Jobs

U.S. Jobs Report Unlikely to Delay December Interest Rate Cut – TipRanks.com

The U.S. Employment Situation Summary for November is out, and with it comes key insights into the country’s jobs and economic state. The U.S. economy added another 227,000 nonfarm jobs during the month, alongside an unemployment rate of 4.2%.

Don’t Miss our Black Friday Offers:

Breaking down that data, nonfarm jobs increased by 36,000 compared to October data. Unemployment saw little change from what was reported in October but is up compared to the 3.7% reported in November 2023.

What This Means for the U.S. Economy

The biggest thing worth noting about this job report is that it is unlikely to alter the Federal Reverse decision concerning an interest rate cut this month. While jobs did increase on a month-to-month basis, the steady unemployment rate implies a rate cut is still likely.

Federal Reserve Chairman Jerome Powell remains cautious in his latest comments but didn’t rule out an interest rate cut. He said, “U.S. economy is in very good shape and there’s no reason for that not to continue. So the good news is that we can afford to be a little more cautious as we try to find neutral.”

How Does This News Affect the Stock Market?

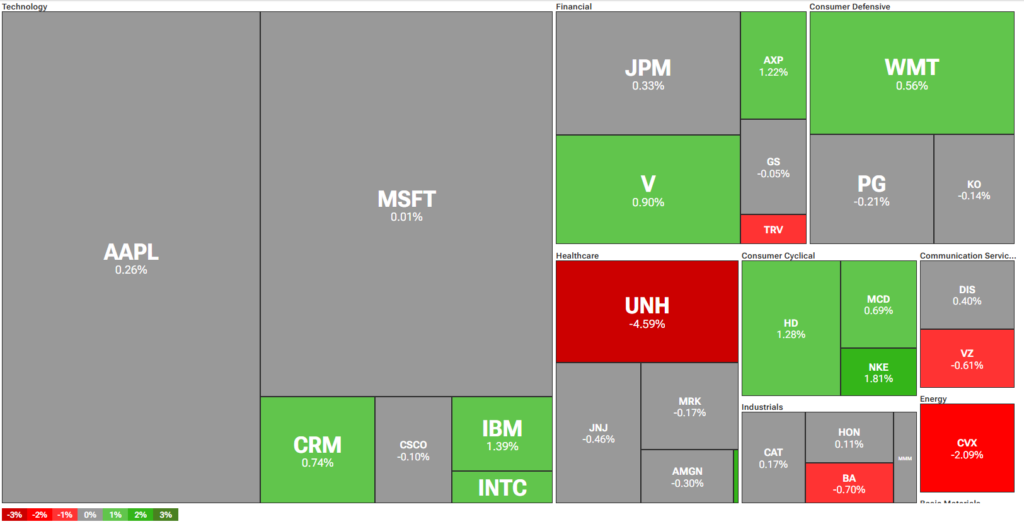

The effect of the November Employment Situation Summary is having a mixed effect on the stock market. Looking at the S&P 500 (SPX), things are looking up with the index rising 0.14% as of this writing. That comes as Broadcom (AVGO), Oracle (ORCL), Adobe (ADBE), and Meta Platforms (META) experience strong gains today.

On the flip side of that, the Dow Jones Industrial Average index (DJIA) isn’t doing so hot as it dropped 0.19% today. Pulling it down are United Health (UNH), Chevron (CVS), Travelers Companies (TRV), Boeing (BA), and Verizon (VZ).