Tech

High Growth Tech Stocks In The United States To Watch

Over the last 7 days, the market has remained flat, but it is up 34% over the past year with earnings expected to grow by 15% per annum over the next few years. In this context, identifying high growth tech stocks that can capitalize on these favorable conditions is crucial for investors seeking robust returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 253 stocks from our US High Growth Tech and AI Stocks screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GoodRx Holdings, Inc., together with its subsidiaries, offers information and tools that enable consumers to compare prices and save on their prescription drug purchases in the United States, with a market cap of $2.63 billion.

Operations: GoodRx Holdings generates revenue primarily from its healthcare software segment, which reported $775.09 million in sales. The company provides tools for consumers to compare prescription drug prices and save on their purchases in the U.S.

GoodRx Holdings has been navigating a challenging landscape with a strategic focus on enhancing healthcare affordability. In Q2 2024, they reported a revenue increase to $200.61 million from $189.68 million year-over-year, reflecting growth amidst market adversities. However, net income significantly dropped to $6.69 million from $58.79 million, indicating underlying challenges despite top-line growth. The company’s commitment to R&D is evident as they continue to innovate in patient affordability programs, recently collaborating with Boehringer Ingelheim on a high-demand biosimilar, which could redefine treatment accessibility and cost-effectiveness in the autoimmune segment. This move aligns with their broader strategy of leveraging technology and partnerships to improve healthcare outcomes while striving for financial stability in an evolving industry landscape.

Simply Wall St Growth Rating: ★★★★★☆

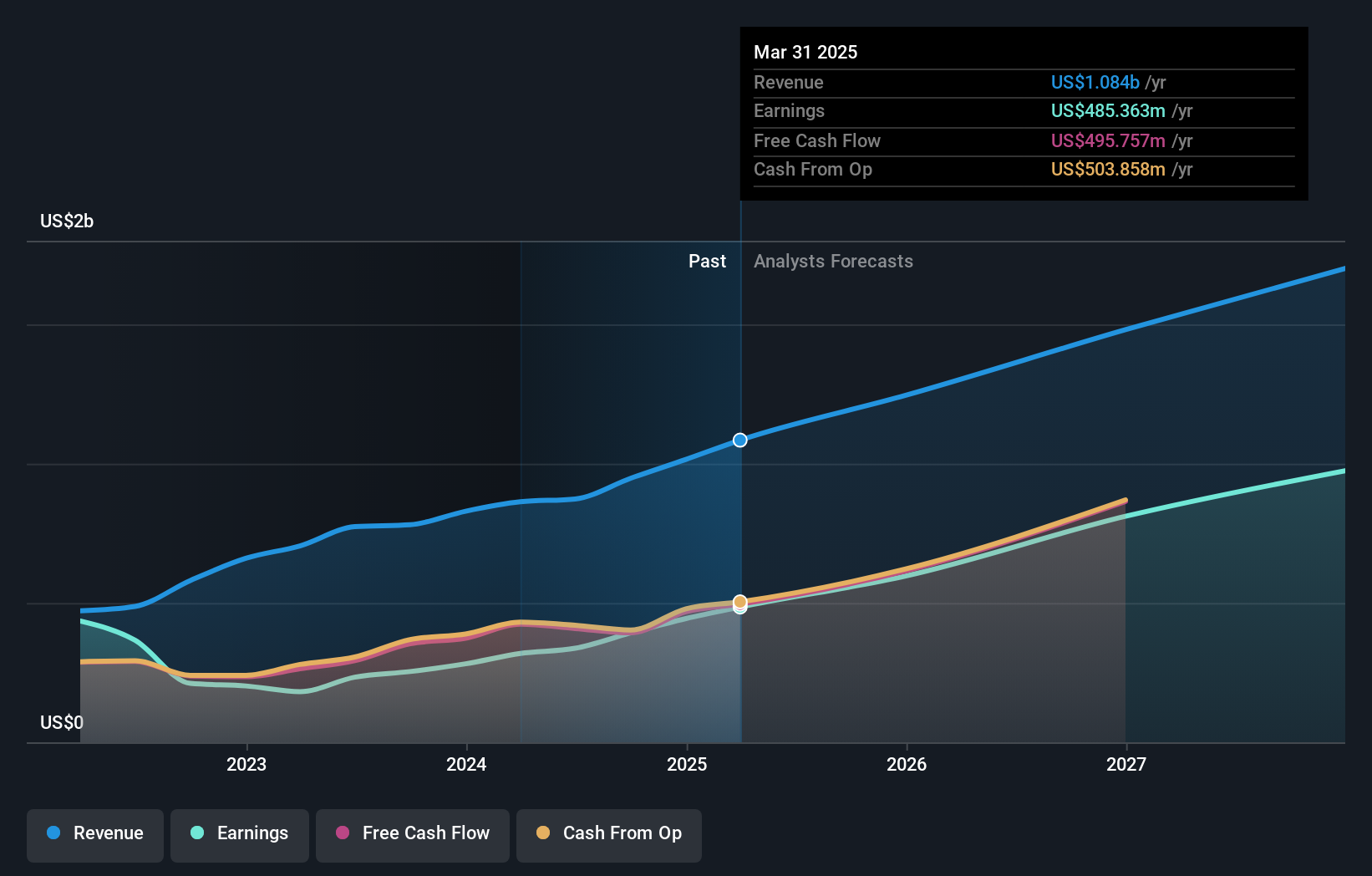

Overview: Halozyme Therapeutics, Inc. is a biopharma technology platform company that researches, develops, and commercializes proprietary enzymes and devices globally, with a market cap of $7.25 billion.

Operations: Halozyme Therapeutics focuses on the research, development, and commercialization of proprietary enzymes, generating $873.30 million in revenue from these activities. The company operates in multiple regions including the United States, Switzerland, Belgium, and Japan.

Halozyme Therapeutics has demonstrated robust growth, with a 15.6% annual revenue increase expected to outpace the US market’s 8.7%. This growth is bolstered by innovative drug delivery technologies like ENHANZE®, which recently enabled FDA approvals for subcutaneous formulations of major treatments, significantly reducing administration time and enhancing patient compliance. The company’s strategic R&D investments are yielding tangible results, as evidenced by a projected earnings growth of 22% per year, reflecting both the success of its current partnerships and potential for future expansions in biopharmaceutical delivery solutions.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VTEX provides a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $1.38 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $220.54 million. VTEX focuses on offering a digital commerce platform tailored for enterprise brands and retailers.

VTEX, amidst a significant transformation in the tech landscape, has shown promising growth indicators. With an impressive 16.4% annual revenue increase, it outpaces the US market average of 8.7%. This growth trajectory is further complemented by an expected earnings surge of 44.3% per year, positioning VTEX well above the industry norm. The company’s commitment to innovation is evident from its R&D spending trends which are strategically aligned with expanding its digital commerce solutions. Notably, VTEX’s recent partnership with H Mart to overhaul its e-commerce operations underscores its capability to deliver advanced SaaS platforms tailored for efficiency and scalability in retail operations.

Where To Now?

- Dive into all 253 of the US High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it’s free and covers every market in the world.

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Halozyme Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com