Shopping

Is in-store shopping on Black Friday dead? Here’s what experts think

Lines wrapped around department stores, fights over products and crowds so large they poured out of retailers’ front doors — this scene used to be par for the course on Black Friday, says Barbara Kahn, a professor of marketing at The Wharton School of the University of Pennsylvania. But in recent years, what defines the shopping event has significantly changed. There’s no more sprinting into stores before sunrise to snag 24-hour doorbuster deals. Now, Black Friday has to compete with Cyber Monday, so sales have largely shifted online, started earlier and stuck around longer. Some even say that Black Friday has been replaced by Black November, the broader term experts use to describe the month-long discounts leading up to Thanksgiving weekend.

“Black Friday used to be a trigger for people to go to the store,” says Kahn. “But as it’s morphed into a general promotional season, Black Friday itself lost its magic: its sense of urgency.”

Black Friday falls on Friday, Nov. 29 this year. To help you understand how it became the busiest shopping day in the U.S., I spoke to experts about its history and charted how it’s changed since its inception. Experts also shared their predictions for Black Friday 2024, as well as how the sale got its name.

SKIP AHEAD Looking back on past Black Fridays | What to expect in 2024 | How Black Friday became Black November | How Black Friday impacts the holiday shopping season | Why is Black Friday called Black Friday?

Want more from NBC Select? Sign up for our newsletter, The Selection, and shop smarter.

Looking back on Black Fridays of years past

Before the Covid-19 pandemic, there were signs that Black Friday’s identity was changing from a predominantly in-store experience to an online shopping bonanza. In 2019, for the first time, Black Friday topped Cyber Monday as the busiest day for online shopping, according to the National Retail Federation (NRF). Then, circumstances in 2020 further motivated retailers to reinvent their typical Black Friday offerings by promoting online shopping and transforming days-long sales into months-long savings events. These efforts worked in retailers’ favor: the number of online Black Friday shoppers passed the 100 million mark in 2020, which it never had previously, according to the NRF. Retailers have approached Black Friday with similar strategies ever since, resulting in comparable trends.

Every year since 2019, there’s been more total online shoppers during Black Friday than during Cyber Monday, according to the NRF. However, people historically spend more on Cyber Monday than on Black Friday, according to Adobe. This may result from messaging on retailers’ websites indicating that Cyber Monday is shoppers’ last chance to take advantage of deals, says Dr. Ross Steinman, a professor of consumer psychology at Widener University. Some websites even display clocks counting the seconds until Cyber Monday is over. By creating pressure to check out before midnight, retailers add a gamification aspect to their sales and make shoppers more competitive while deal hunting, says Steinman.

Beyond shopping online, shopping early alters Black Friday as we once knew it. Discounts leading up to the event give people a long stretch of time to spread out their spending, which may lead to less of a spike in sales on Black Friday itself. This is exactly what happened during Black Friday 2021, the first time revenue growth reversed itself year-over-year — sales totaled $8.9 billion compared to $9 billion in 2020, according to Adobe.

After Black Friday 2021, experts began closely monitoring the impact of early deals. This was especially important in light of Amazon’s first October Prime Day event, which has since become a staple in the retailer’s sales calendar. It essentially kicks off the holiday shopping season and causes other retailers to offer corresponding savings events about a month before Black Friday. But despite a now prolonged period of early deals, Black Friday sales have been back on track since 2022 — Adobe estimates them to total around $9.12 billion in 2022 and $9.8 billion in 2023.

Consumer demand is partly responsible for positive Black Friday performance over the past few years. During the five days from Thanksgiving Day to Cyber Monday 2023, 200.4 million Americans shopped in stores and online, making it the highest figure since the NRF first started tracking this data in 2017. People are more encouraged to shop during Black Friday and Cyber Monday than ever before thanks to in-store and online offerings, ample time to browse deals and an overall hunger for savings opportunities as economic concerns like inflation loom, says Steinman.

What to expect during Black Friday 2024

Experts don’t predict that we’ll see anything out of the ordinary during Black Friday 2024. Discounts started weeks ahead, as they have in years passed, and experts are confident that online sales will dominate between Thanksgiving and Cyber Monday. But if shoppers are going to visit stores in person, Black Friday is the day they’ll do it, says Katherine Cullen, vice president of industry and consumer insights at the National Retail Federation.

This year, consumer demand around Black Friday and Cyber Monday sales remains strong. Due to years of consistent inflation, people are hungry for deals, making them savvy about saving so they can cross their wants and needs off wishlists, says Steinman. Adobe expects shoppers to increase spending on higher-priced items like electronics, appliances and sports gear during the 2024 holiday shopping season so long as retailers offer competitive discounts.

That said, holiday season sales are on track to steadily increase in 2024. The NRF estimates that total holiday spending in November and December will be between $979.5 billion and $989 billion, marking a 2.5% and 3.5% increase over 2023.

How Black Friday became Black November

Black Friday used to mark the beginning of the winter holiday shopping season, while December 24 — the day before Christmas — marked the end, says Cullen. But because many retailers now offer deals over a month ahead of Black Friday, this retail calendar is growing obsolete.

Unlike Amazon Prime Day and Cyber Monday, Black Friday originated as an in-person, social shopping experience. It happens the Friday after Thanksgiving, a paid holiday for most employees. Because people are at home, retailers began slashing prices on merchandise to draw groups into stores, giving friends and family members an activity to do together. “Deals had to be worth jumping out of bed and running to the store for, and maybe even waiting in line for a while, too,” says Kahn.

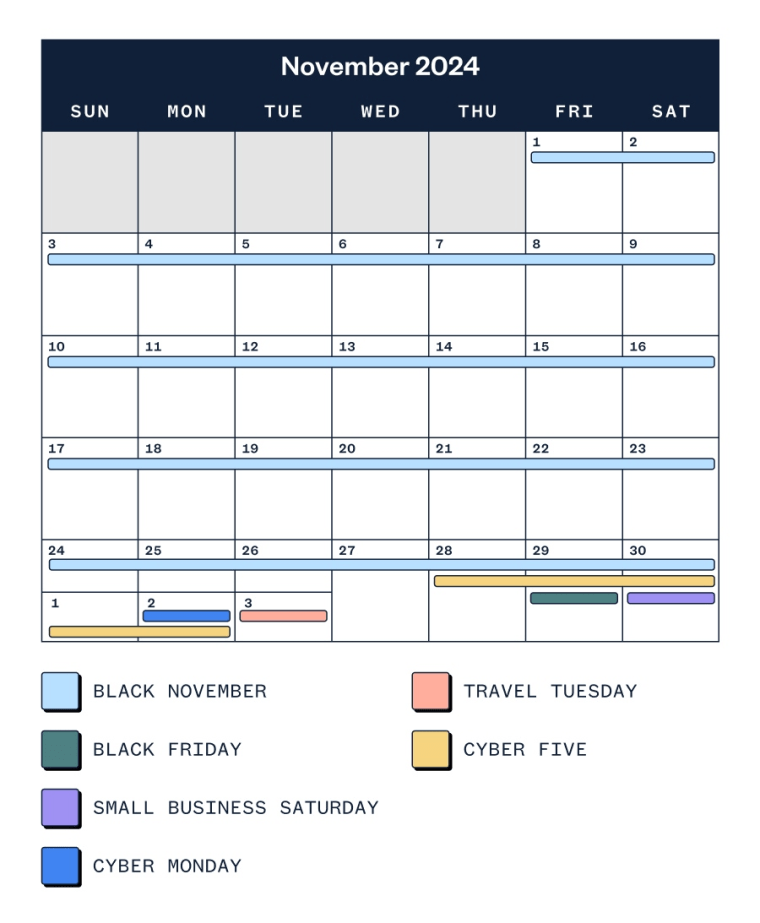

Retailers used to compete with one another to see who could open the earliest on Black Friday, and some even welcomed shoppers into stores on Thanksgiving. “Everyone wanted to participate in the rat race to see who could get people to run to their stores first,” says Kahn. This transformed Black Friday into a five-day shopping weekend beginning on Thanksgiving and ending on Cyber Monday. Now, because so much shopping happens online during that period, experts named it the Cyber Five. But as these five days expanded into a week and then multiple weeks, experts dubbed all of November “Black November.”

“Thanksgiving weekend used to be the start of the shopping season, but now we look at it as more of a halfway point,” says Cullen. “Black Friday and Cyber Monday are hallmark events that have a very important place both for consumers and retailers, but within a broader context of a longer shopping season.”

Why do Black Friday sales start so early?

Starting Black Friday sales early is a response to recent consumer behavior trends, says Cullen. Retailers adjusted their schedules accordingly after seeing a strong increase in early holiday shopping, a trend NRF surveys have supported. In fact, half or over half of shoppers surveyed said they took advantage of early sales before Thanksgiving for years now, says Cullen. Doing so lets them spread out their spending over multiple weeks to avoid “lumpy spending,” or concentrated purchases during the holidays with subsequent massive bills, says Steinman.

Because Black Friday and Cyber Monday are now spread out over five days — or the entire month of November in some cases — retailers have to format their sales strategically to maintain shoppers’ interest. To do so, some promote deals on different product categories during specific days or weeks instead of offering blanket storewide sales throughout the month, says Cullen.

Is in-store Black Friday shopping dead?

No, in-person Black Friday shopping isn’t dead. It’s still the most popular day for in-store shopping over the Thanksgiving weekend, and 76.2 million people participated during Black Friday 2023, according to the NRF.

But due to more shoppers taking advantage of online sales, it’s no longer what defines the holiday. Now, the main segment of shoppers who visit stores in person on Black Friday are those steeped in tradition, says Steinman. They see Black Friday from an experiential lens, want to spend time with loved ones while browsing deals and are reluctant to give up that yearly outing together.

How Black Friday impacts the holiday shopping season

While Black Friday and Cyber Monday are intertwined with the larger holiday shopping season, they’re not dependent on one another, says Cullen. For example, when the NRF surveyed shoppers about how much they spent on holiday-related items during Thanksgiving weekend in 2023, it was down slightly from 2022 ($325.44 in 2022 and $321.41 in 2023). But sales during the overall holiday shopping season — which the NRF defines as the period from Nov. 1 to Dec. 31 — grew 3.9% year-over year.

Black Friday and Cyber Monday also impact the retail calendar worldwide. Americans associate Black Friday and Cyber Monday with Thanksgiving, but over 20 countries, including the United Kingdom, Italy, Sweden and Mexico, host similar sales, some using the same name despite not celebrating Thanksgiving.

All Black Friday shopping events worldwide also take place on the same day — for example, retailers in Canada host Black Friday sales on the same day that they take place in the U.S. despite the country recognizing the second Monday in October as its Thanksgiving holiday. This speaks to Black Friday’s legacy and weight: doorbuster deals and a social shopping experience made for the holiday season, says Kahn.

Why is Black Friday called Black Friday?

The term “Black Friday” originally had no connection to shopping, says Nancy Koehn, a historian and professor at the Harvard Business School. It described a financial panic in 1869 that resulted from investors Jay Gould and Jim Fisk driving up gold prices and ultimately causing the market to crash. Since its 19th century inception, the term “Black Friday” has generally been used to describe other bad events or negative situations, like workers not showing up to their jobs the day after Thanksgiving, Koehn says.

The first time “Black Friday” specifically referred to shopping the day after Thanksgiving was in the 1950s. Police in Philadelphia complained about an influx of people coming to the city to shop the day after Thanksgiving, calling it a “Black Friday” because they had to control crowds. From there, the term was used to describe shopping on that day and gained momentum with each passing year.

Originally, retailers were upset about the name “Black Friday” because the term had a negative connotation, Koehn says. Efforts arose to call it “Big Friday” instead, but they ultimately failed. Retailers then changed the narrative and decided that Black Friday is when they’re supposed to be “in the black,” a financial phrase describing the profitability and prosperity of a business, in contrast to being “in the red,” or in a deficit.

Koehn says the idea of positioning Black Friday as a shopping holiday “galloped forward” between the 1970s and 1980s, which she attributes to retailers instigating competition among themselves and expanding the deals they offered.

Overall, “there was no defining moment that made us call Black Friday ‘Black Friday,’” says Koehn. “It’s really the evolution of language and definition, retail practices and consumers responding to that.”

Meet our experts

At NBC Select, we work with experts with specialized knowledge and authority based on relevant training and/or experience. We also ensure that all expert advice and recommendations are made independently and with no undisclosed financial conflicts of interest.

- Barbara Kahn is a professor of marketing at The Wharton School of the University of Pennsylvania.

- Katherine Cullen is the vice president of industry and consumer insights at the National Retail Federation.

- Nancy Koehn is a historian and professor at the Harvard Business School.

- Dr. Ross Steinman is a professor of consumer psychology at Widener University.

Why trust NBC Select?

I’m a reporter at NBC Select who has covered tentpole sales like Black Friday, Cyber Monday and Amazon Prime Day since 2020. For this article, I researched the history of Black Friday, spoke to four experts and referred to data from sources like the NRF and Adobe Analytics.

Catch up on NBC Select’s in-depth coverage of personal finance, tech and tools, wellness and more, and follow us on Facebook, Instagram, Twitter and TikTok to stay up to date.