Tech

Exploring 3 High Growth Tech Stocks in the United States

Over the last 7 days, the United States market has risen by 1.6%, and in the past year, it has climbed an impressive 32%, with earnings forecasted to grow by 15% annually. In light of these robust market conditions, identifying high growth tech stocks requires a focus on companies that demonstrate strong innovation potential and scalability to align with this upward trajectory.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 23.74% | ★★★★★★ |

| Ardelyx | 25.24% | 69.64% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.49% | ★★★★★★ |

| Clene | 78.50% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.44% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Incyte Corporation is a biopharmaceutical company focused on discovering, developing, and commercializing therapeutics for hematology/oncology as well as inflammation and autoimmunity, with a market cap of approximately $14.41 billion.

Operations: Incyte generates revenue primarily from its biotechnology segment, amounting to $4.08 billion. The company is involved in the discovery, development, and commercialization of therapeutics targeting hematology/oncology and inflammation/autoimmunity markets both domestically and internationally.

Incyte, navigating through a challenging landscape marked by a notable 46.5% anticipated annual earnings growth, contrasts sharply with its current revenue trajectory which lags behind at 9% annually. This juxtaposition highlights the firm’s strategic emphasis on innovation despite market pressures, underscored by its substantial R&D commitment—evident from recent adjustments to clinical trials and product pipelines that could reshape future operations. Moreover, recent corporate maneuvers including revised upward revenue forecasts suggest adaptive strategies to maintain competitiveness in a volatile sector.

Simply Wall St Growth Rating: ★★★★★☆

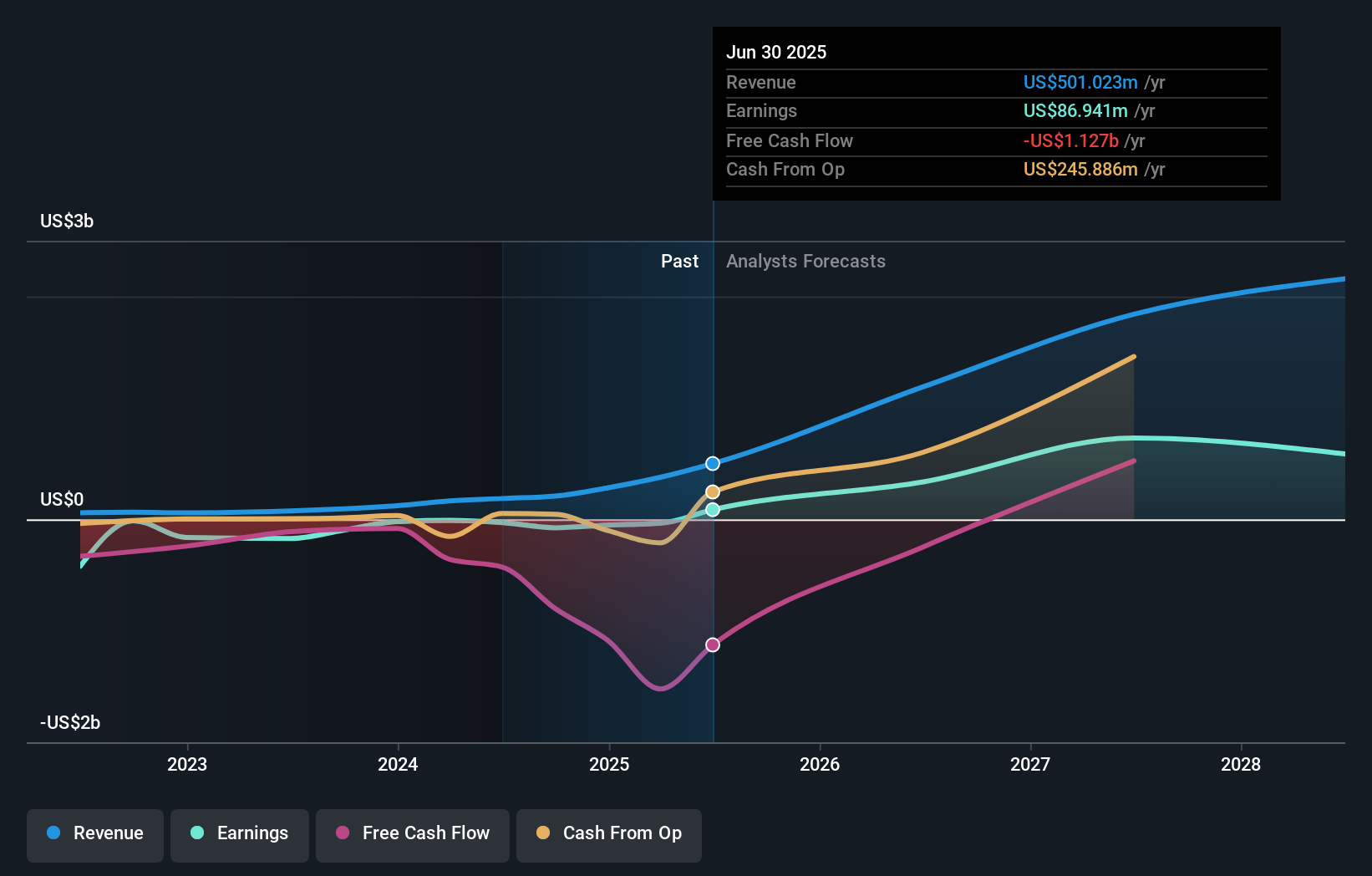

Overview: Iris Energy Limited owns and operates bitcoin mining data centers, with a market cap of $1.81 billion.

Operations: Iris Energy focuses on bitcoin mining through its data centers. The company generates revenue primarily from the production and sale of mined bitcoins, leveraging its infrastructure to optimize operational efficiency.

Iris Energy, amidst a challenging landscape, showcases resilience with a forecasted revenue growth of 40.7% annually, outpacing the U.S. market’s average of 8.9%. This growth trajectory is complemented by an anticipated shift to profitability within three years, reflecting a robust strategic pivot despite recent operational losses such as the Q1 net loss widening to $51.71 million from the previous year’s $5.3 million. The firm’s commitment to innovation is underscored by its R&D efforts which are crucial for sustaining long-term competitiveness in the high-stakes tech arena, especially as it navigates through legal challenges and fluctuating operational metrics like Bitcoin mining outputs and hashrate variations reported monthly.

Simply Wall St Growth Rating: ★★★★★★

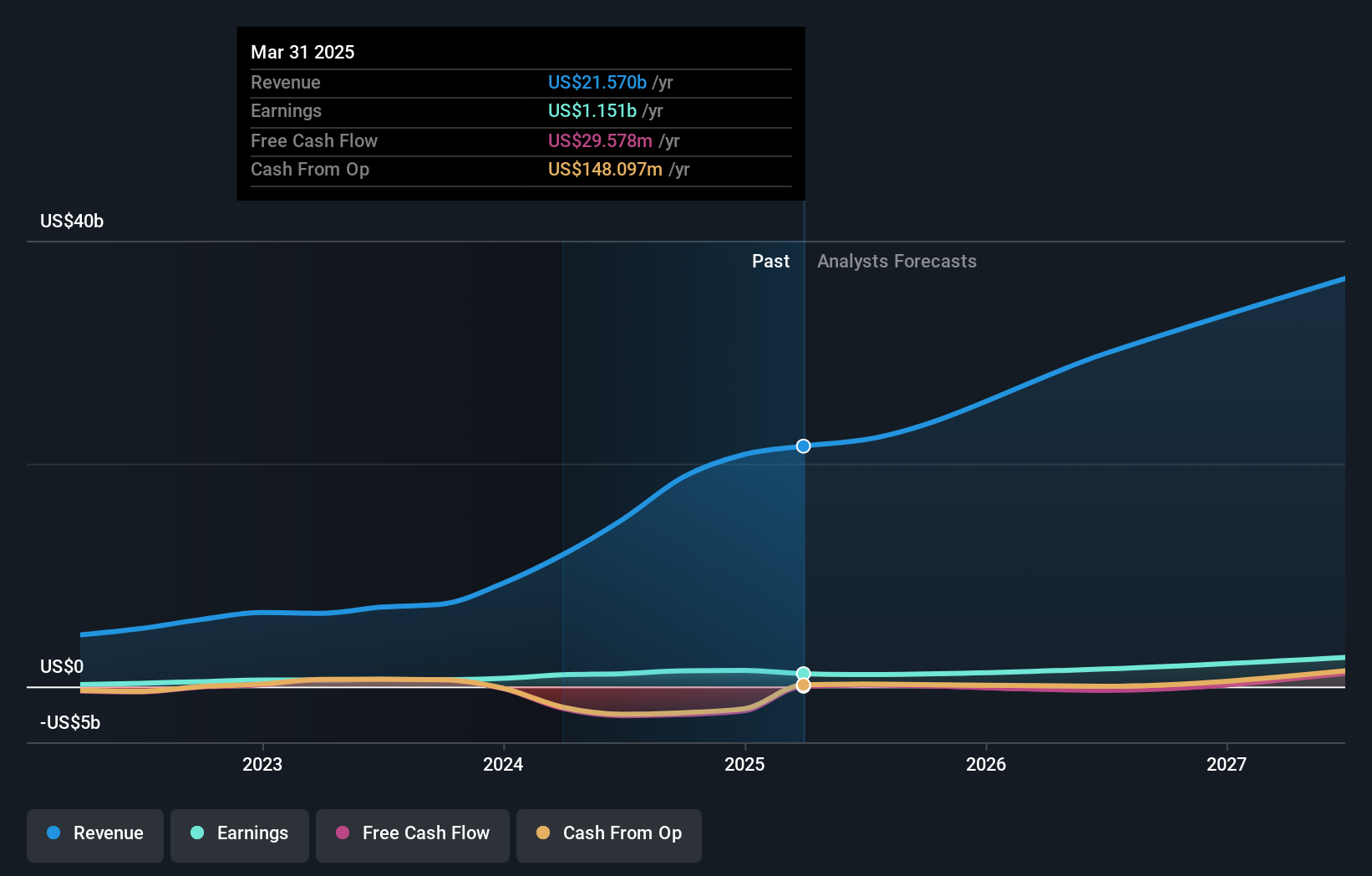

Overview: Super Micro Computer, Inc. is a company that specializes in developing and manufacturing high-performance server and storage solutions with a modular and open architecture, operating across the United States, Europe, Asia, and internationally; it has a market capitalization of approximately $20.16 billion.

Operations: Super Micro Computer, Inc. generates revenue primarily from developing and providing high-performance server solutions, totaling approximately $14.94 billion. The company’s operations span globally across key regions including the United States, Europe, and Asia.

Super Micro Computer, Inc. (SMCI) is navigating a challenging period marked by regulatory scrutiny and filing delays, yet it continues to demonstrate robust financial growth with projected annual revenue increases of 23.8% and earnings growth of 23.7%. Despite recent compliance issues with NASDAQ’s listing requirements due to delayed financial reporting, SMCI’s strategic focus on R&D remains evident; their investment in innovation is critical as they strive for competitive advantage in the rapidly evolving tech landscape. This commitment to R&D not only fuels future capabilities but also positions SMCI favorably as it works through current compliance challenges and aims for sustained long-term growth within the tech sector.

Seize The Opportunity

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com