Infra

A Look Into The Current State Of EV Charging Infrastructure In The U.S.

This edition of the Automotive Industry Spotlight will focus on

the current landscape of electric vehicle (EV) charging

infrastructure.

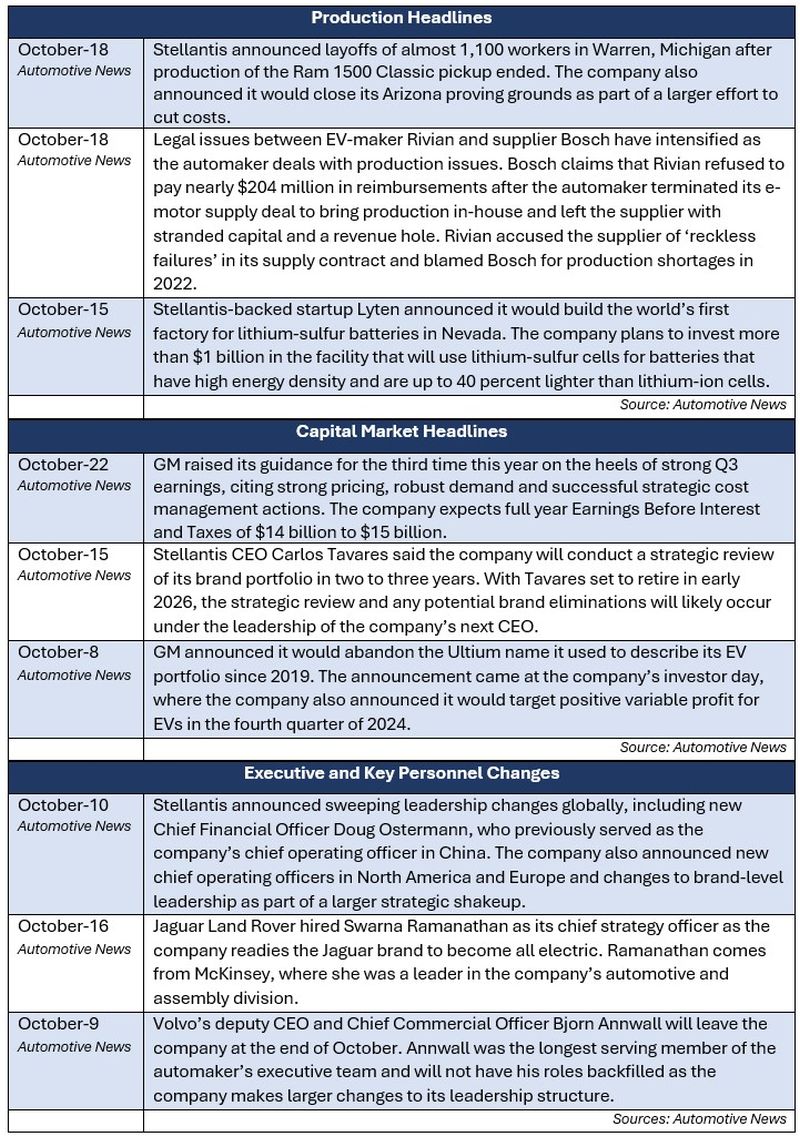

In industry news, the $204 million Rivian and Bosch

dispute escalates as Rivian faces production issues.

GM raises 2024 earnings guidance for the third time this

year, citing strong pricing, robust demand and successful

strategic cost management initiatives. Stellantis announces

sweeping leadership changes globally, including new COOs

across North America and Europe amidst broader changes to its

leadership structure.

In regulatory news, BMW announces a recall of 700,000

vehicles in China related to a coolant pump defect, which

could result in potential fire risk. The National Highway

Traffic Safety Administration (NHTSA) launches an investigation

into Tesla’s full self-driving software due to four

reports of collisions linked to the software. Honda

announces a recall of 1.7 million North American vehicles,

citing steering difficulties resulting from an improperly produced

steering gearbox.

Industry Focus: EV Charging Infrastructure in the U.S.

As excitement around EVs cools, one thing is clear: the lack of

robust public charging infrastructure continues to be a major

barrier to mass adoption. Consumers still hesitate to make the

switch, citing the infamous “range anxiety”1

— the fear that they won’t be able to find an operable

charging station before their battery runs out. In addition,

consumers dread the prospect of having to wait thirty minutes or

more for their vehicle to charge. For years, automakers and

government agencies have been pushing forward initiatives to change

that, but lots of roads will need to be covered to meet larger EV

charging goals.

Government programs, like the Bipartisan Infrastructure Law,

have funneled billions into EV infrastructure. Automakers are

continuing their own investments into solutions for the problem as

well, partnering with charging networks to make EVs more

convenient. Still, the current state of charging infrastructure

suggests we’re far from the goal of making charging stations as

ubiquitous as gas stations. Stakeholders across the EV supply chain

anxiously await the results from the 2024 U.S. presidential

election, which could result in very different outcomes for the

broader EV market.

The Road to 500,000 Charging Ports

The Bipartisan Infrastructure Law, passed in 2021, allocated

$7.5 billion to help states build the infrastructure needed to

reduce range anxiety and push EV adoption. Of that, $5 billion was

set aside for the National Electric Vehicle Infrastructure (NEVI)

plan. NEVI aims to establish EV charging stations every 50 miles

along major U.S. highways, with a target of 500,000 chargers by

2030.2

The most recent data from the U.S. Department of Energy reports

that there are only about 67,000 public charging stations

nationwide, which house approximately 187,000 chargers.3

However, only about 79,000 public chargers are active across the

US.3 In order to meet the goal of 500,000 public

charging ports by 2030, the number of EV chargers would need to

increase at a compounded annual growth rate of nearly 36 percent

between now and 2030; the average annual growth rate between 2014

and 2023 was 22.4 percent.3 Furthermore, the Bipartisan

Infrastructure Law allocates responsibility to the states for

building out EV infrastructure, and most states are falling behind

on their respective targets. The following map illustrates the

progress states have made toward their share of establishing the

alternative fuel corridor on interstate highways.

Even with billions in federal funding and original equipment

manufacturer (OEM) investment, there are regulatory and logistical

hurdles that make building out charging infrastructure a slow,

often frustrating process. Installing a public charger involves

navigating a maze of permits, approvals and zoning laws, and delays

are common. Additionally, states are inconsistent in how they

prioritize EV infrastructure, leading to disparities in progress.

Some states, particularly those in the Midwest and South, lag more

EV-friendly states like California.

Policymakers are trying to address some of these issues. For

instance, the Department of Energy recently announced a conditional

$1.05 billion loan guarantee for EVgo, an EV charging

infrastructure company, to deploy 7,500 charging ports across 1,100

U.S. charging station locations.4 This move aims to

accelerate the installation of charging infrastructure, including

fast charging technology, but OEMs and other private stakeholders

continue with their own initiatives.

OEMs and Charging Providers

While government programs and incentives will provide a

meaningful impact to EV charging infrastructure over time, OEMs and

other stakeholders will need a faster solution to hopefully aid in

reversing sluggish EV demand. Several major OEMs have struck deals

to improve EV charging access. For example, last year Ford

announced a partnership with Tesla, giving Ford EVs access to

Tesla’s extensive supercharger network.5

Additionally, GM has teamed up with Pilot Company — the

interstate travel and fuel center operator — to install up to

2,000 high-power fast chargers along U.S. highways in plans for a

coast-to-coast EV charging network.6

The addition of new charging ports and stations will continue to

be positive momentum for broader EV adoption, which should benefit

the OEMs by way of increased EV sales over time. Acknowledging

this, the need for standardized charging technology has also been

identified as a key area for development. As a result, most of the

major OEMs and third-party charging infrastructure providers have

made the commitment to adopt the North American Charging Standard

(NACS) inlet on their future production of EVs and charging

ports.7 Prior to this commitment, there had been a

variety of charging inlets on the market, which furthered the issue

of range anxiety as compatibility with chargers was not standard.

Collaboration among OEMs and third-party charging infrastructure

providers should continue over the next several years of

infrastructure build up and all stakeholders, including consumers,

should realize benefits from increased standardization and

accessibility in EV charging infrastructure.

2024 Presidential Election: A Potential Sea of Change

With the 2024 U.S. presidential election coming soon,

stakeholders across the automotive industry are anxiously awaiting

the results to react to potentially significant policy changes.

Automakers and suppliers alike have delayed key EV investment

decisions until after the results of the election are

finalized.8 Our previous coverage on the topic noted

that a Harris/Walz administration would likely continue the Biden

administration’s rules on vehicle emissions, which are

estimated to require electric vehicles representing between 30

percent and 56 percent of vehicle sales by 2030-2032.9

Meanwhile, a Trump/Vance administration would likely significantly

change emission guidelines, resulting in less pressure on

automakers to ramp up EV production and reduce production of

internal combustion engine (ICE) vehicles. Furthermore, former

President Trump has indicated he sees a much smaller market in the

near- to mid- term future for EVs due to the losses most OEMs are

incurring on EVs and battery range issues.10

The momentum behind EVs and supporting infrastructure could

change drastically depending on the outcome of the presidential

election. The large-scale buildout of a national charging network

would reliably continue under a Harris/Walz administration, and

OEMs and others in the EV supply chain would potentially receive

continued increased levels of support to grow their own charging

network, which would allow further progress towards scale and

profitability in the EV market. Conversely, a Trump/Vance

administration would potentially put the federal funds allocated to

a national charging network at risk, which may lead OEMs to rethink

their EV production goals — particularly when considering

OEMs lose approximately $6,000 on each EV sold.11

Sources

1. EY Mobility Consumer Index shows US less likely to

purchase an EV than last year. https://www.ey.com/en_us/newsroom/2024/09/us-consumers-less-likely-to-purchase-an-ev-than-last-year

2. US Department of Transportation / Federal Highway

Administration. https://highways.dot.gov/newsroom/biden-harris-administration-celebrates-opening-nations-first-nevi-funded-ev-charging

3. Sherwood News: The biggest barrier to the mass

adoption of electric vehicles is charging them. https://sherwood.news/tech/ev-chargers-2030-infrastructure-goals-struggle/

4. Department of Energy / Loan Programs Office. https://www.energy.gov/lpo/articles/lpo-announces-conditional-commitment-evgo-deploy-nationwide-ev-fast-charging-network

5. Ford: Customers can now charge on Tesla Superchargers

in U.S., Canada. https://media.ford.com/content/fordmedia/fna/us/en/news/2024/02/29/ford-customers-can-now-charge-on-tesla-superchargers-in-u-s—ca.html

6. Automotive World: Pilot Travel Centers LLC, General

Motors, and EVgo make convenient, accessible charging a reality

with opening of first stations in coast-to-cost EV charging

network. https://www.automotiveworld.com/news-releases/pilot-travel-centers-llc-general-motors-and-evgo-make-convenient-accessible-charging-a-reality-with-opening-of-first-stations-in-coast-to-coast-ev-charging-network/

7. The International Council on Clean Transportation:

Public EV charging in the United States is about to get a whole lot

easier. https://theicct.org/public-ev-charging-in-the-us-get-easier-feb24/

8. Automotive News: Toss-up election leads companies to

delay investment decisions until after November. https://www.autonews.com/mobility-report/presidential-election-outcome-weighs-industrys-ev-plans

9. Automotive News: EPA eases ramp-up for vehicle

emissions rule to address industry concerns. https://www.autonews.com/regulation-safety/epa-finalizes-auto-tailpipe-rule-slower-ev-pace-amid-criticism

10. Reuters: Trump says he may end EV tax credit; is open

to naming Elon Musk as an adviser. https://www.reuters.com/world/us/trump-says-he-would-consider-ending-7500-electric-vehicle-credit-2024-08-19/

11. Automotive News: Automakers lose about $6,000 on

every EV they sell. https://www.autonews.com/mobility-report/every-ev-leads-6000-losses-automakers-bcg-says

Additional October insights are included

below.

Industry Update

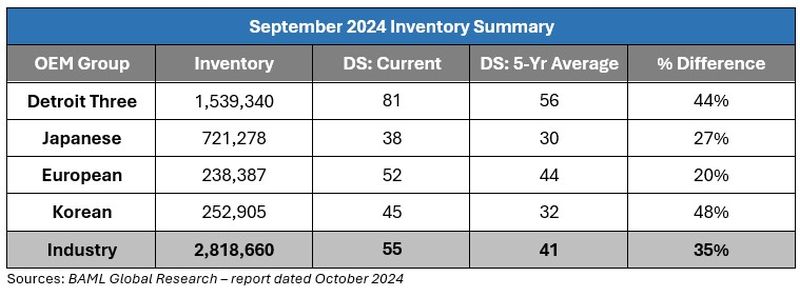

September inventory levels ended at 2.819 million units, a

119,000-unit increase from August. Days’ supply closed at 55,

approximately 35 percent above the five-year average. GM, plus

11,000 units, and Ford, plus 57,000 units, led the way for domestic

increases while Stellantis saw a 7,000-unit decrease.

Regulatory Landscape

BMW Recall: BMW announced it would recall

nearly 700,000 cars in China due to fire risk from a coolant pump

defect. The recall follows a steep drop in deliveries for the

German automaker in China, which is its largest market by revenue;

in the third quarter of 2024, BMW saw its shipments of BMW and Mini

brand cars drop 30 percent.1

Tesla Self-Driving NHTSA Probe: Tesla’s

full self-driving software is again under NHTSA investigation after

four reports of collisions were linked to the software, including

one resulting in a fatality. In all four instances, the vehicle

entered areas with reduced roadway visibility.2

Honda Recall: Honda of North America is

recalling nearly 1.7 million vehicles due to an improperly produced

steering gearbox that swells while driving, causing friction and

difficulty steering. The recall affects nearly a dozen different

models. The company expects that only 1 percent of all vehicles

will actually have the fault.3

Regulatory News Source

1. Automotive News: BMW recalls almost 700,000 cars in

China due to Fire Risk. https://www.autonews.com/china/bmw-recalls-almost-700000-cars-china-fire-risk

2. Automotive News: Tesla Full Self-Driving Software

under US Investigation After Fatal Crash. https://www.autonews.com/regulation-safety/tesla-probed-nhtsa-full-self-driving-collisions

3. Automotive News: Honda Recalls Nearly 1.7M Vehicles in

the US for Steering Wheel Jam. https://www.autonews.com/regulation-safety/honda-recalls-millions-vehicles-steering-problem

31 October 2024

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.