Jobs

US Economy’s Split Personality: Services Thrive While Manufacturing Struggles

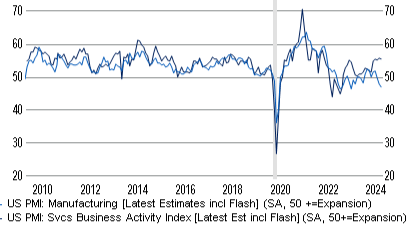

What’s going on here?The latest US flash PMI surveys reveal an economy on two different tracks: while manufacturing hits a 2024 low, the services sector remains robust.

Manufacturing and services survey data diverge. Source: abrdn, S&P Global, Haver.

What does this mean?The US economy is sending mixed signals with its recent flash PMI reports. The manufacturing sector has taken a downturn, falling to a 2024 low of 47 in September, indicating contraction. Conversely, the services sector shows resilience, only slightly dipping to a still-strong 55.4. However, an employment component below the 50-point breakeven rate signals subdued hiring trends. This economic duality plays into the Federal Reserve’s recent policy announcements. At the latest Federal Open Market Committee meeting, Chair Jay Powell hinted at policy easing, with potential 25bps cuts expected in November and December. If economic indicators worsen, more aggressive 50bps cuts could be on the table.

Why should I care?

The bigger picture: Economic policy pivots based on data.The Federal Reserve’s potential policy easing is a direct response to the current economic landscape. Future rate cuts, whether 25bps or 50bps, will depend on incoming data like payroll reports and economic indicators. This underscores the dynamic nature of economic policy and its broader implications for consumer spending, business investment, and overall economic growth.