Bussiness

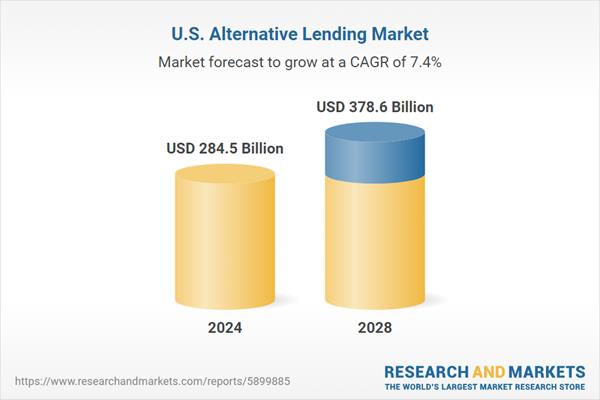

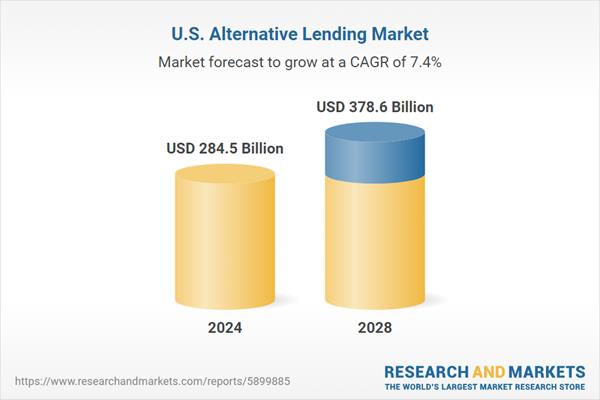

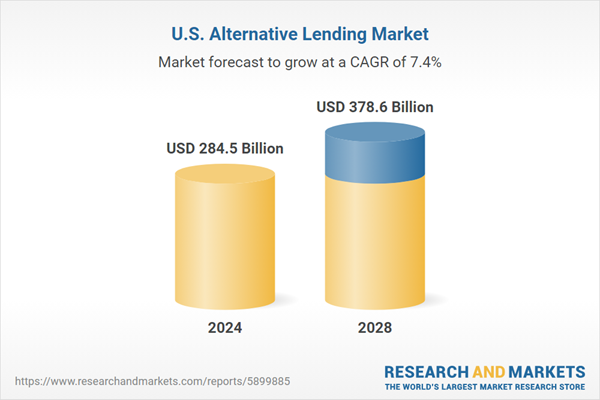

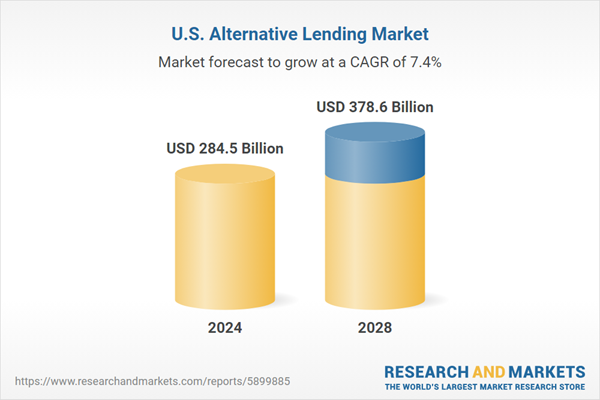

United States Alternative Lending Business Report 2024: Market to Reach $378.61 Billion by 2028 from $255.39 Billion in 2023 – Innovation, Partnerships, and Mergers Shape the Future

U.S. Alternative Lending Market

Dublin, Sept. 27, 2024 (GLOBE NEWSWIRE) — The “United States Alternative Lending Market Business and Investment Opportunities Databook – 75+ KPIs on Alternative Lending Market Size, By End User, By Finance Model, By Payment Instrument, By Loan Type and Demographics” report has been added to ResearchAndMarkets.com’s offering.

The alternative lending in this region is expected to grow by 11.4% on an annual basis to reach US$284.52 billion in 2024. Alternative lending adoption is expected to grow steadily over the forecast period, recording a CAGR of 7.4% during 2024-2028. The alternative lending market in the country will increase from US$255.39 billion in 2023 to reach US$378.61 billion by 2028.

This report provides a detailed data-centric analysis of the Alternative Lending industry, covering market opportunities and risks across a range of industry categories. With over 50 KPIs at the country level, this report provides a comprehensive understanding of Alternative Lending market dynamics, market size and forecast, and market share statistics.

The alternative lending sector in the U.S. is experiencing robust growth, driven by demand for flexible financing and advancements in technology. Key developments include significant funding, innovative product launches, and strategic partnerships that enhance lending capabilities. Mergers and acquisitions reflect ongoing consolidation and investment in technology. Regulatory changes are tightening oversight, emphasizing transparency, consumer protection, and risk management. As the sector evolves, it must balance innovation with regulatory compliance to sustain its growth trajectory.

Growth in the Alternative Lending Sector

Alternative lending in the United States has witnessed significant growth, driven by the increasing demand for flexible financing options from small to medium-sized businesses (SMBs). Digital lenders are capturing market share by offering streamlined application processes and relaxed qualification criteria compared to traditional banks, resulting in higher loan approval rates for borrowers. The alternative lending sector is anticipated to continue growing in the upcoming months as fintech companies innovate and adjust to changing market conditions. This expansion will probably be fueled by ongoing technological advancements and a shift in consumer preferences towards more accessible and efficient lending solutions.

Key Developments in the Alternative Lending Sector

Product Launches and Innovations

LendingTree Secures $175 Million in Funding from Apollo Funds – In 2024, LendingTree, a leading online loan marketplace, secured $175 million in funding from Apollo Funds to expand its alternative lending offerings and enhance its technology platform.

Nova Credit Introduces Nova Credit Platform – In March 2024, Nova Credit launched its Nova Credit Platform, which aims to transform how lenders manage and analyze consumer credit data. This will enable them to make more informed lending decisions and reach underserved borrowers.

Strategic Partnerships

Several key partnerships have emerged in the alternative lending sector in the USA, reflecting a trend of collaboration between traditional banks and fintech companies to enhance lending capabilities.

BNY Mellon and CIFC Partnership Expansion – In March 2024, BNY Mellon announced expanding its partnership with CIFC, a specialist in alternative credit. This collaboration allows BNY Mellon Investment Management to access CIFC’s U.S. direct lending strategy, which aims to serve clients across Europe, the Middle East, Africa, and Asia-Pacific.

This partnership highlights the increasing demand for private capital, particularly for underserved European markets.

JPMorgan Chase and FS Investments / Octagon Credit Investors – JPMorgan Chase was reportedly forming partnerships with FS Investments and Octagon Credit Investors. These partnerships are intended to broaden JPMorgan’s private credit efforts, reflecting a strategic move to enhance its offerings in the competitive alternative lending landscape.

Mergers and Acquisitions

FIS and Worldpay: FIS sold a majority stake in its Worldpay Merchant Solutions business to GTCR for approximately $18.5 billion. This deal is one of the largest private equity transactions in fintech. It reflects ongoing consolidation in the alternative lending sector as firms seek to enhance their technological capabilities and market reach.

Avantax and Cetera Financial Group: Cetera Financial Group, backed by Genstar Capital, acquired Avantax for about $1.2 billion. This acquisition is part of a broader trend where financial services firms merge to create more comprehensive service offerings and capitalize on synergies.

Apollo and Univar Solutions: Apollo Global Management completed a $5.7 billion acquisition of Univar Solutions, a significant move in the broader financial services landscape that includes alternative lending elements, particularly in supporting small and medium enterprises through enhanced service offerings.

Blackstone and Cvent: Blackstone’s acquisition of Cvent for $4.1 billion also highlights the trend of private equity firms investing in technology-driven companies within the financial services sector, which includes alternative lending solutions.

Regulatory Changes

Finalization of Nonbank Lending Reporting Requirements: On May 22, 2024, U.S. federal banking regulators finalized new reporting requirements for bank loans and commitments to nonbank financial entities. This change aims to improve the banking system’s understanding and supervision of credit concentrations and risks. The requirements will apply to insured depository institutions with over $10 billion in total assets, requiring them to disaggregate loans to various categories, including business credit intermediaries and private equity funds. These changes will take effect for the December 31, 2024 reporting period.

Increased Regulatory Scrutiny: Federal banking regulators have indicated they will intensify scrutiny across the financial sector, including alternative lenders. This includes focusing on governance and risk management frameworks, particularly as nonbank entities like fintech companies increasingly offer financial products. The aim is to ensure consumer protection and mitigate risks associated with innovative lending practices.

Consumer Protection Emphasis: In 2024, regulators are expected to prioritize consumer protection, scrutinizing how new financial products and technologies impact consumers. This includes evaluating third-party risk management and partnerships with fintech firms, ensuring that consumer interests are safeguarded amid rapid innovation in the sector.

Potential for New Regulations: As the alternative lending market continues to evolve, further regulatory measures may be introduced. The industry is encouraged to self-regulate effectively to avoid more stringent government interventions similar to those seen after the 2008 financial crisis.

Focus on Transparency: The regulatory environment is also shifting towards requiring greater transparency in lending practices. This move aims to prevent the issues that contributed to past financial crises and ensure that all lending entities maintain high standards of transparency in their operations

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

189 |

|

Forecast Period |

2024 – 2028 |

|

Estimated Market Value (USD) in 2024 |

$284.5 Billion |

|

Forecasted Market Value (USD) by 2028 |

$378.6 Billion |

|

Compound Annual Growth Rate |

7.4% |

|

Regions Covered |

United States |

Scope

United States Economic Indicators

United States Alternative Lending Market Size and Forecast

United States Alternative Lending Market Size and Forecast by End User

-

End User – Business

-

End User – Consumer

United States Alternative Lending Market Size and Forecast by Finance Models

-

P2P Marketplace Consumer Lending

-

P2P Marketplace Business Lending

-

P2P Marketplace Property Lending

-

Balance Sheet Consumer Lending

-

Balance Sheet Business Lending

-

Balance Sheet Property Lending

-

Invoice Trading

-

Debt Based Securities

-

Equity Based Crowd Funding

-

Real Estate Crowd funding

United States Alternative Lending Market Size and Forecast by Payment Instrument – Transaction Value, Volume and Average Value

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

United States Alternative Lending Market Size and Forecast by Payment Instrument to Model

Alternative Lending Market Size and Forecast by Payment Instrument to P2P Marketplace Consumer Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to P2P Marketplace Business Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to P2P Marketplace Property Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Balance Sheet Consumer Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Balance Sheet Business Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Balance Sheet Property Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Invoice Trading

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Debt Based Securities

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Equity Based Crowd Funding

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Real Estate Crowd funding

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

United States Alternative Lending Market Size and Forecast by Loan Types

-

B2C Loans

-

Personal Loan

-

Payroll Advance

-

Home Improvement

-

Education/Student Loans

-

Point of Sale

-

Auto Loans

-

Medical Loans

-

B2B Loans

-

Lines of Credit

-

Merchant Cash Advance

-

Invoice Factoring

-

Revenue Financing

United States Alternative Lending Analysis by Consumer Attitude and Behaviour

For more information about this report visit https://www.researchandmarkets.com/r/r0zm85

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900