Tech

Exploring High Growth Tech Stocks in the United States for September 2024

Over the last 7 days, the market has dropped 4.4%. As for the longer term, the market has risen by 19% in the last year. Looking forward, earnings are forecast to grow by 15% annually. In this context, identifying high growth tech stocks that can capitalize on these trends is crucial for investors seeking robust returns in a dynamic market environment.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Super Micro Computer | 20.49% | 27.13% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Ardelyx | 27.44% | 65.92% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Travere Therapeutics | 26.72% | 68.41% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gambling.com Group Limited operates as a performance marketing company for the online gambling industry worldwide and has a market cap of $363.08 million.

Operations: Gambling.com Group Limited generates revenue primarily through its gambling affiliation segment, which brought in $115.74 million. The company operates as a performance marketing entity within the online gambling sector globally.

Gambling.com Group has demonstrated robust financial performance, with second-quarter sales reaching $30.54 million, a 17.6% increase from the previous year. Net income surged to $6.93 million from $0.28 million, reflecting a significant improvement in profitability. The company’s R&D expenses are noteworthy; investing heavily in innovation ensures continued growth and competitiveness within the tech sector. Additionally, it revised its full-year revenue guidance upward to between $123 million and $127 million and completed share repurchases worth $19.98 million, indicating strong confidence in its future prospects.

Simply Wall St Growth Rating: ★★★★★★

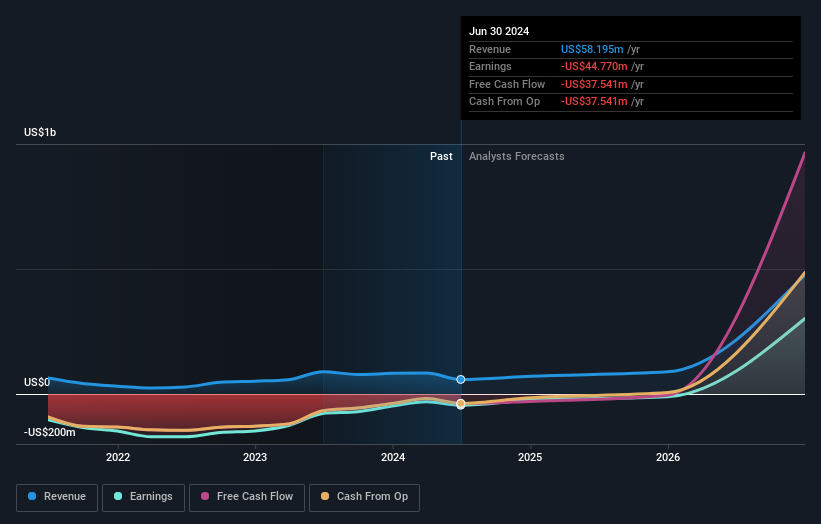

Overview: G1 Therapeutics, Inc. is a commercial-stage biopharmaceutical company focused on discovering, developing, and commercializing small molecule therapeutics for cancer treatment in the United States, with a market cap of $377.11 million.

Operations: G1 Therapeutics generates revenue primarily from its biotechnology segment, amounting to $58.20 million. The company focuses on developing and commercializing small molecule therapeutics for cancer treatment in the United States.

G1 Therapeutics has shown significant potential within the tech sector, particularly in biotechnology. Despite a 27.6% annual revenue growth forecast and a projected earnings increase of 57.8%, the company reported a net loss of $5.47 million in Q2 2024, compared to an $8.71 million net income the previous year. Their R&D expenses reflect their commitment to innovation, with substantial investments aimed at advancing treatments like trilaciclib for cancer patients, despite recent trial setbacks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivid Seats Inc. operates an online ticket marketplace in the United States, Canada, and Japan with a market cap of $961.34 million.

Operations: Vivid Seats generates revenue primarily through its marketplace and resale segments, with the marketplace segment contributing $651.72 million and the resale segment adding $123.89 million. The company operates in the United States, Canada, and Japan.

Vivid Seats’ recent exclusive media deal with I Am Athlete underscores its innovative approach to fan engagement, leveraging high-profile athletes and celebrities. Despite a net loss of $1.06 million in Q2 2024, the company reported revenue growth to $198.32 million from $165.38 million last year. Earnings are forecasted to grow at 30.1% annually, although profit margins have decreased from 9.4% to 4.7%. The company repurchased approximately 2.58% of shares for $19.99 million this year, reflecting confidence in its long-term strategy.

Seize The Opportunity

- Dive into all 249 of the US High Growth Tech and AI Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com