Tech

Exploring High Growth Tech Stocks In United States October 2024

Over the last 7 days, the United States market has remained flat, yet it is up 38% over the past year with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks involves looking for companies that not only align with current market trends but also demonstrate strong potential for sustained revenue and earnings expansion.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 43.83% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| AsiaFIN Holdings | 60.53% | 81.55% | ★★★★★★ |

| Amicus Therapeutics | 20.33% | 62.45% | ★★★★★★ |

| Travere Therapeutics | 27.74% | 70.00% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc. is a digital asset technology company operating in the United States, with a market capitalization of $2 billion.

Operations: TeraWulf generates revenue primarily through digital currency mining, reporting $120.25 million in this segment.

TeraWulf, navigating the volatile terrain of high-growth tech, has shown a promising trajectory with a forecasted revenue growth of 53% per year. This figure notably outpaces the broader US market’s growth rate of 8.9%. Despite current unprofitability, earnings are expected to surge by 108.47% annually, positioning TeraWulf on a path towards profitability within three years. Recent strategic moves like the expanded Lake Mariner lease underscore its commitment to scaling operations in high-performance computing and AI data centers, ensuring long-term sustainability and aligning closely with industry shifts towards more energy-efficient digital infrastructure.

Simply Wall St Growth Rating: ★★★★★★

Overview: Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company specializing in RNA-targeted therapeutics and gene therapies for rare diseases, with a market cap of $12.12 billion.

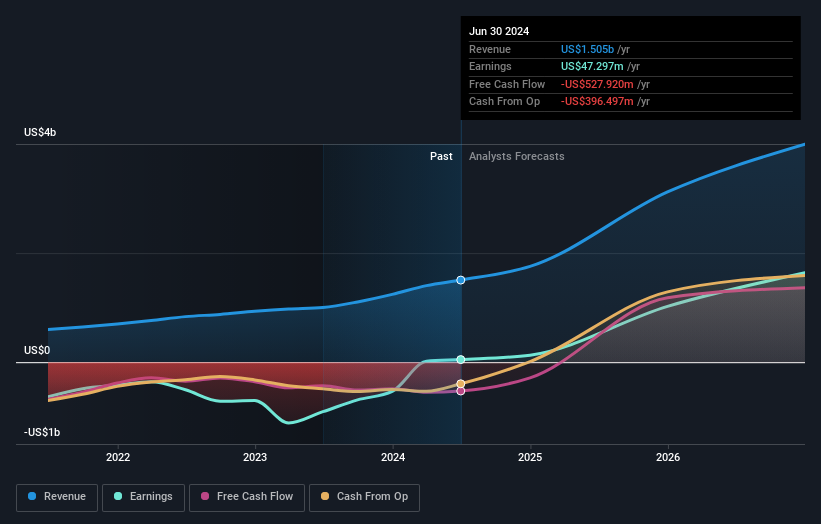

Operations: Sarepta Therapeutics generates revenue primarily from discovering, developing, manufacturing, and delivering therapies, amounting to $1.50 billion. The company is focused on RNA-targeted therapeutics and gene therapies for rare diseases.

Sarepta Therapeutics, stepping into profitability this year, demonstrates a robust growth trajectory with projected revenue increases of 23.7% annually, significantly outpacing the US market average of 8.8%. This biotech innovator is not just growing faster than its peers; it’s also expected to see earnings skyrocket by 43.8% per year. Recent strategic board expansions and high-profile conference presentations underscore Sarepta’s commitment to advancing its leadership in muscle disease therapies, aligning with industry trends towards specialized healthcare solutions.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Corning Incorporated operates in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences sectors both in the United States and globally, with a market capitalization of approximately $39.93 billion.

Operations: Corning generates revenue primarily from its optical communications ($3.86 billion) and display technologies ($3.73 billion) segments, followed by specialty materials, environmental technologies, life sciences, and Hemlock and emerging growth businesses. The company’s cost structure is influenced by its diverse operations across these sectors, with each segment contributing uniquely to the overall financial performance.

Amidst a transformative phase, Corning is steering the tech industry forward with its latest innovation, EXTREME ULE Glass, designed to enhance EUV lithography—a crucial technology for advanced chip manufacturing. This product underscores Corning’s strategic focus on high-tech materials that support next-generation tech needs, aligning with a 10.1% annual revenue growth projection. Furthermore, the company’s commitment to R&D is evident from its significant investment in research activities amounting to $1 billion annually, representing 28.3% of their total expenditures. These initiatives not only propel Corning’s technological edge but also solidify its role in shaping future tech landscapes while navigating through board transitions and maintaining shareholder confidence with consistent dividends and strategic share repurchases totaling $1.8 billion since 2019.

Make It Happen

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com