Tech

Exploring Three High Growth Tech Stocks in the United States

The market has climbed 3.1% in the last 7 days and 25% over the past year, with earnings expected to grow by 15% per annum over the next few years. In this robust environment, identifying high growth tech stocks that align with these promising conditions can be key to successful investing.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| Super Micro Computer | 20.84% | 35.00% | ★★★★★★ |

| Iris Energy | 70.63% | 125.09% | ★★★★★★ |

| G1 Therapeutics | 24.26% | 51.62% | ★★★★★★ |

| Invivyd | 42.85% | 71.50% | ★★★★★★ |

| Clene | 73.06% | 62.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 254 stocks from our US High Growth Tech and AI Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gilead Sciences, Inc. is a biopharmaceutical company that discovers, develops, and commercializes medicines for unmet medical needs globally, with a market cap of approximately $92.69 billion.

Operations: Gilead Sciences focuses on the discovery, development, and commercialization of innovative medicines, generating $27.81 billion in revenue. The company operates internationally across the United States and Europe.

Gilead Sciences has recently secured accelerated FDA approval for Livdelzi, a novel treatment for primary biliary cholangitis (PBC), which is expected to address unmet medical needs in this rare liver disease. The company’s R&D expenses reflect its commitment to innovation, with $2.2 billion invested in 2023 alone, contributing significantly to its pipeline’s growth. Despite a challenging year marked by an 80.8% earnings drop due to a one-off $8.5 billion loss, Gilead’s earnings are forecasted to grow at an impressive 35.9% annually over the next three years, outpacing the US market average of 15.2%.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Seagate Technology Holdings plc provides data storage technology and infrastructure solutions globally, including in Singapore, the United States, and the Netherlands, with a market cap of approximately $21.85 billion.

Operations: Seagate Technology Holdings plc generates revenue primarily from the manufacture and distribution of storage solutions, amounting to $6.55 billion. The company’s operations span multiple international markets, including Singapore, the United States, and the Netherlands.

Seagate Technology Holdings has demonstrated robust growth, with revenues forecasted to increase by 13.1% annually and earnings expected to grow by 26.8% per year. The company’s commitment to innovation is evident in its R&D expenses, which amounted to $1 billion in the past year, supporting advancements like their Circularity Program aimed at reducing e-waste. Recent financial results show a significant turnaround with net income of $513 million for Q4 2024 compared to a net loss of $92 million a year ago, bolstered by strategic collaborations such as the sustainability partnership with eBay.

Simply Wall St Growth Rating: ★★★★☆☆

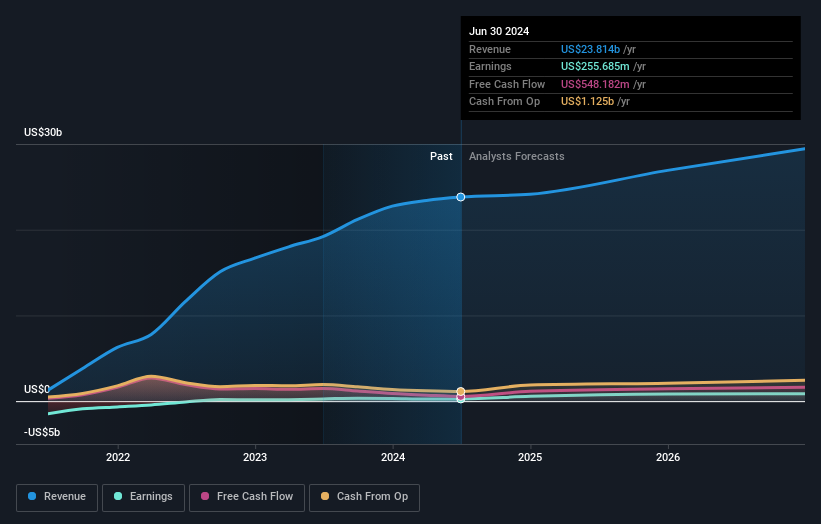

Overview: Live Nation Entertainment, Inc. operates as a live entertainment company worldwide with a market cap of $22.23 billion (NYSE:LYV).

Operations: Live Nation Entertainment generates revenue primarily from Concerts ($19.72 billion), Ticketing ($3.03 billion), and Sponsorship & Advertising ($1.15 billion). The company operates globally, focusing on live events and associated ticket sales.

Live Nation Entertainment’s earnings are projected to grow at 29.6% annually, significantly outpacing the US market’s 15.1%. Despite a one-off loss of $249.8 million, the company reported Q2 sales of $6.02 billion and net income of $297.97 million, reflecting robust performance in its core segments like Ticketmaster and live events. The expanded partnership with PENN Entertainment enhances its reach, potentially driving future revenue growth amidst rising global demand for live events.

Seize The Opportunity

- Access the full spectrum of 254 US High Growth Tech and AI Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com