Infra

U.S. Infrastructure Growth Expected to Continue Post-Election

Donald Trump’s second term as President of the United States, which will begin alongside Republican control of the U.S. House of Representatives and Senate, is likely to include focus on domestic manufacturing, which could act as a catalyst for infrastructure spending. While changes to the landmark infrastructure-related policies passed under the Biden administration are possible, we expect these legislative tailwinds to remain largely intact due to bipartisan support. In our view, the U.S. Infrastructure Development theme can benefit from hundreds of billions of more dollars from public funding and related private spending over the coming years, creating a favorable landscape for investment opportunities.

Key Takeaways

- The election outcome creates heightened policy uncertainty over the short term, but we maintain our view that the Infrastructure Investment and Jobs Act (IIJA) and the Chips and Science Act (CHIPS Act) are likely safe from rollback.

- We continue to believe that the Inflation Reduction Act (IRA), focused on clean technologies, may face a slowdown in implementation rather than a full repeal.

- U.S. manufacturing reshoring and energy permitting reforms could be in line for a boost, potentially creating opportunities for companies throughout the U.S. infrastructure development value chain.

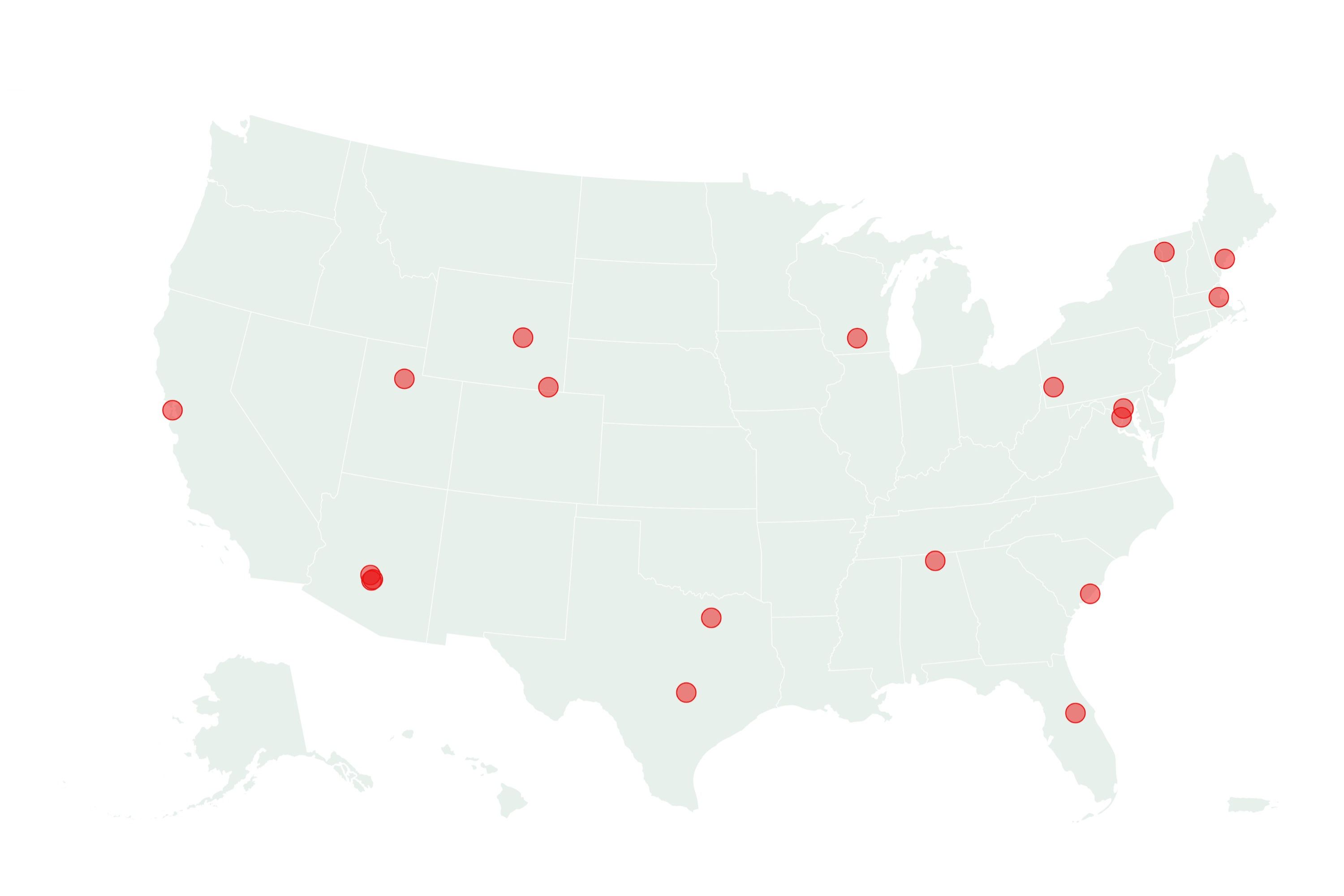

The United States is experiencing an infrastructure renaissance due to strong inflows of public and private spending. First, funding from the IIJA, CHIPS Act, and IRA are slated to add potentially hundreds of billions more dollars into the U.S. infrastructure value chain over the next several years.1 Funds from the IIJA, for example, were only about 60% allocated as of August 2024, and even more funds have not yet been spent as many projects are still in the planning phase.2,3 Additionally, a byproduct of this legislative wave is the related private spending for manufacturing and cleantech, which to date totals over $988 billion.4 The continued buildout of manufacturing facilities and clean power projects requires significant resources, notably labor. According to one estimate, announced investments from the CHIPS Act alone could create around 115,000 construction and manufacturing jobs.5

Following the Republicans’ election sweep, it’s understandable why market participants have questions about the fate of these infrastructure-based laws. But in our view, it’s worth noting that infrastructure is typically a pillar of focus for both Republican and Democratic administrations and lawmakers at all levels. The IIJA is also known as the Bipartisan Infrastructure Law, as the bill received support from members across both parties in the House and Senate.6 Also, while no major infrastructure spending package was passed during Trump’s first term, both parties continually expressed interest in increasing federal support for infrastructure.7 Given that infrastructure typically garners cross-party support, and the fact that over 60,000 infrastructure projects have already received IIJA funding, we believe that the IIJA is likely safe from being rolled back or significantly altered.8

Similarly, we believe that the CHIPS Act is likely safe from repeal or significant modification, despite talk of a repeal on the Trump campaign trail. The CHIPS Act also passed with bipartisan support, against a backdrop of intensifying geopolitical tensions.9 One of its primary objectives is to support national security by increasing the supply of critical technologies, particularly the chips that are critical for defense and everyday items.10 Since its enactment in August 2022, the strategic importance of advancing leadership in AI and semiconductor manufacturing has become even more pronounced. That said, the incoming administration may have different ideas for where to allocate the remaining funds. As of late September 2024, the Biden administration had awarded $36 billion out of the $52 billion set aside for semiconductor manufacturing to companies like Intel, Micron, and Taiwan Semiconductor Manufacturing Company (TSMC).11

President-elect Trump has said that he wants to repeal cleantech-focused legislation, including the IRA.12 That said, while the IRA passed along party lines, several Republican lawmakers have more recently pushed back against a repeal. Most notably, in August 2024, 18 House Republican lawmakers sent a letter to Speaker of the House Mike Johnson to express their support for the IRA due to the investment, innovation, and jobs benefits from energy tax credits.13 A big reason for their stance is that about 60% of the 334 projects announced within the first two years of the IRA are located in Republican-led congressional districts.14 The 201 projects in these districts, which total roughly $106.8 billion in investments, could create more than 77,000 jobs.15

We believe that the cross-party benefits from IRA-related projects along with continued support from legislators can deter a full repeal. However, the new administration may find ways to slow pieces of the IRA’s implementation, likely creating heightened policy uncertainty over the shorter term. EV tax credits in particular are at the center of Trump’s IRA critiques.16 While fewer EV tax credits could result in higher EV prices for potential car buyers over the near term, we expect price reductions across the EV industry over the longer term as economies of scale kick in, battery technologies advance, and domestic manufacturing increases.

Shifting tariff policies could also create near-term headwinds throughout the infrastructure value chain. For example, higher tariffs on imported materials such as lumber and steel could raise prices for some construction segments, including the residential sector.

Reshoring is a structural trend that likely transcends federal policies, in our view. Even before these infrastructure-based laws went into effect, companies across many industries expressed interest in growing U.S. manufacturing to boost supply chain resilience, protect against geopolitical risks, and become more sustainable. Now, a shift towards Trump’s “America First” policy agenda over the long term could further bolster U.S. manufacturing and create additional opportunities for U.S. infrastructure developers. For example, tariffs could lead to a surge in domestic investment and opportunities across the U.S. manufacturing landscape. For historical perspective, import quotas on Japanese cars in the 1980s are recognized as a catalyst for the rapid acceleration of manufacturing in the U.S. auto sector.17

Also, permitting reform has been a focus of Republicans and Democrats in recent years, and reforms may now be more likely with Republicans in full control.18,19 A restructuring of permitting processes could help speed up infrastructure development. Notably, complex environmental review and permitting processes continue to create challenges for many types of infrastructure assets, such as power grids, oil and gas infrastructure, and power generation facilities, including nuclear power and renewables.

After years of neglect, U.S. infrastructure development received policy support during the Biden administration, the benefits of which become more obvious every day as more shovels hit the ground. The IIJA, the CHIPs Act, and the IRA ushered in a new era of improving and advancing the nation’s infrastructure, including as a means of ensuring U.S. competitiveness and national defense. Rhetoric from the incoming administration raises questions about the staying power of these laws, but we believe that Republican support for them is strong. With hundreds of billions of dollars still potentially on the way towards the U.S. infrastructure value chain and the resultant investment opportunities compelling, we believe that the U.S. Infrastructure Development theme remains an attractive growth story.

Related ETFs

PAVE – Global X U.S. Infrastructure Development ETF

DRIV – Global X Autonomous & Electric Vehicles ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.