Tech

Fuel Tech Leads 3 US Penny Stocks To Consider

As the U.S. equities market shows signs of recovery following a recent downturn, investors are exploring various opportunities across different segments. Penny stocks, often associated with smaller or emerging companies, continue to attract attention for their potential to offer growth at lower price points. Despite their vintage name, these stocks can provide value when backed by strong financials and fundamentals, making them an intriguing option for those seeking hidden gems in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8379 | $6.09M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.69 | $2.15B | ★★★★★★ |

| So-Young International (NasdaqGM:SY) | $1.25 | $90.58M | ★★★★☆☆ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.22 | $529.41M | ★★★★★★ |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.20 | $29.91M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.23 | $8.33M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.71 | $139.05M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.942 | $84.72M | ★★★★★☆ |

Click here to see the full list of 748 stocks from our US Penny Stocks screener.

Let’s take a closer look at a couple of our picks from the screened companies.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fuel Tech, Inc. offers boiler optimization, efficiency improvement, and air pollution control solutions to utility and industrial customers globally, with a market cap of $31.63 million.

Operations: The company generates revenue from two primary segments: Fuel Chem, contributing $13.91 million, and Air Pollution Control, contributing $12.28 million.

Market Cap: $31.63M

Fuel Tech, Inc. operates with a market cap of US$31.63 million, generating revenue from its Fuel Chem and Air Pollution Control segments. Despite being unprofitable, the company has reduced losses by 50.4% annually over five years and forecasts earnings growth of 68.82% per year. Recent developments include securing air pollution control orders worth US$2 million across the US, Europe, and Southeast Asia and launching a new commercial program using TIFI® technology with potential annual revenue between US$1.5 to $2 million. The management team is seasoned with an average tenure of 9.6 years, ensuring experienced leadership amidst volatility in penny stocks.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Network-1 Technologies, Inc. focuses on developing, licensing, and protecting intellectual property assets with a market cap of $31.10 million.

Operations: The company’s revenue is derived entirely from the development, licensing, and protection of its intellectual property assets, amounting to $1.88 million.

Market Cap: $31.1M

Network-1 Technologies, Inc., with a market cap of US$31.10 million, focuses on intellectual property assets, generating US$1.88 million in revenue. Despite being unprofitable and experiencing increased losses over five years, the company maintains no debt and has stable short-term financials with assets of US$41.7 million exceeding liabilities. Recent events include an auditor change due to a conflict of interest following Marcum LLP’s acquisition by CBIZ, Inc., and the completion of a substantial share buyback program initiated in 2011. The board is seasoned with an average tenure of 20 years but faces challenges sustaining its dividend policy amidst declining earnings.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: voxeljet AG offers 3D printers and on-demand parts services to industrial and commercial clients across Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of $3.65 million.

Operations: The company’s revenue is divided into two main segments: €21.98 million from Systems and €11.55 million from Services.

Market Cap: $3.65M

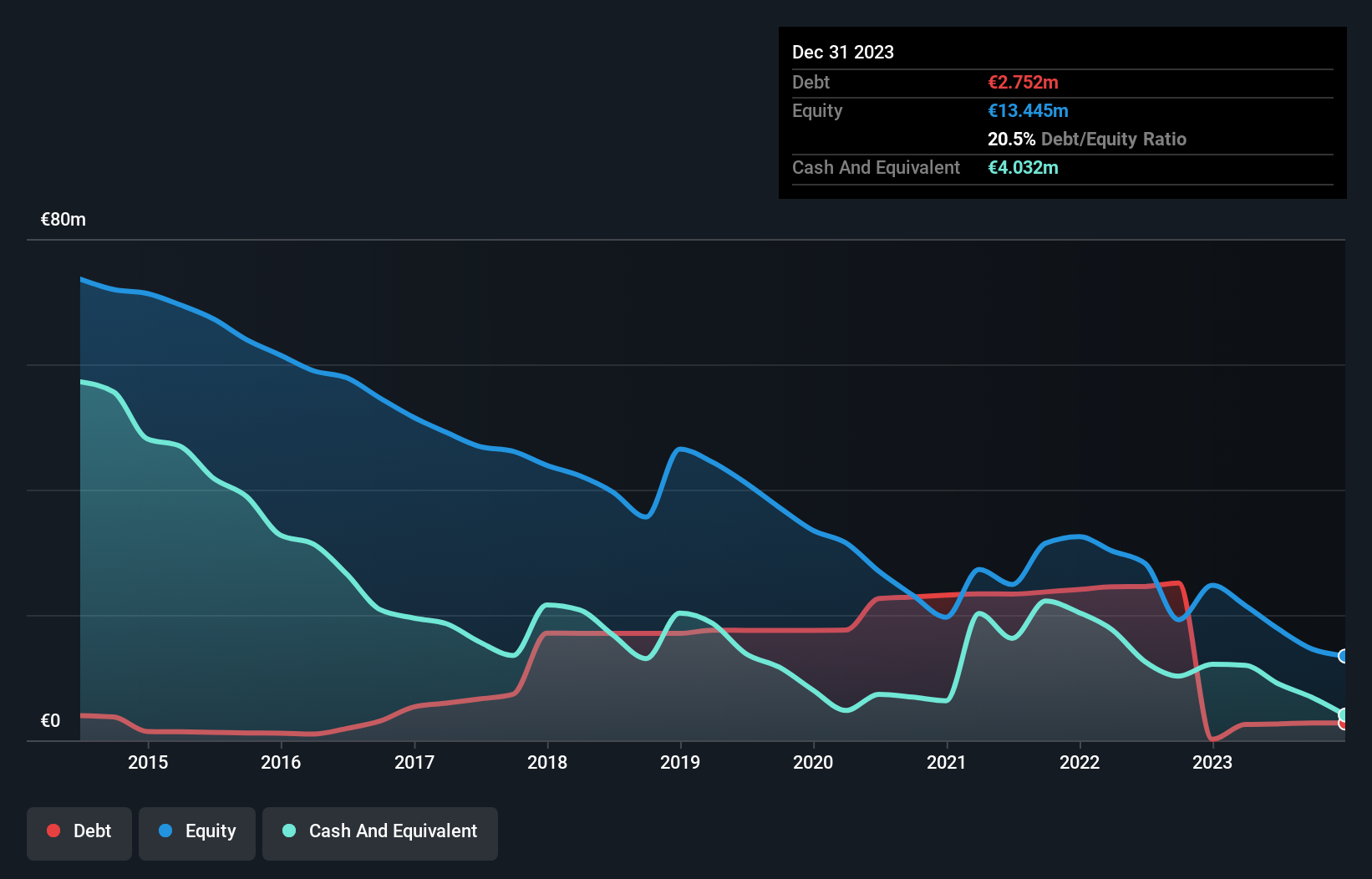

voxeljet AG, with a market cap of $3.65 million, operates in the 3D printing sector and has recently completed a strategic alliance focusing on recycling waste PA12 powder for sustainable production. Despite its innovative strides, the company remains unprofitable but has managed to reduce its debt-to-equity ratio over five years and maintains more cash than debt. Its short-term assets exceed both short- and long-term liabilities, indicating financial stability in the near term. However, voxeljet has lowered its revenue guidance for 2024 to €30-32 million due to ongoing challenges in achieving profitability amidst high volatility.

Turning Ideas Into Actions

- Unlock more gems! Our US Penny Stocks screener has unearthed 745 more companies for you to explore.Click here to unveil our expertly curated list of 748 US Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Network-1 Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com