Bussiness

US indicts Adani for bribing officials in India, misleading investors; issues arrest warrants – Times of India

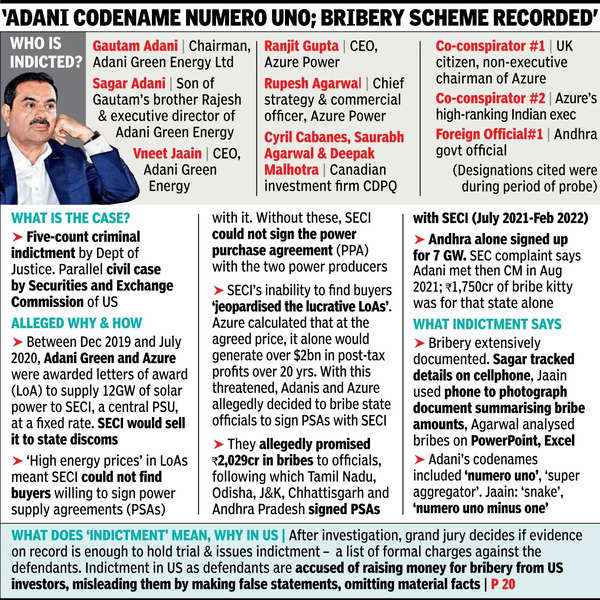

US prosecutors have indicted billionaire Gautam Adani and his nephew, Sagar Adani, among others, for their alleged role in a $265 million (Rs 2,000 crore) bribery case to secure solar power supply contracts in India, plunging the edible oil-to-ports giant into a second major controversy in 22 months, after the allegations by short-seller Hindenburg Research.

Arrest warrants have been issued in the US for Gautam and Sagar Adani and US prosecutors plan to hand those warrants to foreign law enforcement, according to court records, Reuters reported.

Early Wednesday, the US Department of Justice (DoJ) charged the two Adanis, former Adani Green CEO Vneet Jaain and former executives of Azure Power and Canadian pension fund CDPQ for alleged bribery to secure power purchase contracts from five states – Andhra Pradesh, Odisha, Chhattisgarh, Tamil Nadu and J&K – between 2020 and 2024. They have also been charged under the stringent Foreign Corruption Prevention Act (FCPA) as Adani had raised money through bonds from US investors and Azure Power was earlier listed on NYSE.

Separately, the US Securities Exchange Commission (SEC) charged Gautam and Sagar Adani and Cyril Cabanes, a former director on the Azure board, with FCPA violations. It also accused them of raising money from US investors on “false and misleading statements” that they were not involved in bribery.

“The opposite was true. Defendants (Gautam and Sagar Adani) had been personally and intimately involved in paying or promising bribes worth hundreds of millions of dollars to secure undue influence with Indian state govt officials and procure contracts between Indian state govts and SECI that benefitted Adani Green,” SEC said in a complaint to the court, demanding jury trial. DoJ’s charges are criminal; SEC’s are civil.

The indictment filed in US District Court, Eastern District of New York, says most of the bribe – Rs 1,750 crore – was allegedly paid for contracts in Andhra. In a separate complaint, SEC said the money was paid after Gautam Adani met the then chief minister in Aug 2021. (Jagan Mohan Reddy was CM at the time).

At or in connection with that meeting, Gautam Adani paid or promised a bribe to AP govt officials to cause the relevant AP govt entities to enter into power supply agreements with SECI for the purchase of 7,000 MW of power capacity,” SEC said, adding that within weeks, the state cabinet cleared the proposal.

“In other words, the bribes paid or promised worked,” the regulator said.

While making clear that the charges in the indictment are allegations, and the defendants are presumed innocent until proved guilty, US attorney’s office of eastern district of New York levelled charges on five counts 1) alleged conspiracy to violate FCPA by offering or paying bribes; 2) alleged securities fraud conspiracy for making false or misleading statements while raising money; wire fraud conspiracy while raising a syndicate loan of $1.4 billion in 2021; 4) alleged securities fraud during a 2021 bond issue and 5) conspiracy to obstruct justice by destroying and concealing records.

The bribery case relates to contracts initiated in 2020 where Adani Green Energy (8 gigawatts) and Azure Power (4 giga watts) bagged PLI-linked projects to supply solar power to GoI-owned Solar Energy Corporation of India (SECI), in what was billed as one of the largest such projects at that time.

But with SECI unable to find buyers for expensive power, the two companies allegedly devised a plan to sweeten the deal for state power distribution companies in exchange for bribes. According to court documents, Gautam and Sagar Adani along with Jaain were themselves part of the alleged bribery scheme.

The documents also alleged that Adani sought to recover alleged payments of over Rs 600 crore made on behalf of Azure Power, for which the Azure management sought to devise multiple schemes. Subsequently, they decided to surrender 2.3 GW capacity with the understanding that Adanis would get it – something that eventually happened.