Tech

Exploring High Growth Tech Stocks in the United States November 2024

Over the last 7 days, the United States market has experienced a 2.1% decline, though it has shown a robust 30% increase over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves focusing on companies that demonstrate strong innovation and adaptability to capitalize on these favorable long-term trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Invivyd | 54.76% | 71.32% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Clene | 78.50% | 60.70% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Travere Therapeutics | 31.75% | 72.43% | ★★★★★★ |

| Blueprint Medicines | 25.47% | 68.62% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Netflix, Inc. offers entertainment services and has a market capitalization of $352.21 billion.

Operations: The company generates revenue primarily from its streaming entertainment service, which amounts to $37.59 billion.

Netflix’s strategic maneuvers, including a recent partnership with Converge ICT Solutions and the launch of the Converge Netflix Bundle, underscore its commitment to enhancing subscriber experiences and expanding market reach. This collaboration is poised to leverage Converge’s claim as the fastest internet provider in the Philippines, potentially boosting Netflix’s user engagement and satisfaction. Financially, Netflix has demonstrated robust growth with a third-quarter revenue surge to $9.82 billion from $8.54 billion year-over-year and net income rising sharply to $2.36 billion from $1.68 billion in the same period. The company’s forward-looking statements suggest a continuation of this trajectory with revenue projections for 2025 between $43 billion and $44 billion, marking an upswing of 11%-13% from its 2024 guidance of $38.9 billion, driven by innovations in content and new segments like gaming and advertising services.

Moreover, Netflix’s R&D investments are pivotal in sustaining its competitive edge by fostering innovation across its service offerings; these expenditures are crucial for developing new technologies that enhance viewer experiences through improved content delivery platforms or groundbreaking features like interactive storytelling or AI-driven personalization techniques which could further solidify its market position against competitors.

Simply Wall St Growth Rating: ★★★★★☆

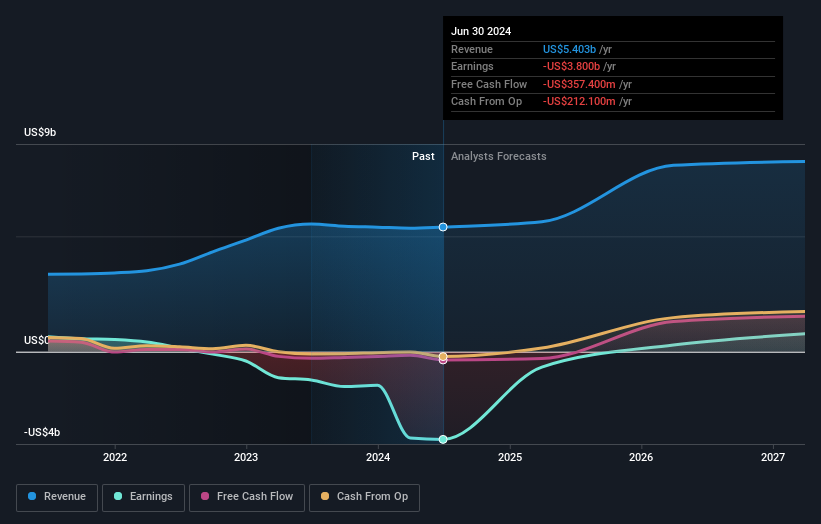

Overview: Take-Two Interactive Software, Inc. develops, publishes, and markets interactive entertainment solutions globally and has a market cap of $31.19 billion.

Operations: Take-Two generates revenue primarily through its publishing segment, which accounts for $5.46 billion. The company is involved in the creation and distribution of interactive entertainment products worldwide.

Take-Two Interactive Software, despite recent financial challenges marked by a net loss reduction to $365.5 million from $543.6 million year-over-year in Q2 2024, shows promising signs of recovery and strategic refocusing. The company’s revenue growth at 14.4% annually surpasses the US market average of 8.9%, reflecting its resilient demand dynamics even during unprofitable phases. With earnings expected to surge by an impressive 102.6% annually, Take-Two’s commitment to innovation is evident in its R&D investments, crucial for maintaining competitiveness in the evolving gaming landscape. Moreover, the potential divestiture of its adtech division Chartboost indicates a strategic shift towards core gaming operations, which could streamline efforts and capitalize on high-growth areas like AAA titles, enhancing future profitability prospects.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A. operates as a global provider of audio streaming subscription services with a market capitalization of approximately $92.62 billion.

Operations: Spotify generates revenue primarily through its Premium subscription service, which accounts for €13.28 billion, and its Ad-Supported segment, contributing €1.82 billion.

Spotify Technology has demonstrated a robust turnaround, with its latest quarterly earnings showing a surge in net income to €300 million from €65 million year-over-year, and sales climbing to €3.988 billion from €3.357 billion. This growth is underpinned by a strategic push in R&D, where expenses are aligned with fostering innovation and enhancing platform capabilities—critical for staying competitive in the dynamic tech landscape. The company’s projected revenue growth of 12.5% annually outpaces the US market average of 8.9%, while earnings are expected to grow at an impressive rate of 29.5% per year, signaling strong future prospects amidst aggressive market competition.

Make It Happen

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com