Tech

Exploring 3 High Growth Tech Stocks In The United States

In the last week, the market has been flat, but it is up 23% over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying high growth tech stocks that can capitalize on these favorable conditions is crucial for investors seeking substantial returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Super Micro Computer | 20.62% | 27.13% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.45% | 61.85% | ★★★★★★ |

| Clene | 73.06% | 62.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amdocs Limited, through its subsidiaries, provides software and services worldwide and has a market cap of $9.93 billion.

Operations: Amdocs generates revenue primarily from providing software products and services, amounting to $4.98 billion. The company operates on a global scale through its subsidiaries.

Amdocs, a significant player in the tech sector, has recently secured multiple high-profile contracts, including agreements with TELUS and VodafoneZiggo to modernize their monetization engines. The company’s earnings are expected to grow 24.1% annually over the next three years, outpacing the US market’s average of 15%. Despite a recent net income decline of $140.29 million from $159.43 million YoY for Q3 2024, Amdocs continues to invest heavily in R&D with expenditures contributing significantly to its innovative edge and future growth prospects.

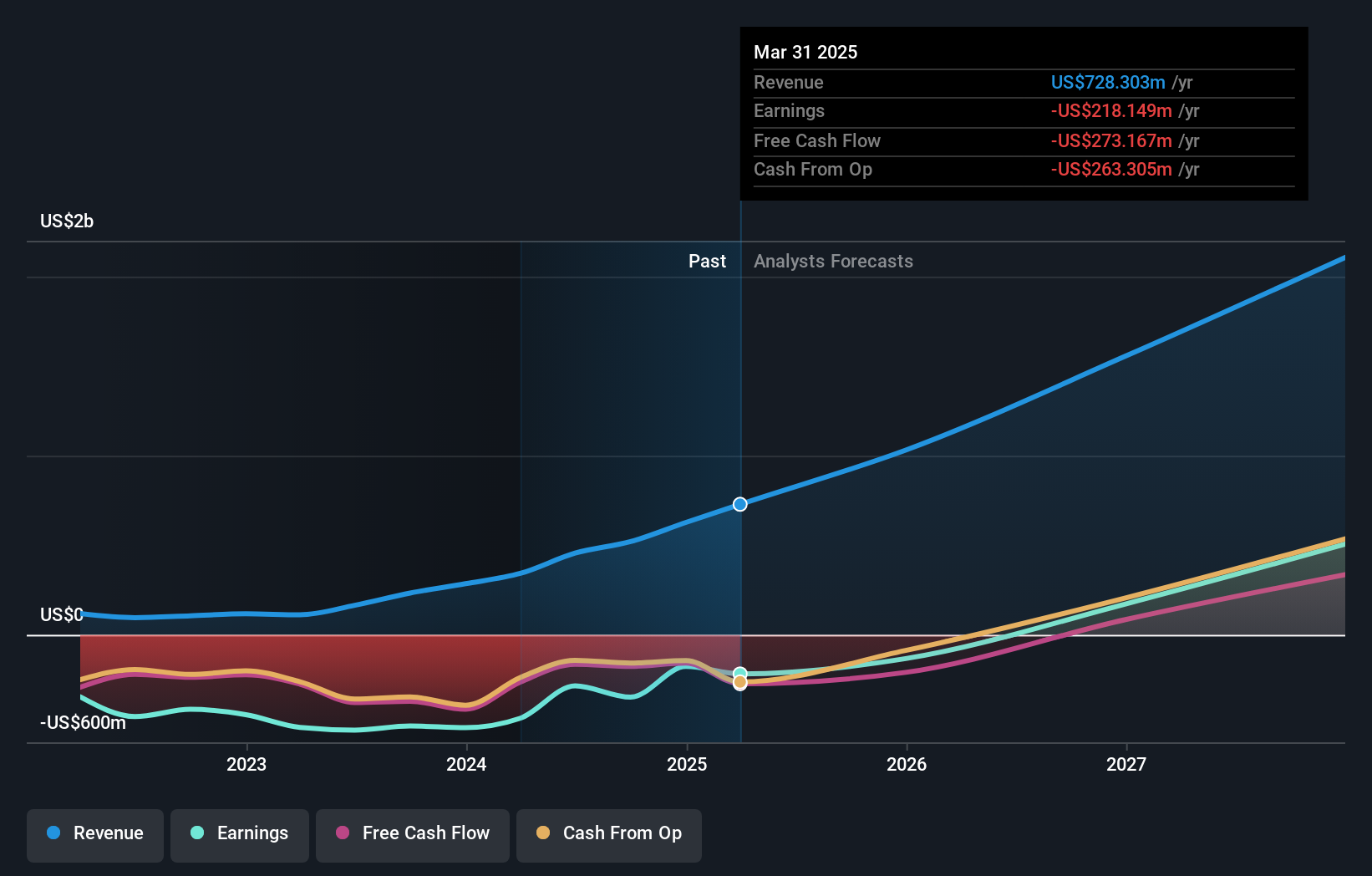

Simply Wall St Growth Rating: ★★★★★☆

Overview: Legend Biotech Corporation is a clinical-stage biopharmaceutical company focused on the discovery, development, manufacturing, and commercialization of novel cell therapies for oncology and other indications globally, with a market cap of $10.54 billion.

Operations: Legend Biotech Corporation generates revenue primarily from its biotechnology segment, amounting to $455.99 million. The company operates in the United States, China, and internationally, focusing on novel cell therapies for oncology and other indications.

Legend Biotech’s revenue is forecast to grow at 35.4% annually, significantly outpacing the US market’s average of 8.7%. The recent approval of cilta-cel by China’s NMPA for treating relapsed or refractory multiple myeloma highlights their innovative edge in CAR-T therapies. Despite a net loss reduction from $199.13 million to $18.2 million YoY in Q2 2024, substantial R&D investments continue, with expenditures driving future growth prospects and maintaining a competitive advantage in the biotech sector.

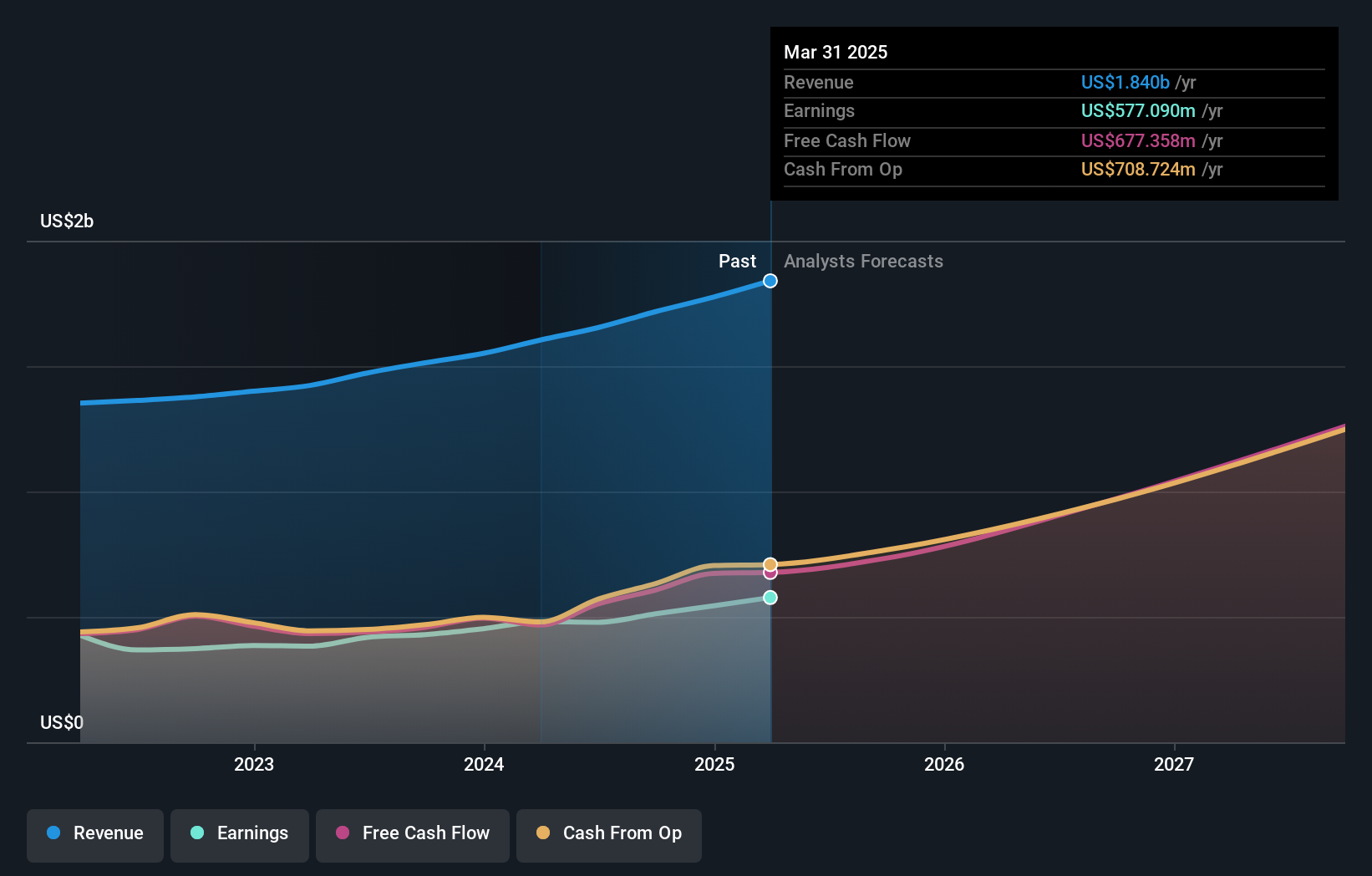

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fair Isaac Corporation develops analytic, software, and digital decisioning technologies and services that enable businesses to automate, enhance, and connect decisions across various regions globally, with a market cap of $42.42 billion.

Operations: Fair Isaac Corporation generates revenue primarily through its Scores segment, which brought in $866 million, and its Software segment, contributing $787.45 million. The company’s operations span multiple regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Fair Isaac Corporation (FICO) has demonstrated robust growth with earnings increasing 17.8% annually over the past five years and a projected revenue growth of 12.3% per year, outpacing the US market’s average of 8.7%. The company has significantly enhanced Mexico’s power and water systems, saving $300 million in 2022 alone through its advanced optimization tools. R&D expenditures have been substantial, driving innovation and maintaining competitive advantage; FICO repurchased shares worth $383.53 million in recent months, reflecting confidence in its future prospects.

Taking Advantage

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com