Tech

High Growth Tech Stocks in the United States to Watch

Over the last 7 days, the United States market has dropped 2.6%, yet it remains up by 23% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies with strong innovation potential and robust financial health that can capitalize on these positive long-term trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.51% | 54.38% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Bitdeer Technologies Group | 50.20% | 126.70% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★★★

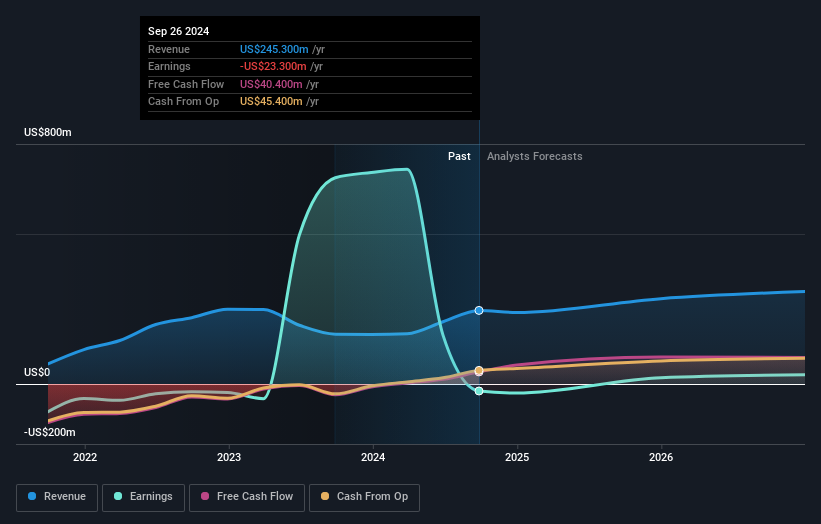

Overview: Travere Therapeutics, Inc. is a biopharmaceutical company focused on identifying, developing, and delivering therapies for rare kidney and metabolic diseases with a market cap of approximately $1.51 billion.

Operations: The company generates revenue primarily from the development and commercialization of innovative therapies, amounting to $203.45 million.

Travere Therapeutics, recently spotlighted at multiple healthcare conferences, underscores its commitment to addressing rare kidney disorders with its innovative drug, FILSPARI. Despite a challenging financial landscape marked by a net loss of $54.81 million in Q3 2024 and a follow-on equity offering raising $125 million, the company’s strategic R&D investments are fostering notable clinical advancements. These efforts are mirrored in their robust pipeline developments which demonstrated significant proteinuria reduction in recent studies, positioning Travere potentially at the forefront of nephrology treatment innovations. With revenues witnessing a substantial increase to $158.39 million over nine months and projected annual revenue growth of 28.7%, Travere is navigating its unprofitability towards anticipated market gains, supported by an aggressive research agenda that aligns with high industry standards for therapeutic efficacy and patient outcomes.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: National CineMedia, Inc. operates a cinema advertising network in North America through its subsidiary, National CineMedia, LLC, with a market cap of $614.10 million.

Operations: The company generates revenue primarily from its advertising segment, amounting to $245.30 million.

Despite a challenging financial year, National CineMedia (NCM) showcases resilience with strategic innovations and partnerships. The company’s recent collaboration for the first-ever 4DX ad spot in the U.S., featuring dynamic cinema experiences, underscores its commitment to revolutionizing advertising in theaters. This innovation aligns with NCM’s reported revenue growth of 11.8% annually, outpacing the US market average of 9.2%. Moreover, NCM’s transition towards profitability is projected over the next three years, reflecting an anticipated earnings growth of 107% per year. These developments suggest a strategic pivot that could redefine engagement in media consumption while navigating current unprofitability towards future gains.

Simply Wall St Growth Rating: ★★★★☆☆

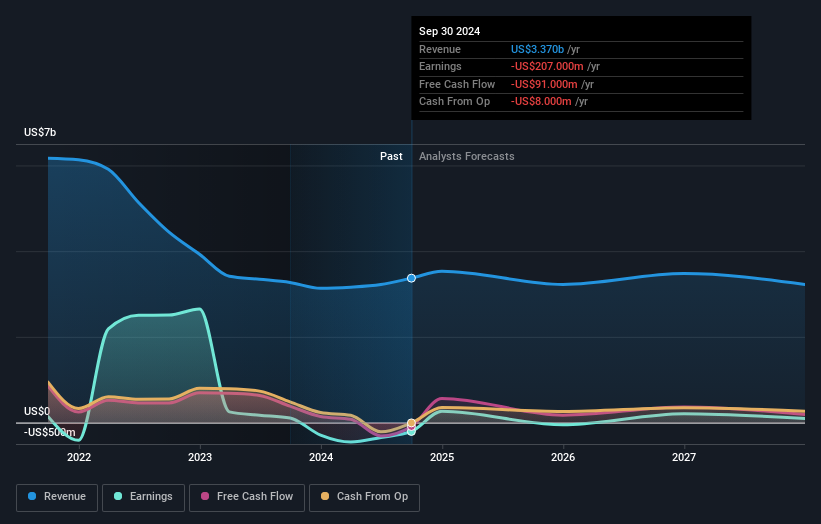

Overview: Sinclair, Inc. is a media company that delivers content via local television stations and digital platforms across the United States, with a market cap of approximately $1.04 billion.

Operations: Sinclair generates revenue primarily from its Local Media segment, which contributes $3.09 billion, and also earns from its Tennis segment with $244 million.

Sinclair’s strategic maneuvers, including its recent foray into spatial computing via a partnership with Mindgrub, mark a significant pivot towards modernizing media consumption. This innovation leverages cutting-edge technology to blend digital content with physical surroundings, enhancing viewer interaction and engagement. Despite facing a projected revenue decline of 2.6% annually over the next three years, Sinclair is poised for profitability with earnings expected to grow by 15.9% per year. Additionally, the company has actively participated in mergers and acquisitions, signaling robust adaptability in an evolving regulatory landscape. This proactive approach could well position Sinclair at the forefront of technological integration within the media sector.

Next Steps

- Click this link to deep-dive into the 233 companies within our US High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Travere Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com