Tech

High Growth Tech Stocks To Watch In The United States

The market remained flat over the last week but has risen 27% over the past 12 months, with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability, positioning them well in an evolving economic landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 237 stocks from our US High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★★★

Overview: TG Therapeutics, Inc. is a commercial stage biopharmaceutical company dedicated to acquiring, developing, and commercializing novel treatments for B-cell mediated diseases globally, with a market cap of approximately $4.60 billion.

Operations: TG Therapeutics focuses on developing and commercializing treatments for B-cell mediated diseases, generating revenue primarily from its biotechnology segment, which accounts for approximately $264.79 million.

TG Therapeutics, despite its current unprofitability, is on a robust upward trajectory with revenue growth forecasted at 34.9% annually, significantly outpacing the US market’s 9.1%. The firm’s strategic focus on innovative treatments in multiple sclerosis has shown promising long-term efficacy and safety results, particularly with their BRIUMVI product during the ULTIMATE I & II Phase 3 trials. Notably, their recent share repurchase of $2.15 million underscores a commitment to enhancing shareholder value as they edge closer to profitability projected within three years. This blend of aggressive growth strategy and groundbreaking clinical outcomes positions TG Therapeutics as a dynamic player in biotech’s competitive landscape.

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation operates a software-based platform designed to assist advertisers in optimizing the marketing and monetization of their content globally, with a market capitalization of $108.89 billion.

Operations: AppLovin generates revenue primarily through its Software Platform, which accounts for $2.80 billion, and Apps segment, contributing $1.49 billion. The company’s focus is on providing tools for advertisers to improve marketing efficiency and content monetization across international markets.

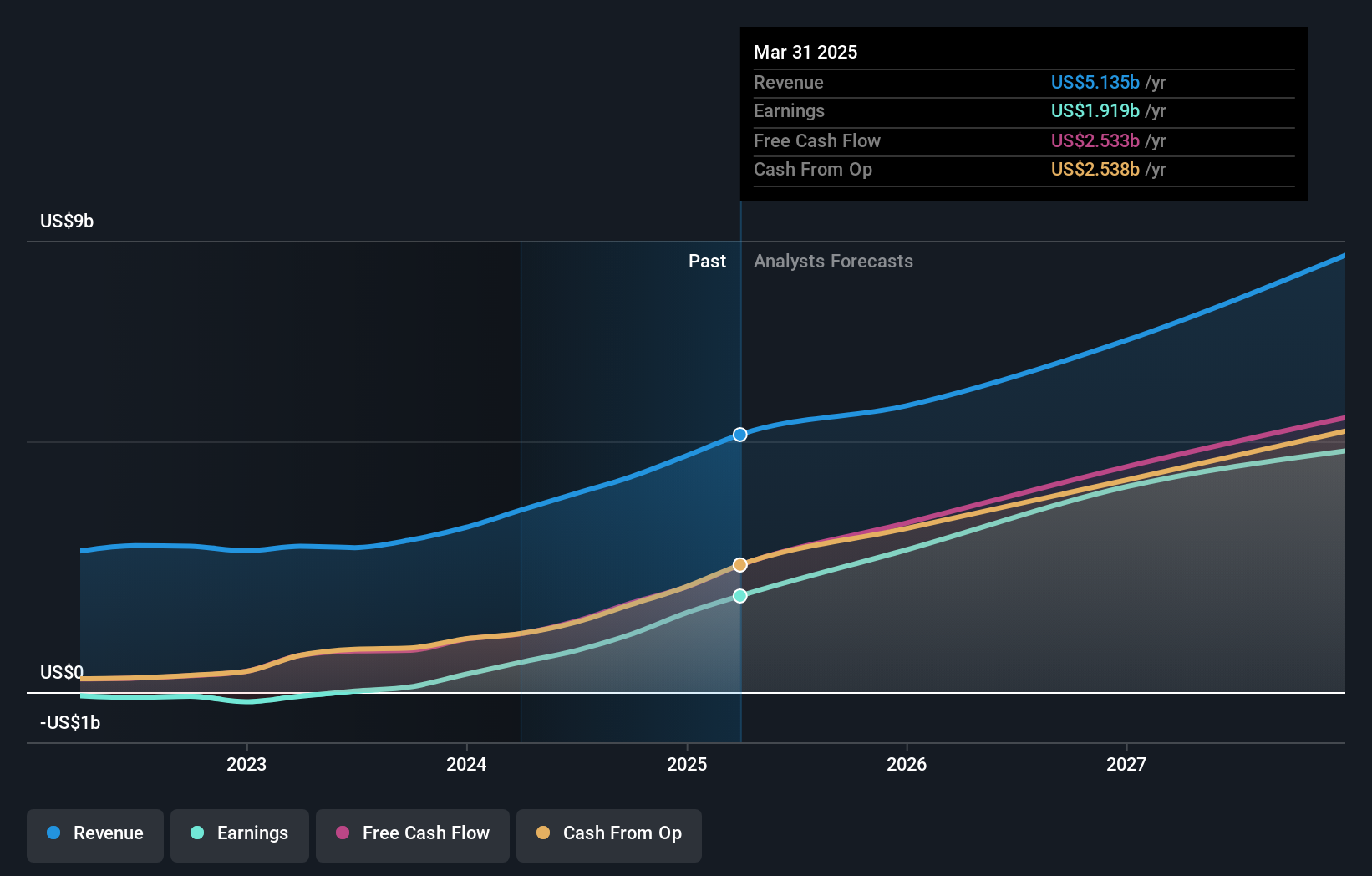

AppLovin’s strategic maneuvers in the tech landscape underscore its robust growth trajectory, with a notable 18.8% annual revenue increase and an impressive 32.5% surge in earnings. Recent activities, including a substantial $999.62 million fixed-income offering and inclusion in the NASDAQ-100 Index, reflect its expanding financial foundation and market confidence. The company’s aggressive R&D investment aligns with these expansions, fostering innovation that keeps it competitive within the dynamic tech sector. This approach not only enhances AppLovin’s product offerings but also solidifies its position as a forward-thinking player amidst evolving industry demands.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Okta, Inc. operates as an identity partner in the United States and internationally, with a market cap of $14.05 billion.

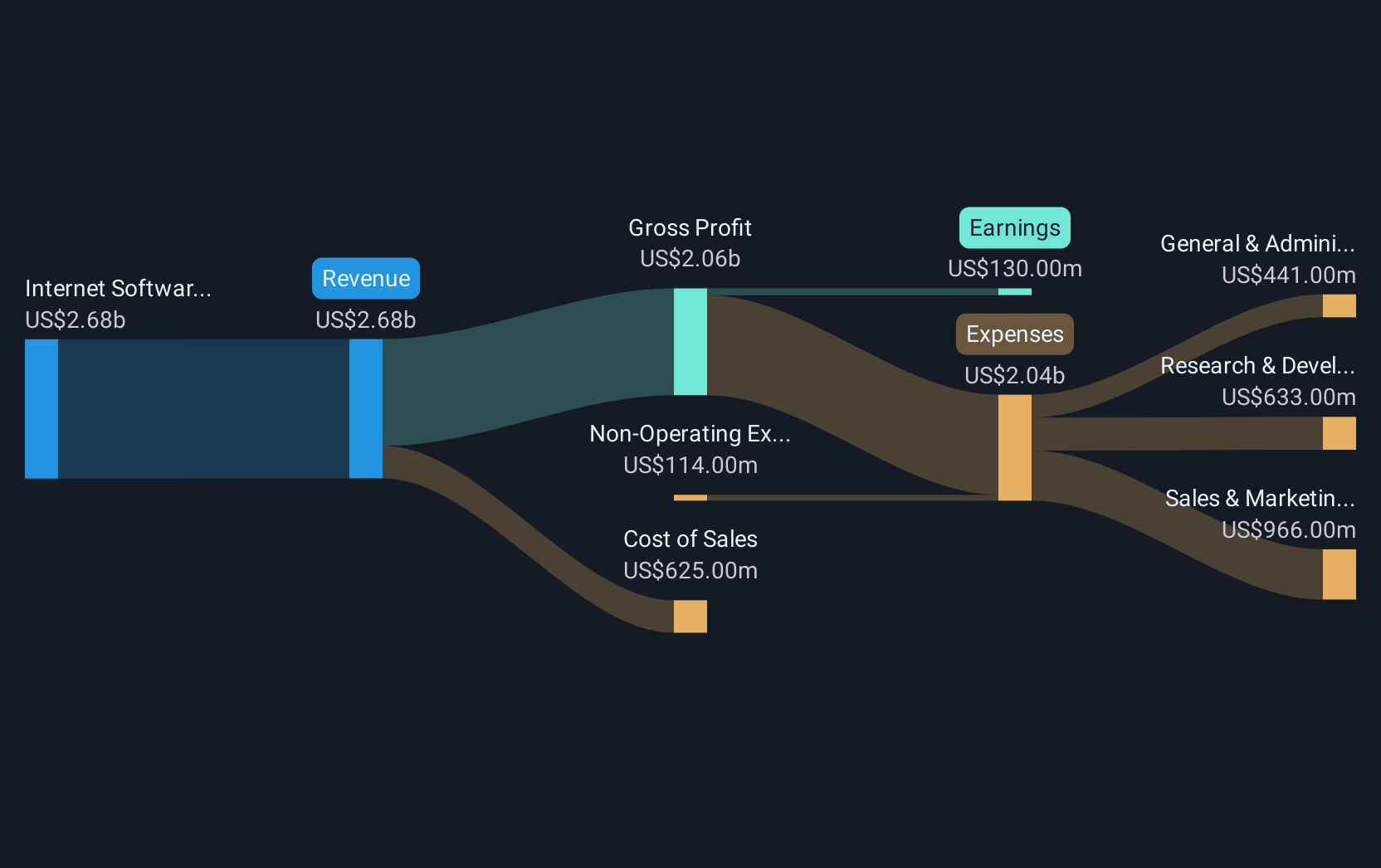

Operations: Okta generates revenue primarily from its Internet Software & Services segment, amounting to $2.53 billion. The company focuses on providing identity solutions across various regions.

Okta’s recent performance and strategic partnerships underscore its strengthening position in the identity verification sector, crucial for enhancing cybersecurity in a cloud-centric world. The company’s transition to profitability is evidenced by a swing from a net loss of $81 million to a net income of $16 million year-over-year in Q3, alongside an impressive annual revenue growth forecast at 15%. This growth is complemented by innovative collaborations, like with Persona, which integrates advanced identity verification into Okta’s services to bolster defenses against sophisticated cyber threats. These moves not only enhance Okta’s service offerings but also solidify its role in evolving digital security landscapes.

Summing It All Up

- Navigate through the entire inventory of 237 US High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St’s free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com