Jobs

Greenback lower ahead of US jobs – United States – English

Written by the Convera Market Insights team

BoJ drives APAC volatility

The greenback was weaker over the last 24 hours, with the USD index falling to the lowest level since 22 October, after Thursday’s Bank of Japan decision signaled the BoJ was less likely to raise rates than expected.

The BoJ cited worries about “market volatility” as a reason to keep interest rates on hold and the USD/JPY lost 0.8% and fell from three-month highs.

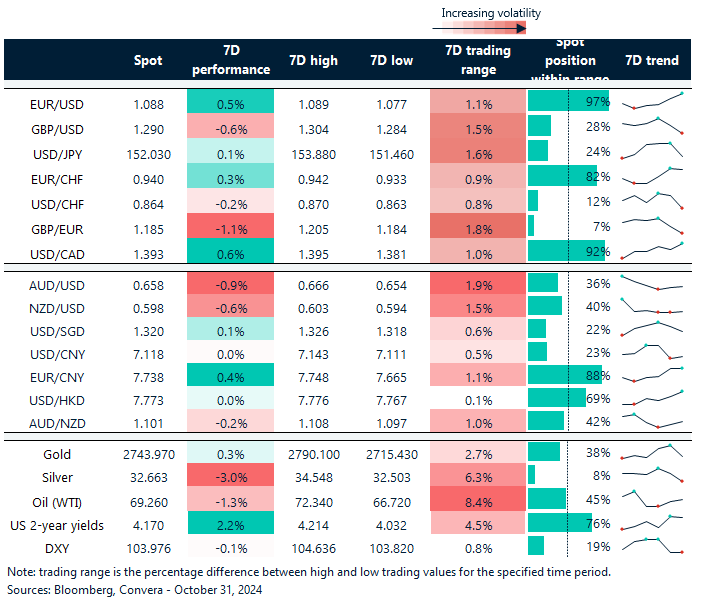

The US dollar was weaker in most markets with the EUR/USD up 0.3%, USD/CHF down 0.3% and AUD/USD up 0.1%.

However, the British pound was weaker as markets continued to react to this week’s UK Budget, while the CAD fell after yesterday’s speech from Bank of Canada governor Tiff Macklem continued to signal the chance for further local rate cuts.

Weak hiring? US jobs due

All eyes are on the US jobs report today and whether a big miss or beat will jolt Fed rate expectations and impact markets on a broader scale. With the US election just days away, perhaps traders will prefer to stay on the sidelines. The US dollar is slightly softer going into the risk event, but is set to close October with around a 3% gain versus a basket of major currencies, marking its strongest monthly rise in over two years.

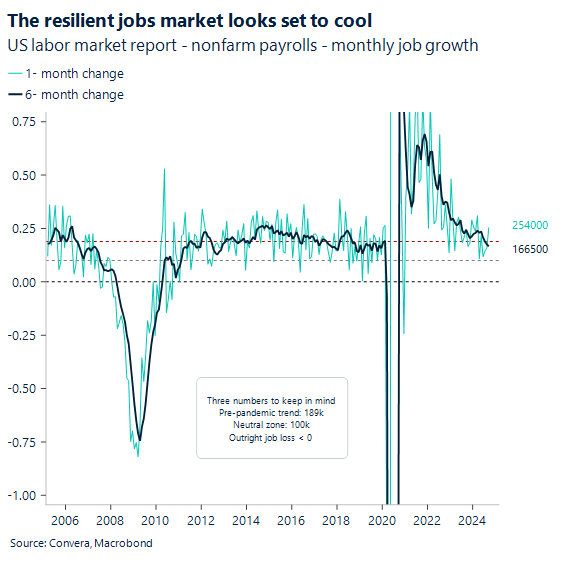

US job growth is set to downshift from the recent uptick seen in September. The October print is expected to come in slightly above 100k, less than 50% of the previous 254k figure. It is important to note that Bloomberg economics forecasts a negative -10k print due to the slowdown in hiring related to the hurricane season.

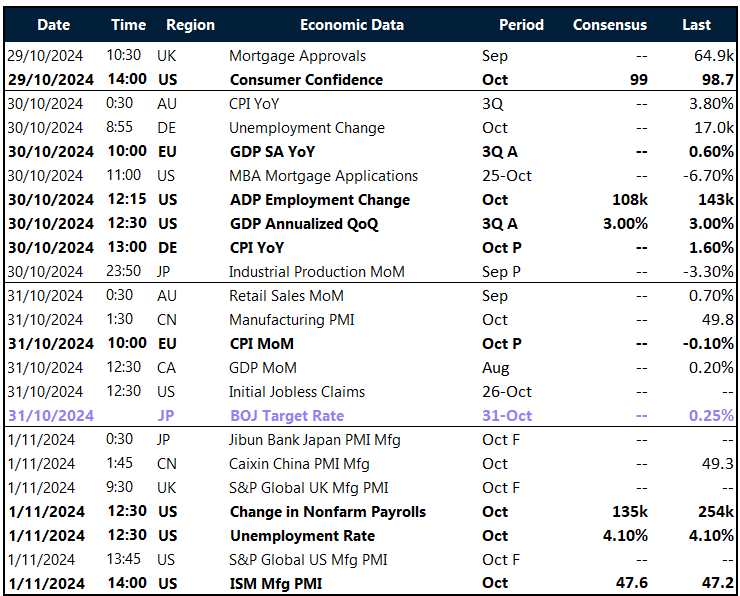

The S&P purchasing manager indices beat expectations across the board. It is now up to the more important ISM to show the same. Consensus expects a slight improvement in October as regional Fed PMIs have painted a somewhat positive picture as of late.

Sterling still whirling

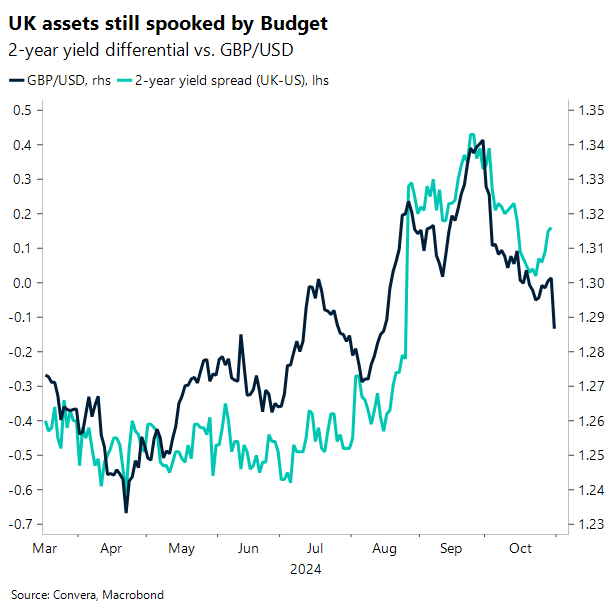

The volatility in UK gilts and the British pound are far shy of what took place in the run up and aftermath of the infamous 2022 mini-budget. However, the reaction from markets to the Labour party’s Budget has still been pretty awful.

The UK 10-year gilt yield surged above 4.51%, the highest in a year, whilst the fall in GBP/USD accelerated to $1.29. This kind of response by financial markets is not what a Chancellor wants to see after a budget, especially amidst the plethora of risk events looming in the near future.

The US election, Fed and Bank of England decisions on interest rates next week all have the capacity to aggravate what is already a delicate situation for UK assets.

Greenback extends recent losses

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 28 October – 1 November

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.