Bussiness

Auto insurance, transportation costs continue to hike up inflation as the Fed cuts interest rates

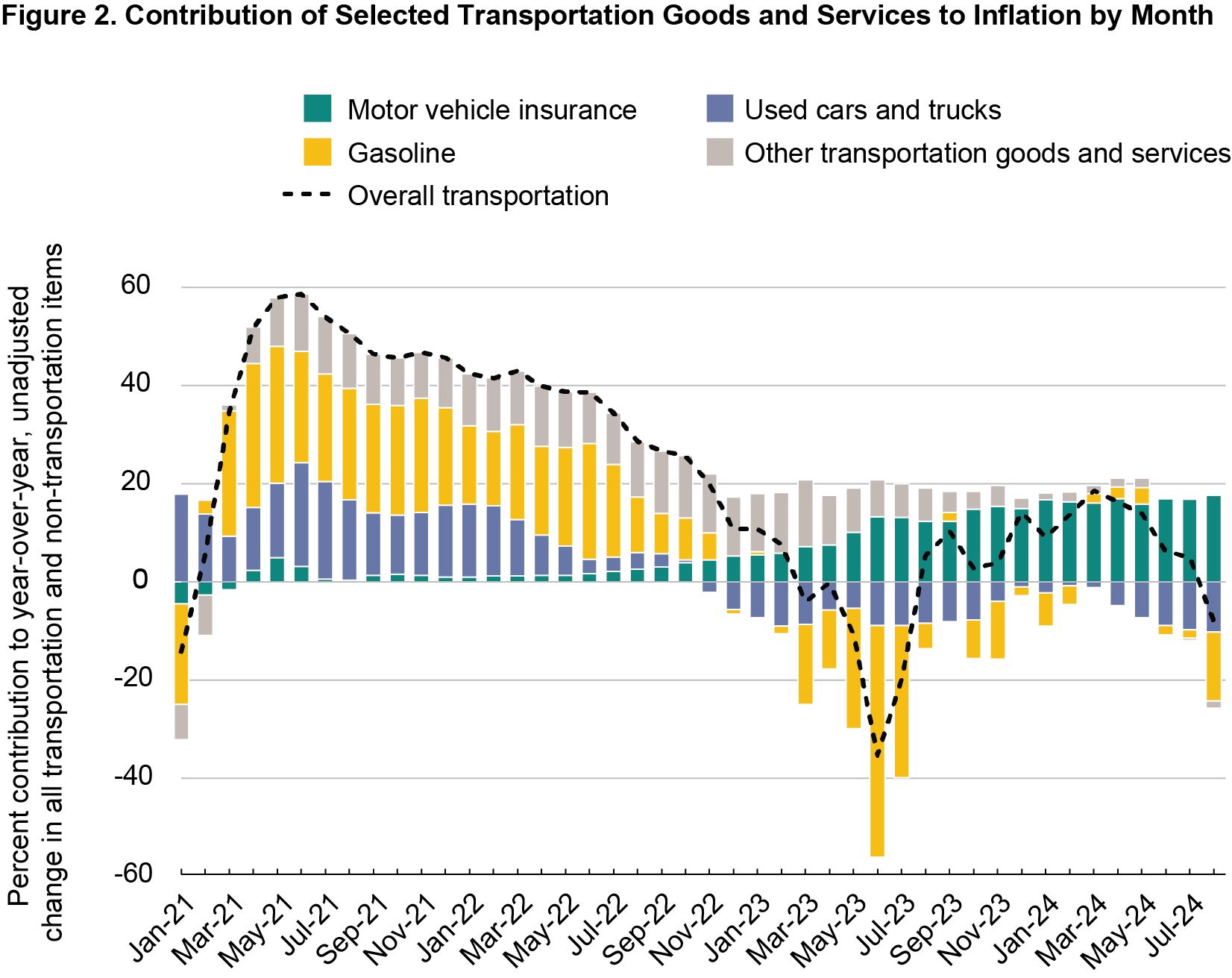

The U.S. Department of Transportation reports that motor vehicle insurance has continued to contribute to inflation at 17.6% in August 2024 — the greatest contribution since July 2016 (recordkeeping of this statistic began in 2012).

Motor vehicle insurance became the No. 1 transportation contributor to inflation in December 2022 and, as of August 2024, remains the top contributor.

From June 2021 — when transportation costs reached an all-time high and contributed the most on record to inflation — to November 2022, gasoline contributed more to inflation than any other transportation good or service, according to USDOT.

During four of the 18 months from June 2021 through November 2022, the contribution to inflation by used car and truck prices differed from gasoline contribution by less than 2 percentage points, making used cars and trucks the second largest transportation contributor to inflation.

Transportation costs “dampened” inflation by 8.1% in August for the first time since July 2023. The decrease is due to year-over-year declines in the price of most transportation goods and services, USDOT said.

Transportation would have dampened inflation by 25.7% in August, excluding motor vehicle insurance, USDOT said. Motor vehicle maintenance, repair, and fees also positively contributed to inflation in August but to a lesser extent at 2% and 0.6%, respectively.

Last week, the Federal Reserve lowered its benchmark interest rate by half a percentage point, which will make it cheaper to get a car loan, finance a business, or carry a credit card balance, according to NPR.

“Wednesday’s rate cut is the Fed’s first since 2020, but it won’t be the last,” an NPR article states. “On average, members of the Fed’s rate-setting committee expect borrowing costs to drop by another half a percentage point this year and an additional full point next year. That’s a more rapid decline than committee members were projecting just three months ago.

“The shift to lowering interest rates marks a major turning point in the Fed’s two-and-a-half-year battle to curb inflation. The central bank began raising rates in March 2022 in an effort to tamp down demand and bring prices under control. By last summer, interest rates had climbed to between 5.25% and 5.5%, their highest level in more than two decades.”

NPR reported the annual inflation rate had fallen sharply to 2.5% in August from a peak of 9.1% in June 2022.

The Federal Reserve Board has also released the Federal Open Market Committee’s economic projections from now to 2027. The report includes the most likely outcomes for real gross domestic product (GDP) growth, unemployment rate, and inflation for each year of those years, over the longer term.

According to AM Best, the U.S. property & casualty (P&C) industry recorded a $3.8 billion net underwriting gain during the first half of 2024 — “a significant improvement from the $24 billion loss recorded in the same prior-year period.”

The preliminary results are detailed in a new Best’s Special Report titled “First Look: Six-Month 2024 US Property/Casualty Financial Results.” The data is derived from companies whose six-month 2024 interim period statutory statements were received as of Sept. 4, 2024, accounting for an estimated 99% of total industry net premiums written, AM Best said in a news release.

According to the report, the P&C industry’s combined ratio improved to 97.7 during the first half of the year from 104.4 compared to the same period in 2023.

“AM Best estimates that catastrophe losses accounted for 7.4 points on the six-month 2024 combined ratio, down from an estimated 9.7 points in the previous year, which had been impacted by record losses due to severe convective storm losses,” the release states. “The underwriting gain, due predominantly to improvements in personal lines results, along with a 26.6% increase in earned net investment income, drove pre-tax operating income up to $47.3 billion, compared with $10.0 billion in first-half 2023.

“A $50 billion change in net realized capital gains at National Indemnity Company resulted in the industry’s net income skyrocketing to $97.6 billion in the first half of this year from $9.4 billion last year.”

In December 2023, AM Best reported that the market segment continued to have a subpar outlook driven by several factors working against the industry.

“The outlook for the personal lines segment remains negative amid deteriorating personal auto and homeowners results,” AM Best said in its report.

The agency’s outlook is a reflection of how current trends are likely to impact insurers throughout the next year. It said its less than favorable outlook for personal lines doesn’t necessarily mean all companies will do poorly, but that they’ll likely be impacted by ongoing conditions.

In July, Fitch Ratings reported that the U.S. P&C market was positioned for a return to underwriting profitability and significant return on capital improvements for the full year following the best Q1 result since 2007.

However, full-year results may not match Q1’s due to natural catastrophes and loss reserve experience unknowns, the report states.

“The industry underwriting combined ratio (CR) improved by over eight points YoY [year over year] to 94% in Q1, representing the best first quarter underwriting result since 2007. Favorable prior-period reserve development was higher in Q1, representing 3.3% of earned premiums versus 1.9% in the prior-year quarter. Fitch’s sector outlook for U.S. personal lines insurance recently moved to ‘improving.’”

Fitch says strong statutory underwriting profit YoY during Q1 was driven by lower winter storm losses and a recovery in personal auto results.

Images

Featured image credit: Khanchit Khirisutchalual/iStock

Charts provided by USDOT

Share This: