Tech

High Growth Tech Stocks in the United States to Watch

In the last week, the market has stayed flat while the Materials sector gained 3.1%, and over the past 12 months, it has risen by 32% with earnings forecasted to grow by 15% annually. In this context, identifying high growth tech stocks becomes crucial as they often offer significant potential for capital appreciation in a steadily advancing market.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.46% | 66.34% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 254 stocks from our US High Growth Tech and AI Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alvotech, with a market cap of $3.38 billion, develops and manufactures biosimilar medicines for patients worldwide through its subsidiaries.

Operations: Alvotech generates revenue primarily from its biotechnology segment, amounting to $308.73 million. The company focuses on the development and manufacturing of biosimilar medicines through its subsidiaries.

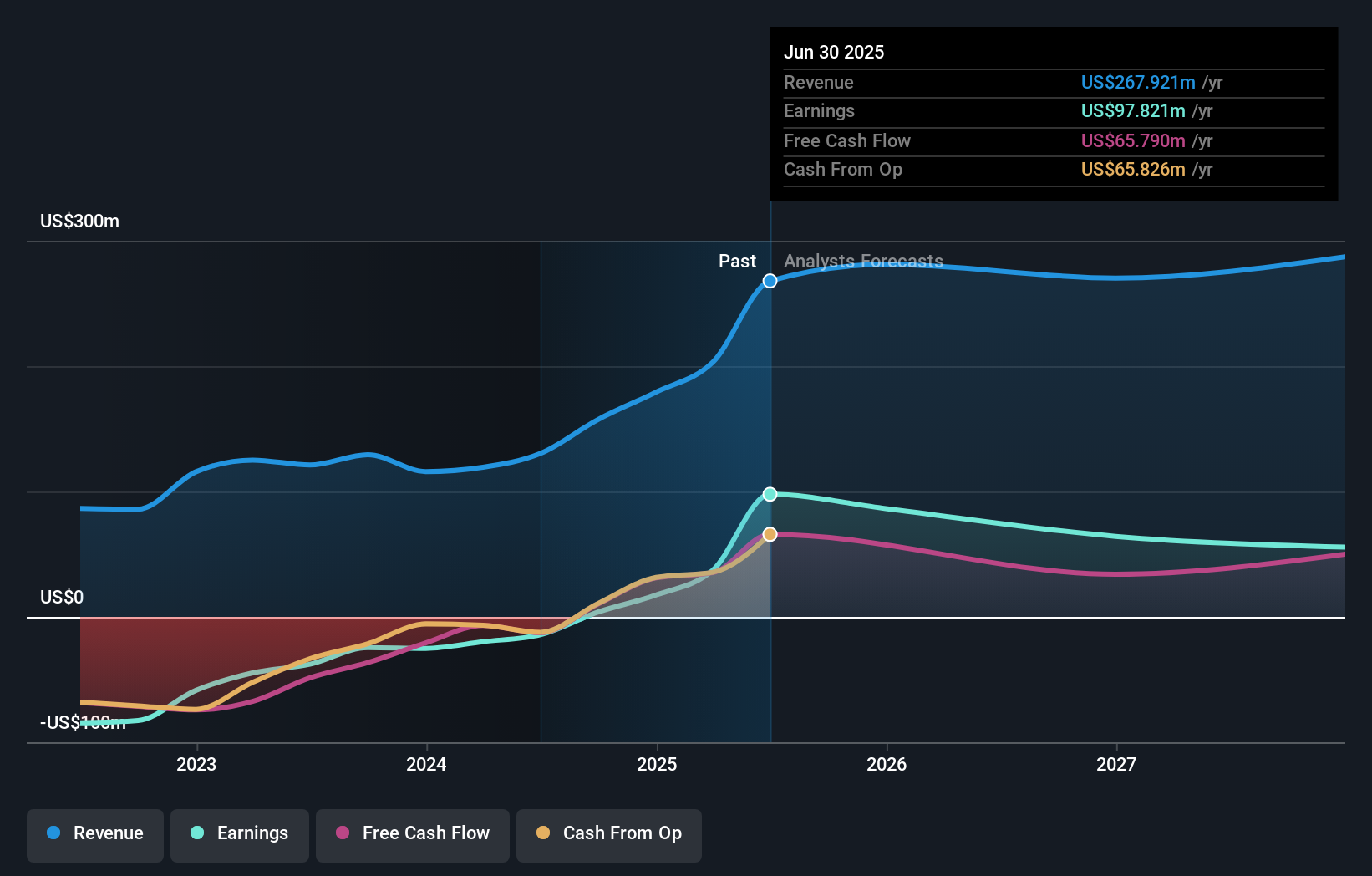

Alvotech’s trajectory in the biotech sector is marked by ambitious growth and innovation, particularly in its biosimilar programs. With a revenue forecast growing at 33.1% annually, significantly outpacing the US market average of 8.7%, Alvotech is setting a brisk pace. This growth is underpinned by robust R&D investment, crucial for staying competitive in biotech’s fast-evolving landscape. Recent developments include initiating a patient study for AVT16, aimed at treating Ulcerative Colitis, and filing marketing applications for three biosimilars within 2024. These steps illustrate Alvotech’s strategy to expand its biosimilar portfolio aggressively while navigating toward profitability projected within three years—a noteworthy rebound given the current unprofitable status with earnings expected to surge by 107.5% annually.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Five9, Inc., along with its subsidiaries, offers intelligent cloud software solutions for contact centers globally and has a market cap of approximately $2.11 billion.

Operations: Five9, Inc. generates revenue primarily from its Internet Software & Services segment, amounting to $968.26 million. The company specializes in providing intelligent cloud software solutions for contact centers both in the United States and internationally.

Amidst a bustling tech landscape, Five9 stands out with its strategic focus on enhancing customer experiences through innovative AI solutions. With a robust 11.3% annual revenue growth, the company is pacing ahead of the broader U.S. market’s 8.7% expansion rate. This growth trajectory is complemented by substantial R&D investments, which have surged to $57.7 million, demonstrating a commitment to maintaining technological leadership and fostering innovation in contact center operations. Recent partnerships and product launches further underscore Five9’s dedication to integrating cutting-edge technology to streamline communication processes and improve service efficiency across various industries.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rigel Pharmaceuticals, Inc. is a biotechnology company focused on discovering, developing, and providing therapies for hematologic disorders and cancer, with a market cap of $282.40 million.

Operations: Rigel Pharmaceuticals, Inc. generates revenue primarily from its biotechnology segment, amounting to $130.20 million. The company focuses on therapies for hematologic disorders and cancer.

Rigel Pharmaceuticals has been dynamically advancing in the biotech sector, particularly noted for its strategic collaborations and innovative drug developments. Recently, Rigel’s engagement in a Phase 1b/2 clinical trial with MD Anderson underscores its commitment to addressing acute myeloid leukemia through advanced therapy combinations. This initiative is part of a broader strategy that saw R&D expenses rise significantly, aligning with the company’s focus on pioneering treatments in oncology—a field where precision and innovation are critical. Moreover, the recent licensing agreement with Kissei Pharmaceutical extends Rigel’s global reach into Asian markets, potentially boosting future revenues by leveraging regional growth opportunities. These moves exemplify how Rigel is not just expanding its therapeutic portfolio but also strategically positioning itself for sustained growth in specialized medical domains.

Next Steps

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com