Bussiness

Markets at the mercy of ‘unrestrained Trump’ as US president-elect threatens tariffs

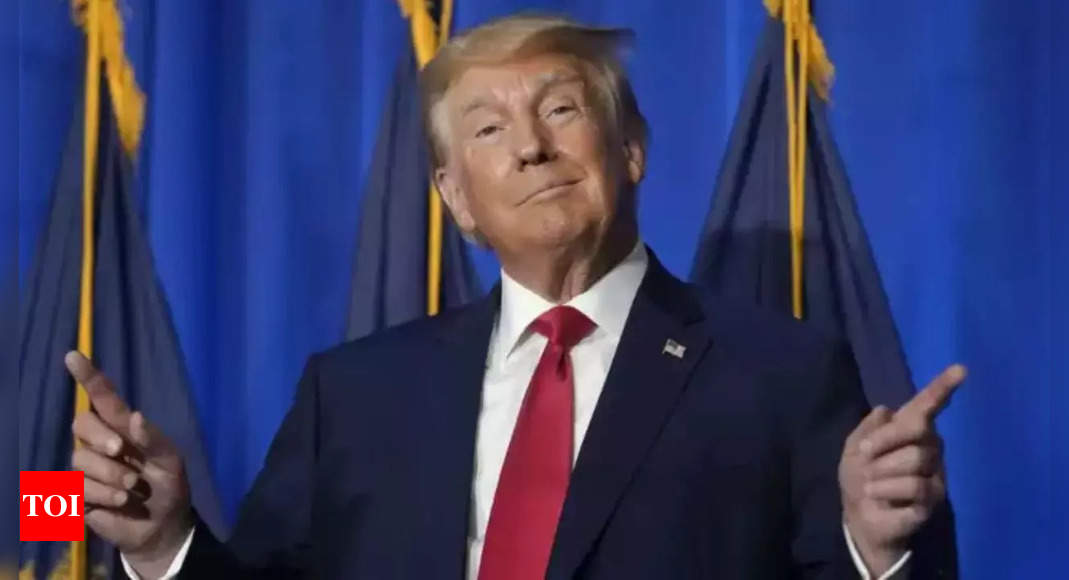

What a difference a few hours makes for markets — especially when at the mercy of Donald Trump.

Just on Tuesday morning, Wall Street had cheered the relatively orthodox choice the US president-elect had made for his Treasury secretary nomination.

NAB strategist Rodrigo Catril described veteran hedge fund manager Scott Bessent as “a safe pair of hands” and “a voice of reason that should be a moderating influence on the president”.

Bloomberg News declared that the pick would give China “breathing room” on tariffs, based on Bessent’s previous interview comments that Trump’s tariff talk was a “maximalist negotiating position”.

US Treasury yields tumbled while the Dow Jones added 1 per cent.

But just hours after the US market had closed, with cheerful analyst notes still hitting inboxes, things took a turn.

Moderated, Trump wasn’t.

“On January 20th, as one of my many first executive orders, I will sign all necessary documents to charge Mexico and Canada a 25 per cent tariff on ALL products coming into the United States,” Trump posted on his Truth Social Platform.

He bemoaned “drugs pouring in” to the US and pointed the finger at his old foe China.

“Until such time as they stop, we will be charging China an additional 10 per cent tariff, above any additional tariffs, on all of their many products coming into the United States of America.”

The Australian share market turned negative, as did US stock market futures, and the Australian dollar took a hit as the US dollar rallied.

“It’s had an immediate effect on the Australian dollar and that plays on our psychology,” Westpac senior economist Elliot Clarke said.

Here we go again

Amid the whiplash you could have been forgiven for thinking we were back in the depths of 2018.

There was a time where watching the news, the markets, or both, often meant waking with the feeling that anything could have happened overnight.

Now, Australians may be experiencing déjà vu.

“He hasn’t taken office yet, so this is just the starting point,” Mr Clarke noted.

“We will have to see how all the Trump policies work together, but the fact we’re already seeing announcements tells you this will be a period of uncertainty.”

Trump’s cabinet nominations have been pored over by pundits and traders alike, in search of some semblance of policy certainty.

But Capital Economics has warned against reading too much into the picks:

“Following his comprehensive election victory this is Trump’s world, while the rest of us, including his cabinet, just live in it.

“This time around, Trump — and the people closest to him — are more experienced in government, having had four years to plan, and we would expect them to be a lot more effective from day one onwards,” Capital Economics’ chief north America economist Paul Ashworth continued.

“Moreover, after his comprehensive election victory, he has the mandate to push through those more radical trade and immigration policies, and to reshape the federal bureaucracy.

“Make no mistake, his cabinet nominees will be expected to stay loyal to Trump and carry out his policies to the letter.”

Interest rates could come down to offset ‘extreme’ trade war

Analysts sounded a note of caution about the market reaction to the tariff threat.

With it being after-hours for the US, less money is moving through markets, amplifying immediate movements during the Australian and Asian sessions, and the moves weren’t massive there anyway.

While the US isn’t a significant export market for Australian goods, our fortunes are of course closely tied to one of the key targets.

“Australia should be relatively immune from direct impacts from an increase in tariffs in the US,” Commonwealth Bank economists noted last week.

“The larger impact is likely to come through second round impacts to China’s economy and reduction in demand for Australia’s key exports.”

It’s an impact the Reserve Bank was weighing up even prior to the election, internal briefing documents released under freedom of information laws have revealed.

Central bank staff analysed the impact of the eventual outcome — a Republican clean sweep of the presidency, the House and the Senate.

“Weaker Chinese growth will have relatively strong negative implications for Australia given the strength of export trade links,” the RBA papers stated.

Both so-called “extreme” and “moderate” scenarios are expected to put downward pressure on economic growth, and the Australian dollar.

But a more extreme trade war could see the RBA consider earlier interest rate cuts than otherwise:

“Weaker export demand, and slower growth would be disinflationary, putting downward pressure on policy rate expectations, government bond yields and the Australian dollar.”

Among the scenarios RBA staff considered was an ‘unrestrained Trump’.

Given how quickly the president-elect disrupted the sigh of relief markets breathed about a potential tempering influence, it’s no longer just a hypothetical scenario.