Tech

Exploring Three High Growth Tech Stocks In The United States

Over the last 7 days, the United States market has remained flat, but it is up 39% over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and potential to capitalize on expanding market opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 21.08% | 28.73% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.26% | 62.89% | ★★★★★★ |

| MediaAlpha | 26.82% | 83.70% | ★★★★★★ |

| Travere Therapeutics | 29.32% | 70.79% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 247 stocks from our US High Growth Tech and AI Stocks screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Incyte Corporation is a biopharmaceutical company focused on discovering, developing, and commercializing therapeutics for hematology/oncology and inflammation and autoimmunity areas globally, with a market cap of $14.18 billion.

Operations: Incyte focuses on developing and commercializing treatments in hematology/oncology and inflammation/autoimmunity sectors, generating revenue primarily through product sales and collaborations. The company operates internationally, leveraging its research capabilities to expand its therapeutic offerings.

Incyte’s strategic focus on R&D is evident, with a significant 8.9% of its revenue directed towards these activities, underscoring a commitment to innovation despite the broader industry challenges. This investment is part of why earnings are projected to surge by an impressive 46.4% annually over the next three years, outpacing the general market’s growth. Recent financials reveal a dip in net income from USD 171.27 million to USD 106.46 million year-over-year for Q3, yet Incyte continues to push forward in high-stakes markets like oncology and immunotherapy with promising clinical trials and FDA approvals that could pivot future profitability and market position robustly.

Simply Wall St Growth Rating: ★★★★★☆

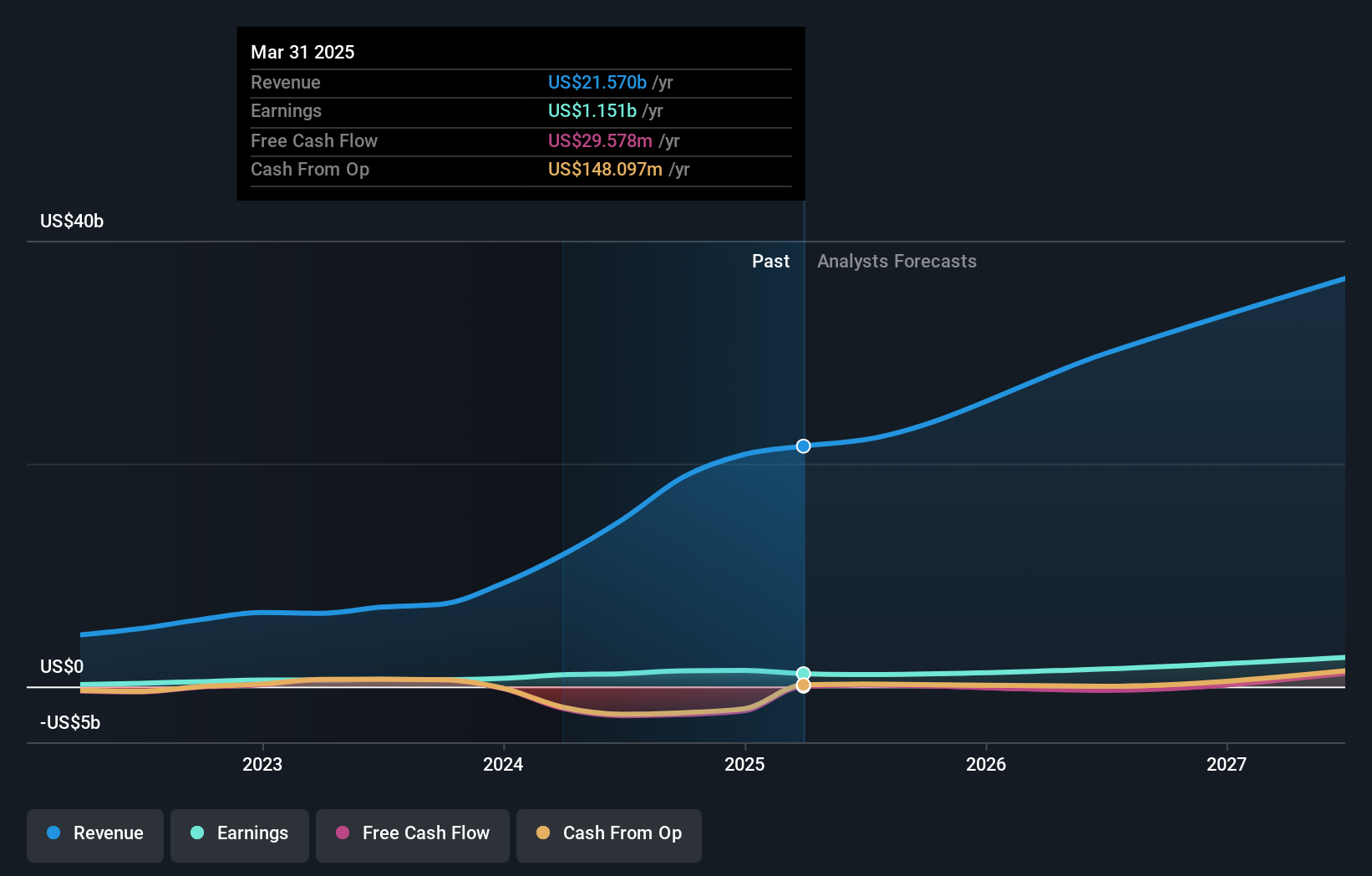

Overview: Nutanix, Inc. offers an enterprise cloud platform across multiple regions including North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa with a market capitalization of approximately $17.17 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $2.15 billion. The business operates across various global regions, focusing on providing a comprehensive enterprise cloud platform.

Nutanix, despite its current unprofitability, shows a promising trajectory with an expected revenue growth of 13.1% per year, outpacing the US market’s average of 8.9%. This growth is bolstered by significant R&D investment, critical for sustaining innovation and competitiveness in the rapidly evolving tech landscape. Recent strategic movements include a substantial shelf registration and active participation in high-profile tech conferences, signaling ongoing efforts to expand its market influence and operational capabilities. Moreover, with earnings forecasted to surge by approximately 85% annually over the next few years and a recent share repurchase worth $131.14 million underlining confidence in its financial strategy, Nutanix is positioning itself as a resilient contender in the tech sector.

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc. develops and manufactures high performance server and storage solutions using modular and open architecture, serving markets in the United States, Europe, Asia, and internationally with a market cap of approximately $27.94 billion.

Operations: Super Micro Computer, Inc. focuses on developing and providing high-performance server solutions, generating approximately $14.94 billion in revenue. The company leverages modular and open architecture to cater to diverse international markets.

Super Micro Computer is making significant strides in the tech industry, particularly with its latest advancements in liquid-cooled data centers and AI infrastructure. The company’s revenue growth is projected at an impressive 21.1% annually, outpacing the US market average of 8.9%. This growth is supported by a robust R&D commitment, with recent announcements highlighting their transition to energy-efficient solutions for high-demand AI applications. Notably, Super Micro’s earnings have surged by 88.8% over the past year, demonstrating a strong market position and innovation capability that exceeds the tech industry average growth of 31.4%. Their strategic focus on integrating NVIDIA technologies for exascale computing positions them well for future expansion in AI-driven environments.

Taking Advantage

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com