Tech

High Growth Tech Stocks To Watch In The United States

In the last week, the market has been flat, though it is up 34% over the past year and earnings are expected to grow by 15% per annum over the next few years. In this context, identifying high growth tech stocks that can capitalize on these favorable conditions becomes crucial for investors seeking robust returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 253 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Soleno Therapeutics, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing novel therapeutics for the treatment of rare diseases, with a market cap of $1.96 billion.

Operations: Soleno Therapeutics focuses on developing and commercializing novel therapeutics for rare diseases. The company operates as a clinical-stage biopharmaceutical entity with no reported revenue segments.

Soleno Therapeutics, recently added to the S&P Global BMI Index, is poised for significant revenue growth with forecasts showing a 64.5% increase per year. This growth trajectory is notably higher than the US market average of 8.7%. Despite current unprofitability and substantial shareholder dilution over the past year, Soleno’s R&D focus could catalyze future profitability, with earnings expected to surge by 68.2% annually. The firm’s recent FDA filing acceptance for its Prader-Willi syndrome treatment underscores its potential in addressing severe medical conditions, enhancing its profile in biotech innovation.

Simply Wall St Growth Rating: ★★★★★☆

Overview: KalVista Pharmaceuticals, Inc. is a clinical-stage pharmaceutical company focused on discovering, developing, and commercializing drug therapies for diseases with unmet needs, with a market cap of $500.44 million.

Operations: KalVista Pharmaceuticals, Inc. specializes in the discovery and development of drug therapies targeting diseases with unmet medical needs. The company is currently in the clinical stage, focusing on advancing its pipeline of pharmaceutical inhibitors.

KalVista Pharmaceuticals is making significant strides in the biotechnology sector, particularly with its innovative approach to treating hereditary angioedema (HAE). The company’s recent Marketing Authorization Applications for sebetralstat across multiple countries underscore its commitment to expanding access to this potentially transformative treatment. Notably, sebetralstat demonstrated a rapid onset of symptom relief in clinical trials, achieving primary endpoints with a safety profile comparable to placebo. With R&D expenses constituting 61.3% of their revenue stream, KalVista’s investment in development is robust, aligning with an anticipated revenue growth rate of 53.8% per year. This aggressive focus on research and expansion into new markets positions KalVista as a noteworthy entity in the high-growth biotech landscape.

Simply Wall St Growth Rating: ★★★★☆☆

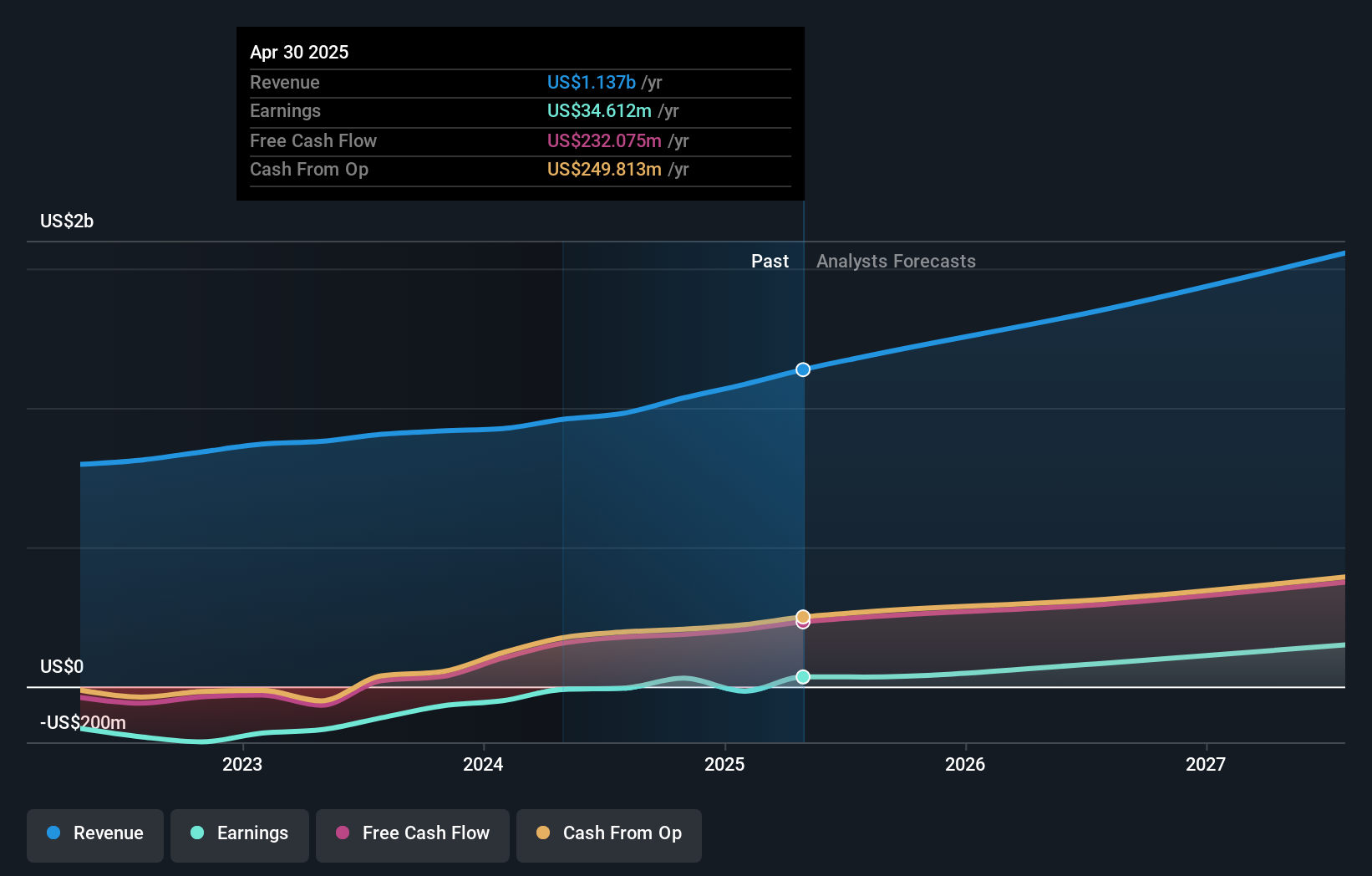

Overview: Guidewire Software, Inc. provides a platform for property and casualty (P&C) insurers worldwide and has a market cap of $15.19 billion.

Operations: Guidewire Software, Inc. generates revenue primarily through its Software & Programming segment, which brought in $980.50 million. The company focuses on providing a platform tailored for property and casualty insurers globally.

Guidewire Software, despite being unprofitable, is navigating its challenges with strategic agility. The company’s R&D expenses are a testament to its commitment to innovation, significantly shaping its product offerings and market position. Notably, Guidewire’s recent initiatives in enhancing hurricane and wildfire risk assessments through HazardHub highlight a proactive approach in addressing climate-related risks. This focus on integrating comprehensive risk data aligns with the growing demand for tailored insurance solutions in an era of increasing climate volatility. With expected revenue growth of 12.6% per year outpacing the US market forecast of 8.7%, Guidewire is strategically positioning itself within the tech landscape by leveraging advanced analytics to enhance underwriting precision and operational efficiency—critical factors as it aims for profitability within three years amidst a competitive sector.

Make It Happen

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if KalVista Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com