Bussiness

Adani setback 2.0: US indictment sends shockwaves across India and world – Times of India

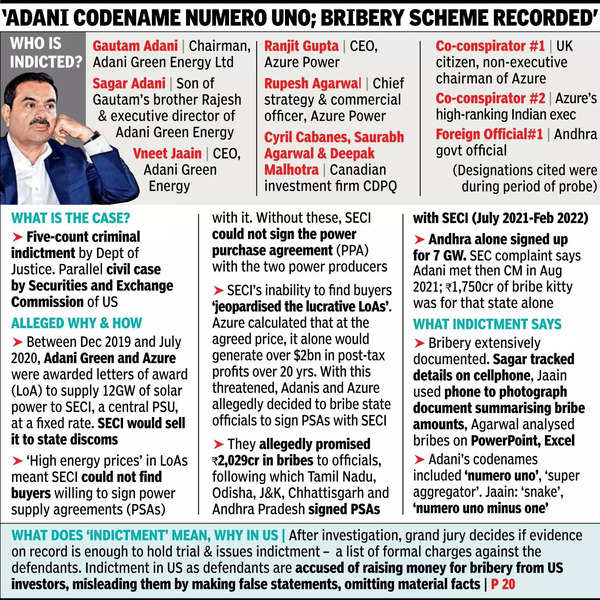

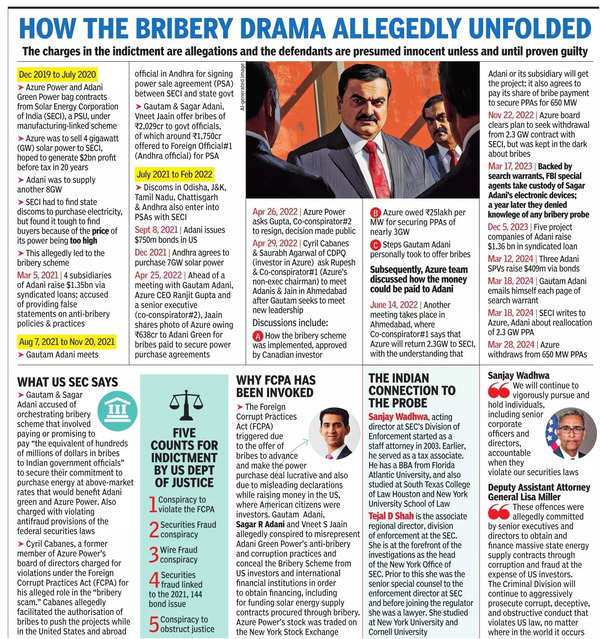

On November 20, 2024, US prosecutors charged Indian businessman Gautam Adani and several executives from his conglomerate, the Adani Group, with orchestrating a $250 million bribery scheme aimed at securing contracts for solar power projects in India.

Driving the news

- The US Department of Justice has indicted Gautam Adani, India’s second-richest man, along with his nephew,

Sagar Adani , and several associates. They are accused of orchestrating a $250 million bribery scheme to secure lucrative green energy contracts in India. The charges include securities and wire fraud, alleging the Adani Group lied to US investors about its anti-bribery practices while engaging in widespread corruption. - This case marks a significant escalation in scrutiny against Adani, who has been under investigation since a 2023 report from Hindenburg Research accused his group of stock manipulation and accounting fraud.

- Simultaneously, the Securities and Exchange Commission (SEC) has filed a civil suit against the two Adanis and a third individual.

- As a result of these charges, Guatam Adani is facing an arrest warrant and criminal penalties in US.

- In response, the Adani Group has strongly denied the allegations, calling them “baseless” and vowing to seek “all possible legal recourse.”

- Meanwhile, the Securities and Exchange Board (Sebi) is investigating whether the Adani Group breached rules requiring the disclosure of market-sensitive information, focusing on Adani Green Energy Ltd’s handling of a US Justice Department probe into bribery allegations, according to a Bloomberg report. Sebi has sought clarification from stock exchange officials and plans to complete the fact-finding process in two weeks, after which it may decide on launching a formal investigation, the Bloomberg report quoting sources said.

Why it matters

- This indictment represents a seismic moment in the intersection of Indian business, global finance, and geopolitics.

- The fallout threatens to disrupt India’s ambitious green energy goals, undermine foreign investor confidence, and tarnish the nation’s corporate reputation on the global stage.

- Adani Green Energy, a central pillar of India’s renewable energy ambitions, faces significant hurdles.

- Because of the US indictment, the group canceled a $600 million bond sale amid plunging share prices, erasing $27 billion in market value across Adani companies.

- Adani’s projects were vital to India’s pledge to generate 50% of its energy from renewables by 2030. Now, financing difficulties could delay solar and wind projects critical to reducing India’s dependence on fossil fuels.

- “India’s renewable energy sector, a critical pillar for global climate goals, may face reduced international investment as a result of this controversy,” Nimish Maheshwari, an independent analyst who publishes on Smartkarma, told Reuters. “Investors may demand greater transparency and due diligence, slowing down the pace of project financing.”

- The group’s role in developing domestic solar manufacturing to reduce reliance on China also hangs in the balance.

- The indictment raises broader questions about the effectiveness of India’s regulatory bodies. Critics argue that Indian regulators have failed to act on previous allegations against Adani, leaving foreign authorities to lead accountability efforts.

- Rick Rossow of the Center for Strategic and International Studies warned, “The silence of India’s regulators is worrying for investors who rely on them to ensure a clean market.”

- The indictment’s impact extends beyond Adani and his empire. Other Indian conglomerates, such as Vedanta Resources, are reassessing bond sales amid fears of investor backlash. Kenyan and Bangladeshi governments have already canceled or reconsidered deals with the Adani Group, citing the scandal.

- Furthermore, international investors may reassess their positions in Indian markets if they perceive an increased risk associated with corporate governance practices. This situation could deter foreign direct investment (FDI) at a time when India is actively seeking to attract global capital.

What they’re saying

- Adani Group: In a strongly worded statement, the conglomerate rejected the allegations. “The charges made by the US Department of Justice and SEC against directors of Adani Green are baseless and denied,” the group said, promising to fight the case vigorously.

- US prosecutors: The Justice Department described the alleged scheme as “extensive,” accusing Adani and his associates of using code names like “numero uno” in WhatsApp conversations to conceal bribery payments.

- Opposition leaders: Rahul Gandhi and others have called for a parliamentary investigation into the Adani Group, citing the indictment as proof of Modi’s preferential treatment of his allies.

- Market analysts: S&P downgraded the outlook for three Adani companies- Adani Green Energy, Adani Electricity and Adani Ports to “negative” from “stable”, warning of reduced access to global capital and rising funding costs.

- “The group will need regular access to both equity and debt markets given its large growth plans, in addition to its regular refinancing. We believe domestic, as well as some international banks and bond market investors, look at Adani entities as a group and could set group limits on their exposure,” S&P said.

- “For Adani, this hits hard, no matter how you slice it. His public relations machine was in overdrive for nearly two years rehabilitating his image following the Hindenburg allegations. This indictment came like a bolt from the blue and instantly reversed all recent progress in salvaging his reputation and business empire,” said Michael Kugelman, director of the South Asia Institute at the Wilson Center.

Zoom in

- The bribery scheme: According to US court filings, Sagar Adani kept meticulous “bribe notes” on his phone, documenting payments to officials in Indian states like Andhra Pradesh, Odisha, and Tamil Nadu.

- In one instance, Adani allegedly offered $200 million in bribes to Andhra Pradesh officials in exchange for a 7,000 MW power contract.

- Prosecutors claim Adani and his team discussed doubling “incentives” to ensure compliance from reluctant officials.

- A canceled $600 million bond issuance reflects the challenges the group now faces in securing international financing.

- Adani Group companies have suffered a sharp decline in value, with investors reassessing their exposure. Foreign lenders, once eager to back Adani’s projects, are now seeking clarity from the group on the indictment’s implications.

- However, Shares of Gautam Adani group companies like Adani Enterprises rallied Friday to pare the previous day’s frenzied sell-off .

Between the lines

- The allegations deepen skepticism about the Adani Group’s rapid ascent. Previous accusations of market manipulation by US-based short-seller Hindenburg Research prompted an outcry but no significant action from Indian regulators. Now, with US prosecutors stepping in, the spotlight is once again on Adani’s business practices.

- Meanwhile, the indictment comes amid strained ties between Washington and New Delhi. The Biden administration has been working to strengthen its partnership with India as a counterbalance to China but now faces new diplomatic hurdles.

- The government is likely to resist any extradition requests from the US, further complicating the situation.

- “It is also worth asking whether

Donald Trump , America’s president-elect, who is on good terms with Mr Modi and who loathes his own justice department, might make the Adanis’ problems go away. But such an arrangement is unlikely to be cost-free for India,” a report in the Economist said.

What next: Too big to fail?

- As of now, the group’s financial position shows a total debt of Rs 2.4 lakh crore, with available cash reserves of Rs 59,791 crore, leading to a net debt position of Rs 1,81,604 crore. The cash holdings represent 24.77% of total debt, providing sufficient liquidity to cover debt obligations for 30 months. Consequently, creditors are not currently concerned about debt servicing capabilities.

- Despite the US allegations, Adani’s domestic influence remains formidable. Public sector banks hold significant exposure to the group’s debt, and government is unlikely to allow a collapse. So, there is no collapse risk for the Adani group in the near future.

- Though the indictment doesn’t pose an immediate existential threat, it significantly complicates the group’s operations. Adani may need to rely more on domestic banks for funding, limiting its ability to expand globally. Key international projects, such as solar manufacturing and infrastructure deals in Africa and Southeast Asia, may face delays or cancellations.

- As for as proceedings in US court are concerned, the timeline for a trial remains uncertain. Even if Adani is extradited or voluntarily surrenders to US authorities, legal processes could extend over a prolonged period.

- If convicted, Adani could face substantial prison time and significant financial penalties. The exact sentence would be determined by the presiding judge, considering the severity of the offenses and other relevant factors.

The bottom line

The indictment of Gautam Adani represents a defining moment for India’s corporate and political landscape. As the case unfolds in US courts, its implications are likely to ripple across global financial markets and diplomatic relations.

Whether the Adani Group can weather this storm depends not only on its legal strategy but also on how India and its global partners navigate the challenges ahead.

But on the political front, one thing is certain: the upcoming Parliament session is likely to see many disruptions over opposition’s demand to arrest of Gautam Adani and for forming a JPC to investigate into US charges.

(With inputs from agencies)