Tech

Exploring High Growth Tech Stocks in the United States December 2024

Over the last 7 days, the United States market has experienced a 4.0% drop, yet it remains up by 24% over the past year with earnings forecasted to grow by 15% annually. In this dynamic landscape, identifying high growth tech stocks involves focusing on companies that demonstrate strong innovation and adaptability to capitalize on these promising market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.95% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Applied Optoelectronics, Inc. designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China with a market capitalization of $1.45 billion.

Operations: The company generates revenue primarily from its optical networking equipment segment, totaling $209.55 million.

Applied Optoelectronics, a player in the high-tech optics sector, is navigating a challenging landscape with significant volatility and recent strategic moves aimed at stabilization and growth. Despite reporting a net loss of $17.76 million in Q3 2024, up from $8.95 million the previous year, the company is optimistic about its future, projecting Q4 revenues between $94 million to $104 million. This projection aligns with their aggressive R&D investment strategy which remains crucial as they aim to reverse their fortunes and capitalize on growing demands in tech innovations. Recent activities including multiple follow-on equity offerings indicate efforts to bolster financial flexibility amidst these transitions.

Simply Wall St Growth Rating: ★★★★★☆

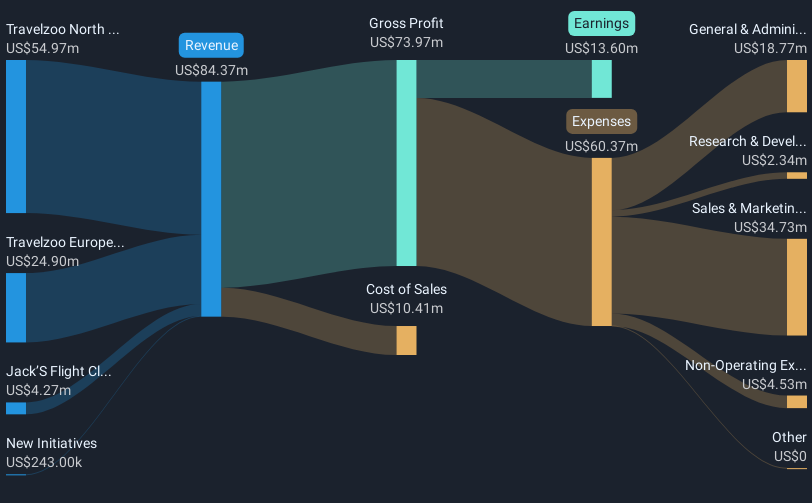

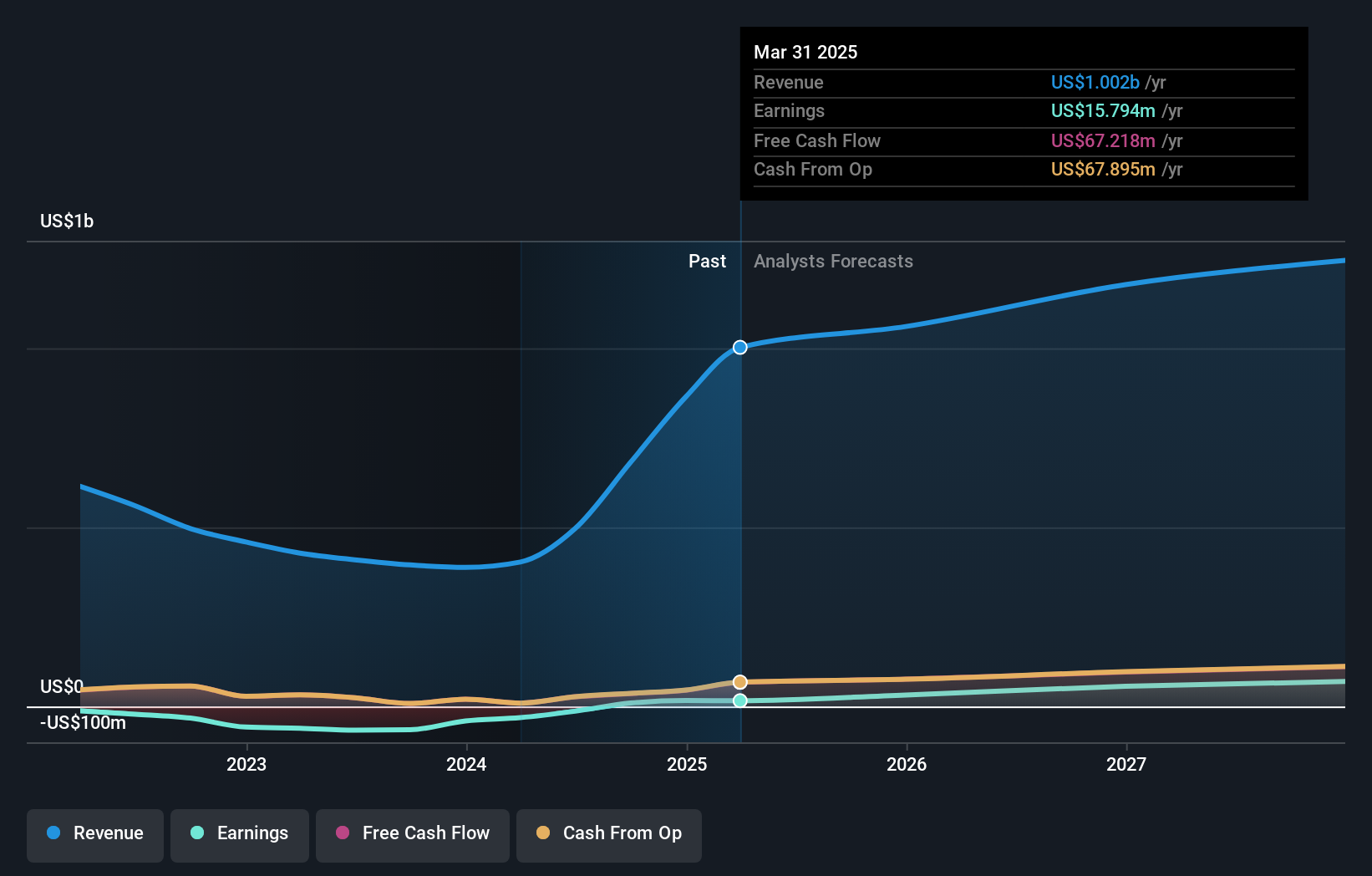

Overview: Travelzoo, with a market cap of $250.84 million, operates as an Internet media company offering travel, entertainment, and local experiences globally through its subsidiaries.

Operations: The company generates revenue primarily from Travelzoo North America ($54.97 million) and Travelzoo Europe ($24.90 million), with additional contributions from Jack’s Flight Club ($4.27 million) and New Initiatives ($0.24 million).

Travelzoo, amidst a dynamic tech landscape, demonstrates robust growth with a 24.8% annual increase in revenue and an even more impressive 34.7% surge in earnings. This performance outpaces the broader U.S. market’s growth rates of 9.1% and 15.3%, respectively, underscoring its potential in the interactive media and services sector where it has eclipsed industry earnings decline of -2.5%. Furthermore, Travelzoo’s commitment to shareholder returns is evident from its recent buyback activities, repurchasing shares worth $12.57 million, enhancing investor confidence amid financial strategies aimed at sustaining growth trajectories and capital efficiency.

Simply Wall St Growth Rating: ★★★★★☆

Overview: MediaAlpha, Inc. operates an insurance customer acquisition platform in the United States and has a market capitalization of approximately $769.97 million.

Operations: The company generates revenue primarily through its Internet Information Providers segment, amounting to $681.23 million. It focuses on facilitating insurance customer acquisition in the U.S., leveraging a platform-based approach.

MediaAlpha’s recent performance underscores a significant turnaround, with third-quarter sales soaring to $259.13 million from $74.57 million the previous year, and net income flipping to $9.48 million from a loss of $13.5 million. This growth trajectory is supported by an aggressive forecast for the fourth quarter, expecting revenues between $275 million to $295 million—a potential 143% increase year-over-year at the midpoint. Such figures are reflective of MediaAlpha’s successful strategic adjustments and operational efficiencies in a competitive tech landscape, where innovation and market adaptability remain critical for sustaining high growth rates in revenue and earnings.

Summing It All Up

- Click through to start exploring the rest of the 232 US High Growth Tech and AI Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Travelzoo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com