (with each investment subject to a $20 million minimum).

NHL institutional investments are also subject to a blanket minimum

five-year holding period. The NHL does not allow active players to

invest in teams, or in funds that invest in teams.4

Major League Soccer

MLS institutional investment rules are like those in other

leagues, but also impose additional fund diversity requirements for

“qualified fund[s]”.5 Similar rules include a four-team

limit per fund, a $20 million minimum investment per team, a 20%

investment limit in each franchise and an aggregate institutional

ownership limit of 30% per franchise. For a private equity fund to

be “qualified” to invest in the league, it must have at

least $500 million in committed capital and not have concentrated

ownership. A single investor or group may hold no more than 25% of

such fund, may not invest more than 10% of the fund’s capital

into a single franchise and may not concentrate more than 25% of

the fund’s capital in MLS club investments.6 Asset managers may invest in common

equity or senior equity instruments without debt-like features.

Like other leagues, all investments in MLS clubs must be passive

and carry limited governance rights. The club’s controlling

owner must also have first negotiation rights upon the

institutional investor’s exit and drag-along rights if they

choose to sell their majority stake.

Takeaways

The demand for sports-connected assets has never been greater

and marked increases in media revenues have been driving team and

league valuations to even higher levels. While this is generally

very good news for team owners and investors, rapidly rising

valuations, coupled with strict league debt policies, create a need

for institutional investment and capital. Jerry Jones bought the

Dallas Cowboys in 1989 for $140 million; it’s hard to imagine

completing such a large transaction today without institutional

investment partners.

Private equity investments or private credit solutions can offer

a unique solution for team owners seeking to augment limited

liquidity for operations or to generate capital for technology

investments or venue improvements. Institutional investors have

become increasingly important partners in team ownership and the

capital they provide fuels future growth for the leagues and

continued growth in team valuations.

For institutional investors, there are key considerations.

First, there are substantial differences in team operating

parameters, with media market size being one of the most

significant. As the regional sports network landscape continues to

evolve, some teams in the NHL, NBA and MLB are seeing potentially

significant reductions in local media rights revenue. While these

reductions are largely offset by increases in national revenues at

the NBA and MLB, that is not the case for all leagues. Teams in

smaller media markets have more limited options for the

distribution of local media rights, and agreements with

over-the-air broadcasters generate a fraction of the revenue that

Regional Sports Network (RSN) deals used to provide for teams,

Another complicating factor for institutional investors is the

typical holding period for team and league investments. While

several of the leagues impose explicit minimum holding periods, a

more significant factor is the liquidity in the market. The limited

number of team transactions each year, coupled with relatively long

holding periods for these investments, make exits for institutional

investors more challenging. Thoughtful and creative exit strategies

need to be considered and negotiated when private equity investors

close on investments in this space. Regardless, the enviable rates

of growth in team valuations have more than made up for the

liquidity challenges.

The NFL’s announcement of its institutional investment

policy may well set off an old-fashioned land grab—with

private equity and credit investors looking for pieces of not only

some of the most iconic sports assets and brands in North America,

but some of the most valuable and profitable teams in all of

sports. The NFL’s decision to allow teams to seek investments

of up to 10% from institutional investors could generate $12-$15

billion in transactions.

Long gone are the days when team ownership was regarded as a

sideline hobby or a small family business. Today, sports teams are

sophisticated media entities with multibillion-dollar valuations,

generating returns that have been substantially out-performing

other asset classes as investments and a need for the capital

solutions provided by institutional investors. The trends driving

these dramatic increases in team valuations and the just announced

changes in the NFL’s private equity policies may well unleash

another torrent of investments in sports teams.

Footnotes

1.

https://finance.yahoo.com/quote/%5EGSPC/history?period1=946684800&period2=1719187200&interval=1mo&filter=history&frequency=1mo&includeAdjustedClose=true

2.

https://www.espn.com/nfl/story/_/id/40164039/private-equity-nfl-ownership-proposal-changes

3.

https://www.sportico.com/business/team-sales/2024/nwsl-private-equity-rules-sovereign-wealth-1234768705/

4.

https://www.espn.com/nfl/story/_/id/40164039/private-equity-nfl-ownership-proposal-changes

5.

https://www.sportico.com/business/finance/2021/mls-private-equity-rules-1234645955/

6.

https://www.sportico.com/business/finance/2021/mls-private-equity-rules-1234645955/

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.