Tech

High Growth Tech Stocks in the United States to Watch

The market has stayed flat over the past 7 days but has risen 25% in the past 12 months, with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks that align with these robust market conditions can be crucial for investors seeking strong returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| Super Micro Computer | 20.76% | 28.05% | ★★★★★★ |

| Iris Energy | 70.63% | 125.09% | ★★★★★★ |

| G1 Therapeutics | 24.26% | 51.62% | ★★★★★★ |

| Invivyd | 42.85% | 71.50% | ★★★★★★ |

| Amicus Therapeutics | 20.45% | 61.85% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★★

Overview: TG Therapeutics, Inc., a commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally with a market cap of $3.60 billion.

Operations: TG Therapeutics generates revenue primarily from its biotechnology segment, which accounted for $346.72 million. The company focuses on developing and commercializing treatments for B-cell mediated diseases both domestically and internationally.

TG Therapeutics has made significant strides with its recent FDA clearance for Azercabtagene Zapreleucel (azer-cel) to treat progressive multiple sclerosis, marking a pivotal step in the biotech sector. The company reported $73.47 million in Q2 2024 revenue, up from $16.07 million a year ago, and achieved net income of $6.88 million compared to a loss of $47.61 million last year. With an expected annual profit growth rate of 43.1% and revenue growth forecasted at 28.6% per year, TG Therapeutics is poised for robust future performance bolstered by innovative treatments and strategic financial maneuvers like the recent $250 million term loan facility secured from HealthCare Royalty and Blue Owl Capital.

Simply Wall St Growth Rating: ★★★★☆☆

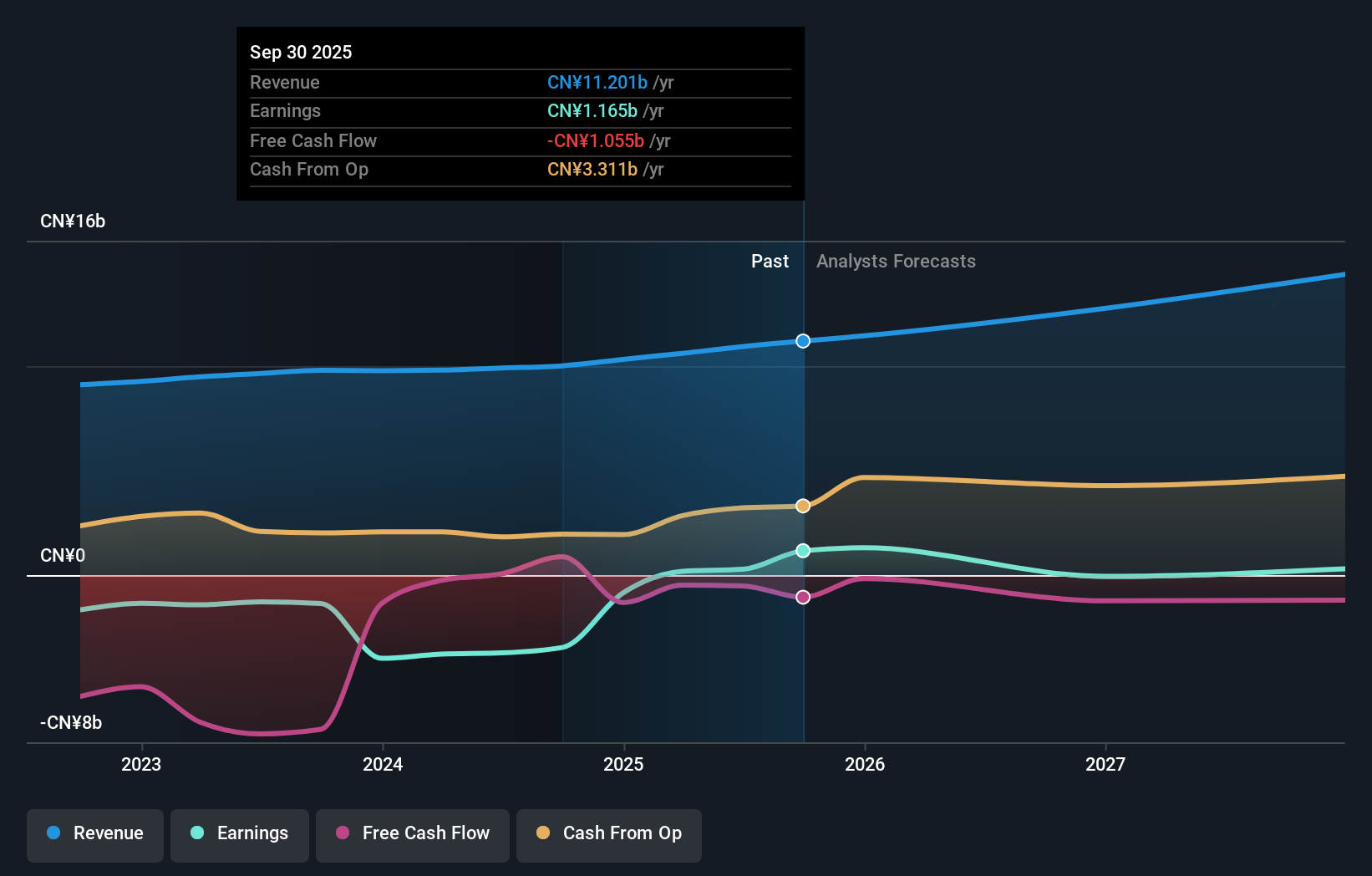

Overview: GDS Holdings Limited, with a market cap of $2.87 billion, develops and operates data centers in the People’s Republic of China.

Operations: GDS Holdings Limited focuses on developing and operating data centers in China. The company’s primary revenue streams are derived from leasing space, power, and cooling to customers within these facilities.

GDS Holdings reported a 15.4% annual revenue growth rate, reaching CNY 5.45 billion for the first half of 2024, up from CNY 4.88 billion last year. Despite a net loss of CNY 225.74 million in Q2, the company’s R&D expenses underscore its commitment to innovation in data center solutions, vital for AI and cloud services expansion. With earnings forecasted to grow by nearly 76% annually over the next three years, GDS’s strategic focus on technological advancements positions it well within the high-growth tech landscape.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Evolent Health, Inc., through its subsidiary Evolent Health LLC, provides specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States and has a market cap of $3.23 billion.

Operations: Evolent Health generates revenue primarily from its pharmacy services, which amounted to $2.35 billion. The company focuses on specialty care management in oncology, cardiology, and musculoskeletal markets within the United States.

Evolent Health’s recent earnings report highlighted a significant revenue increase to $647.15 million in Q2 2024, up from $469.14 million the previous year, reflecting a 37.93% growth. The company’s R&D expenses are crucial to its innovation strategy, with substantial investments driving advancements in healthcare technology solutions. Evolent’s forecasted annual revenue growth of 13.7% surpasses the US market average of 8.8%, while earnings are expected to grow by an impressive 62.12% annually over the next three years, indicating strong future potential despite current unprofitability.

Seize The Opportunity

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com