Tech

Exploring Three High Growth Tech Stocks In The United States

The market has climbed 1.2% in the last 7 days, with a gain of 1.3%, and is up 30% over the last 12 months, with earnings forecast to grow by 15% annually. In this thriving environment, identifying high growth tech stocks that align with these positive trends can be crucial for investors looking to capitalize on the momentum.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.81% | 27.98% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.46% | 66.34% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 251 stocks from our US High Growth Tech and AI Stocks screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GDS Holdings Limited, along with its subsidiaries, develops and operates data centers in the People’s Republic of China and has a market cap of approximately $3.80 billion.

Operations: GDS Holdings generates revenue primarily through the design, build-out, and operation of data centers in China, reporting CN¥10.53 billion from this segment. The company focuses on providing reliable infrastructure for its clients’ data storage needs.

GDS Holdings, navigating through a challenging landscape, reported a slight reduction in net loss to CNY 225.74 million from CNY 226.58 million year-over-year for Q2 2024, reflecting resilience amidst volatility. Despite current unprofitability, the company’s revenue trajectory is promising with a forecasted annual growth rate of 15%, outpacing the US market average of 8.7%. This growth is underpinned by significant R&D investment aimed at innovation and competitive differentiation in the tech sector. Looking ahead, GDS is positioned to pivot into profitability within three years, spurred by an aggressive earnings growth forecast of 83.37% annually, showcasing potential for substantial future gains in an ever-evolving industry landscape.

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc., along with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture globally, with a market cap of $26.78 billion.

Operations: Super Micro Computer, Inc. generates revenue primarily through the development and provision of high-performance server solutions, amounting to $14.94 billion. The company operates in the United States, Europe, Asia, and other international markets.

Super Micro Computer has been making significant strides in the tech industry, notably with its inclusion in the FTSE All-World Index and its innovative FlexTwin systems launch, designed for high-complexity computing tasks. Despite facing compliance issues with NASDAQ’s listing rules due to delayed financial reporting, the company’s recent unveiling of FlexTwin highlights its commitment to addressing advanced computing needs through cost-effective and energy-efficient solutions. This focus on specialized high-performance computing not only caters to current market demands but also positions Super Micro strategically for future technological advancements.

Simply Wall St Growth Rating: ★★★★★☆

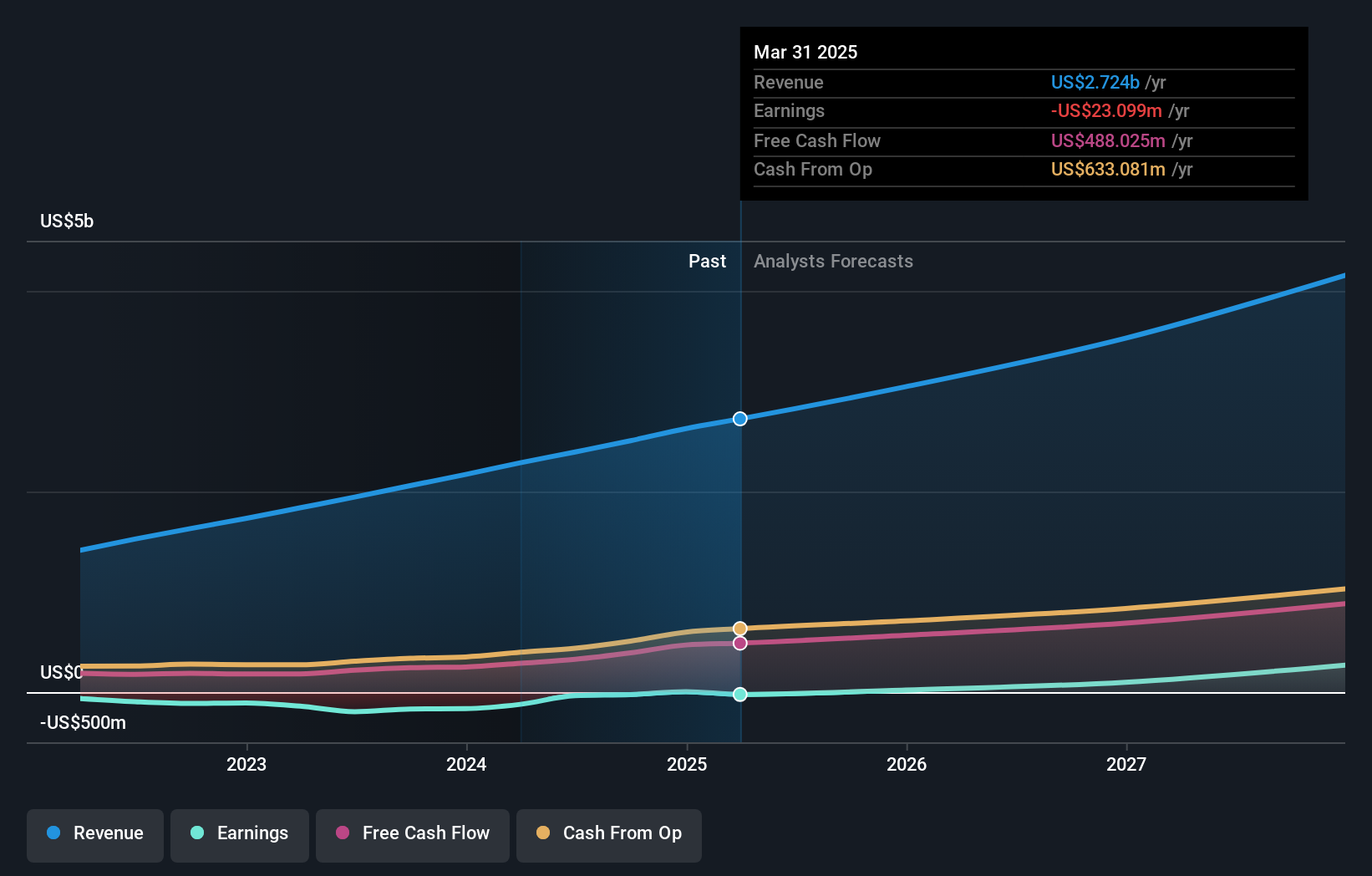

Overview: HubSpot, Inc., along with its subsidiaries, offers a cloud-based customer relationship management (CRM) platform for businesses across the Americas, Europe, and the Asia Pacific and has a market cap of approximately $27.05 billion.

Operations: HubSpot generates revenue primarily from its Internet Software & Services segment, which brought in $2.39 billion. The company focuses on providing a CRM platform to businesses across multiple regions, including the Americas, Europe, and the Asia Pacific.

HubSpot, amidst a tech landscape where AI and data-driven solutions are paramount, is positioning itself as a crucial player with its recent product launches and strategic alliances. The company’s R&D expenses have been pivotal, fostering innovations like Breeze AI which integrates seamlessly across its platforms to enhance CRM capabilities and marketing efficiency. This focus on unified, efficient solutions is reflected in their expected revenue growth of 14.9% annually, outpacing the US market average of 8.7%. Moreover, HubSpot’s commitment to growth is underscored by its forecasted profit surge at an impressive rate of 46.2% per year, signaling robust future prospects despite current unprofitability. These strategic moves not only cater to immediate customer needs but also lay a foundation for sustained long-term growth in the evolving digital economy.

Next Steps

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com