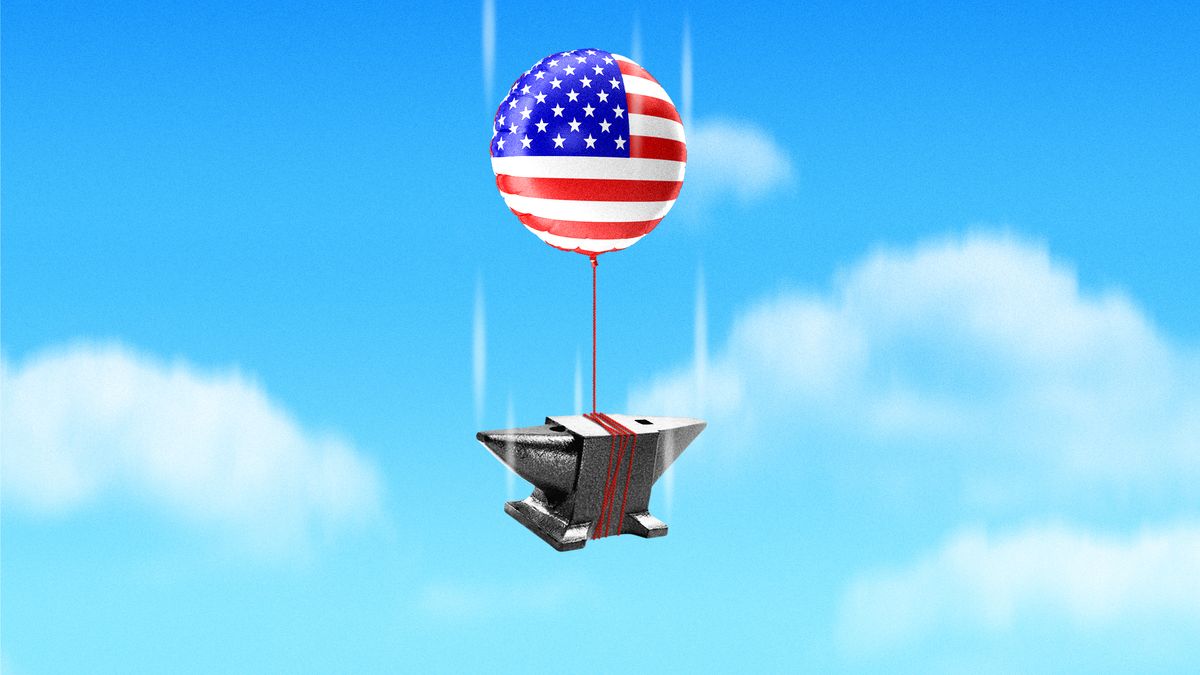

Is 2024 the year America gets the recession economists expected in 2023? It’s a growing concern. A “worse-than-expected” jobs report this month could signal an economic slowdown that “threatens to downshift the nation’s brisk economic growth,” said The Associated Press. The economy added just 175,000 new jobs in April — “well short” of expectations — following reports that America’s overall economic output “slowed dramatically at the outset of 2024.”

The “hard landing” that economists predicted last year never materialized. Current expectations for a “soft landing” for the economy “could be wrong too,” Fortune said. Surveys show companies are pulling back on hiring and workers are increasingly worried about keeping their jobs, Citi chief U.S. economist Andrew Hollenhorst told Bloomberg TV. The good news? That could lead the Federal Reserve to start aggressively cutting interest rates. “I think the Fed’s going to see enough to cut,” Hollenhorst said, “because we’re more toward the hard landing end of the spectrum.”

“The economic slowdown is here. Welcome it,” Aaron Back said in The Wall Street Journal. Why? Because investors really would welcome more Federal Reserve interest rate cuts. Slightly higher unemployment and somewhat slower wage growth — hourly earnings were up just 3.9% in April, compared to 4.3% in February — will also ease the momentum of “stubbornly high inflation.” This means the latest economic data could, oddly, be good news. “A little summer slowdown could be just what this economy needs.”

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

SUBSCRIBE & SAVE

Sign up for The Week’s Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“Declarations that America has achieved a soft landing look premature,” said The Economist. America emerged from the pandemic with a stronger economy than peer nations. Economic growth has been resilient and inflation is less pressing, but it is still close to 3%, above the Federal Reserve’s target rate of 2%. The Fed raised interest rates to rein in inflation; now it must lower rates without letting inflation run rampant again. That’s no sure thing. “Until both are achieved, things could yet go awry.”

“The U.S. economy’s soft landing is still on track,” a trio of Boston Consulting Group economists said in Harvard Business Review. Recent economic data has indeed “given pessimists new resolve.” The economy is still sorting through its “post-pandemic gyrations.” But job growth, wage growth and company balance sheets are all generally strong. “Another recession is an eventual certainty, but we think not in 2024.”

What next?

The soft jobs report means that Federal Reserve rate cuts “will move back up the agenda,” one investment expert told the BBC. Inflation is still higher than the Fed wants to see, but it may have little choice but to act if it appears too much “heat may be coming out of the world’s largest economy.”

“Most Americans are crossing their fingers” a recession won’t happen soon, Business Insider said. Recessions cause businesses to close and workers to lose jobs. That can have long-term effects: “It took many millennials a long time to recover financially from the Great Recession.” The good news? Recent research suggests that recessions have become less common in the United States. So while the next recession might seem unavoidable, “that isn’t necessarily true.”