Bussiness

Joe Biden blocks Nippon Steel-US Steel merger citing Trump and unions opposition. What this means? | Company Business News

United States President Joe Biden has officially decided to block Nippon Steel’s proposed acquisition of US Steel, sources told Reuters on January 3. According to a report by the Washington Post citing two administrative officials, the official decision is likely to be out today itself.

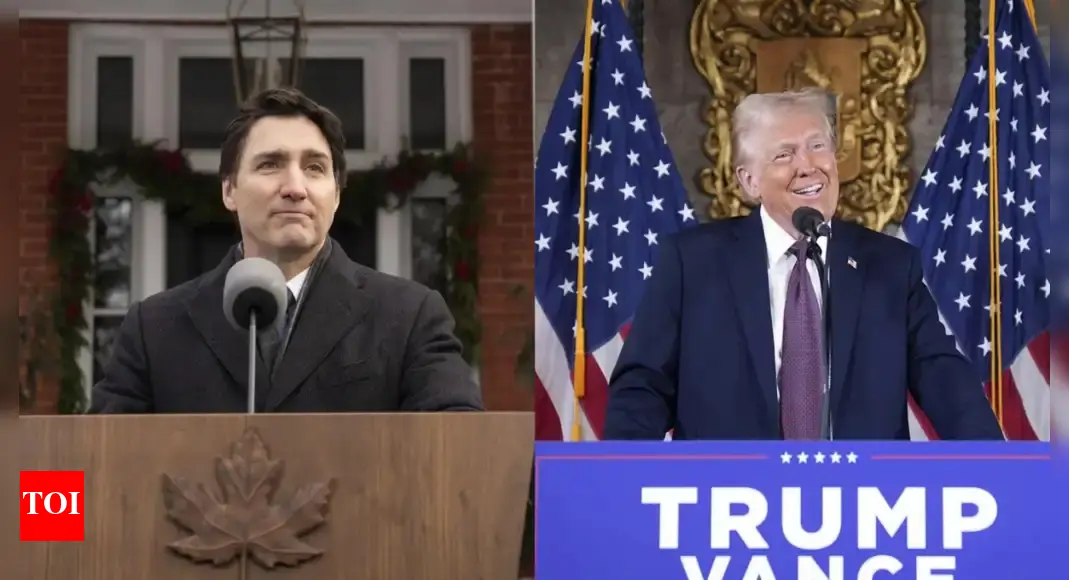

Biden, President-elect Donald Trump and a politically-influential labour union had voiced opposition to the effort by Japan’s top steelmaker to acquire the iconic American firm that helped build the Empire State Building and arm allied forces in World War Two.

World Steel Association data showed the estimated $15-billion merger would have created the world’s third-largest steelmaker after China’s Baowu Steel Group and Luxembourg-based ArcelorMittal.

US Steel’s shares had tumbled in recent weeks following a Bloomberg report that Biden planned to kill the merger. Here is a look at the latest developments:

National Security Concerns

The Committee on Foreign Investment in the United States, a government panel that assesses inbound foreign investment for national security risk, had been reviewing the transaction for months.

But it was unable to reach a consensus and late last month referred to Biden the decision on whether to approve the deal, the companies said.

In August, the panel told the firms in a letter that the tie-up could hurt the supply of steel needed for critical transport, construction and agriculture projects, Reuters reported.

Days later sources said Biden was poised to block the deal.

But the panel opted to extend deliberations, pushing the decision back to after the November 5 presidential election.

Nippon Steel had repeatedly said it was confident of closing the deal by the end of 2024.

Trump’s Stance

Trump, who takes office on January 20, has repeatedly vowed to block the sale.

“I am totally against the once great and powerful US Steel being bought by a foreign company, in this case Nippon Steel of Japan,” he wrote on his Truth Social platform last month.

“As president, I will block this deal from happening. Buyer Beware!!!”

Outcome of a Block

US Steel has previously said the deal’s failure would put at risk thousands of US union jobs and it might be forced to close some steel mills. The United Steelworkers union, which opposes the deal, has called those assertions baseless threats and intimidation.

Nippon Steel previously said it was considering all possible measures, including legal action, to close a deal it sees as key to its future growth.

But some lawyers, such as Nick Wall, M&A partner at Allen & Overy, have said mounting such a legal challenge would be tough.

Nippon Steel had committed to paying a $565-million break-up fee to U.S. Steel if the deal did not get regulatory approval, according to a U.S. Steel filing in January.

Disclaimer: This story has been published from a wire agency feed without modifications to the text. Only the headline has been changed.