Tech

High Growth Tech Stocks in the United States

Over the last 7 days, the United States market has dropped 2.6%, yet it has risen by 24% over the past year, with earnings expected to grow by 15% per annum in the coming years. In this context of fluctuating performance and anticipated growth, identifying high growth tech stocks involves looking at companies with innovative technologies and strong potential for future expansion.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.51% | 54.38% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Blueprint Medicines | 22.63% | 55.38% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: AC Immune SA is a clinical stage biopharmaceutical company focused on discovering, designing, and developing medicines and diagnostic products for neurodegenerative diseases related to protein misfolding, with a market cap of $267.14 million.

Operations: The company specializes in creating therapeutic and diagnostic solutions for neurodegenerative diseases linked to protein misfolding. It operates as a clinical stage biopharmaceutical entity with a focus on innovation in this niche field.

AC Immune’s recent executive reshuffling underscores a strategic emphasis on enhancing its R&D capabilities, particularly in AI and digital technologies, which are crucial for advancing its biotech innovations. The company has demonstrated robust revenue growth at 30.5% annually, outpacing the industry average. Moreover, AC Immune’s focus on developing treatments for neurodegenerative diseases is highlighted by the positive interim results from its ACI-7104.056 trial for Parkinson’s disease and ACI-24.060 for Down syndrome-related Alzheimer’s, both showing promising safety profiles and immunogenic responses. This progress is pivotal as it aligns with the fast-track designation received from the FDA, potentially accelerating the path to market and benefiting patients sooner.

Simply Wall St Growth Rating: ★★★★☆☆

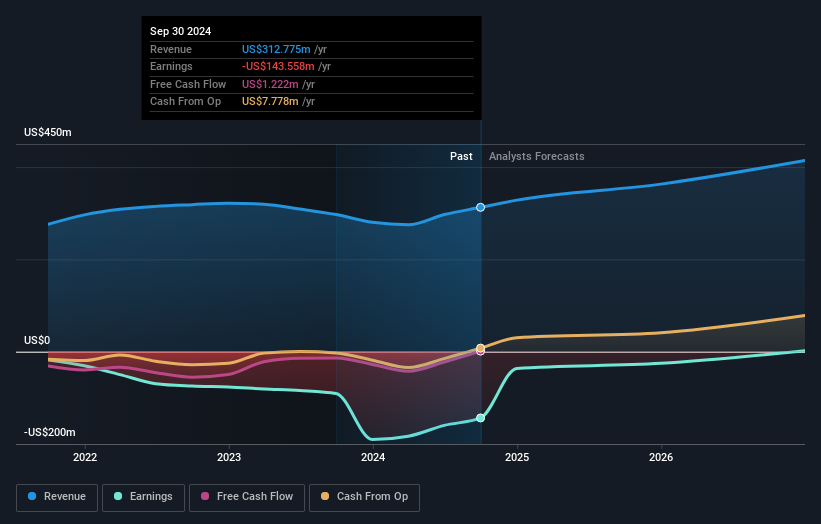

Overview: CareDx, Inc. focuses on developing and commercializing diagnostic solutions for transplant patients and caregivers globally, with a market cap of $1.15 billion.

Operations: Specializing in diagnostic solutions for transplant patients, the company generates revenue primarily from its biotechnology segment, which amounts to $312.78 million.

CareDx, with a revenue surge of 12.3% annually, outpaces the U.S. market’s growth and is set to become profitable within three years, showcasing a robust trajectory in the high-growth tech landscape. The company’s recent strategic alliance with Dovetail Genomics underscores its innovative approach by enhancing HLA genotyping for transplant matching, leveraging next-gen technologies for more precise donor-recipient pairing. This move not only amplifies CareDx’s footprint in precision medicine but also aligns with its increased R&D focus, as evidenced by their latest earnings call where they highlighted significant advancements in integrating AI into patient care solutions.

Simply Wall St Growth Rating: ★★★★★☆

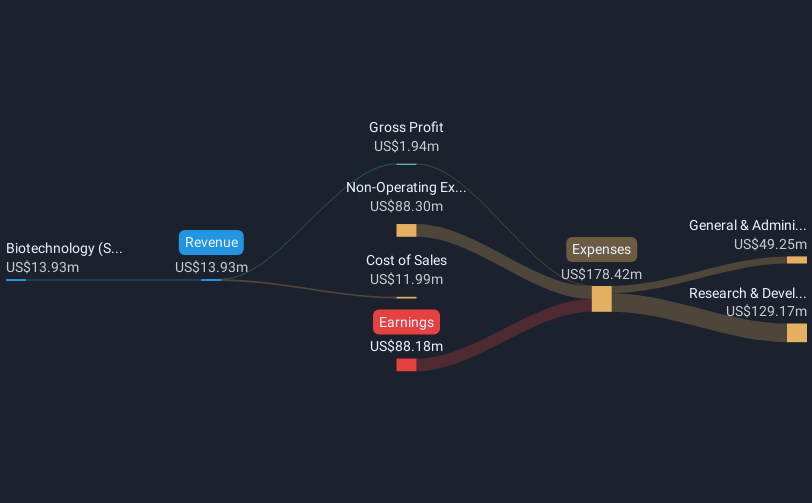

Overview: MeiraGTx Holdings plc is a clinical-stage gene therapy company dedicated to developing treatments for patients with serious diseases, with a market capitalization of $475.95 million.

Operations: Focused on biotechnology for startups, MeiraGTx Holdings generates revenue primarily from this segment, amounting to $13.93 million.

MeiraGTx Holdings, with a projected annual revenue growth of 41.9%, is poised to outperform the U.S. market average significantly, reflecting its dynamic position in the biotech sector. This growth is complemented by an expected annual earnings increase of 26.3%, signaling robust potential as the company moves towards profitability within three years. Recent FDA designations and clinical advancements, such as the RMAT for AAV2-hAQP1 and promising trial results for AAV-GAD in Parkinson’s treatment, underscore MeiraGTx’s strategic focus on pioneering gene therapies that address unmet medical needs. These developments not only enhance its market presence but also reflect a deep commitment to innovation backed by substantial R&D investments, aligning with broader industry trends towards targeted and regenerative treatments.

Make It Happen

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com